Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please specify cleary which accounts are being debited and creditted in each transaction and by how much , also please make sure the answer is

please specify cleary which accounts are being debited and creditted in each transaction and by how much , also please make sure the answer is written in a way that is coherent to read

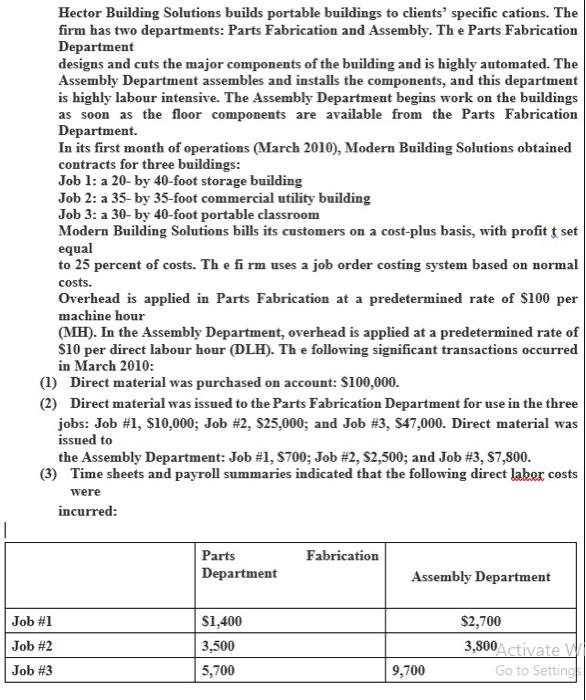

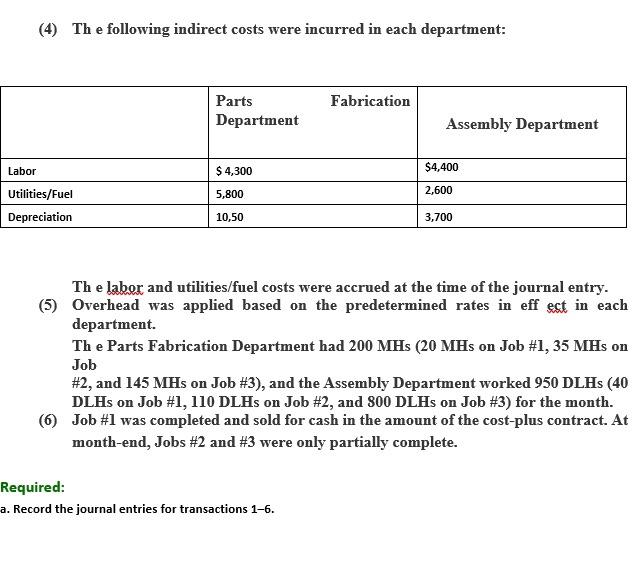

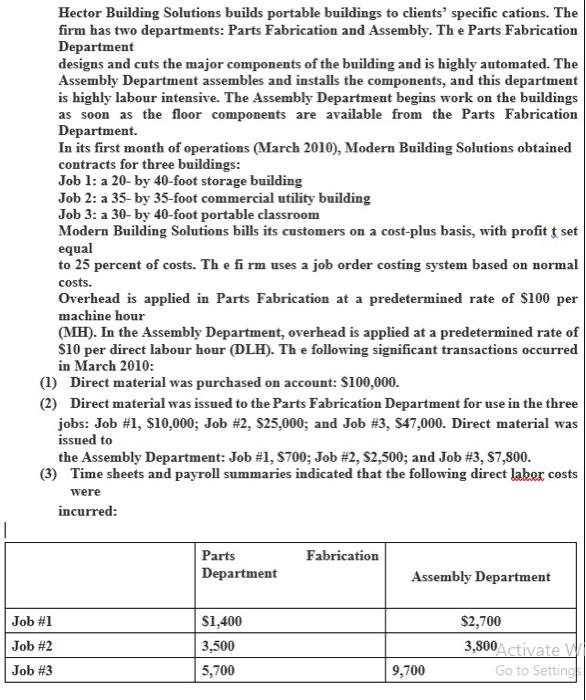

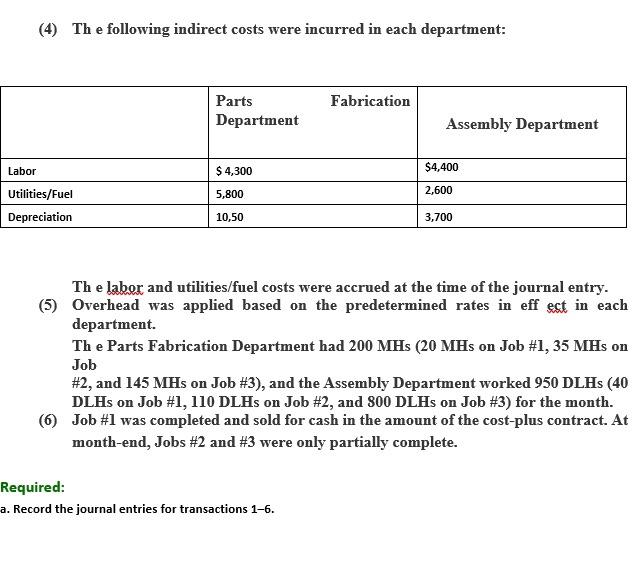

Hector Building Solutions builds portable buildings to clients' specific cations. The firm has two departments: Parts Fabrication and Assembly. The Parts Fabrication Department designs and cuts the major components of the building and is highly automated. The Assembly Department assembles and installs the components, and this department is highly labour intensive. The Assembly Department begins work on the buildings as soon as the floor components are available from the Parts Fabrication Department. In its first month of operations (March 2010), Modern Building Solutions obtained contracts for three buildings: Job l: a 20- by 40-foot storage building Job 2: a 35- by 35-foot commercial utility building Job 3: a 30- by 40-foot portable classroom Modern Building Solutions bills its customers on a cost-plus basis, with profit t set equal to 25 percent of costs. The firm uses a job order costing system based on normal costs. Overhead is applied in Parts Fabrication at a predetermined rate of $100 per machine hour (MH). In the Assembly Department, overhead is applied at a predetermined rate of $10 per direct labour hour (DLH). The following significant transactions occurred in March 2010: (1) Direct material was purchased on account: $100,000. (2) Direct material was issued to the Parts Fabrication Department for use in the three jobs: Job #1, $10,000; Job #2, $25,000; and Job #3, S47,000. Direct material was issued to the Assembly Department: Job #1, 5700; Job #2, S2,500; and Job #3, S7,800. (3) Time sheets and payroll summaries indicated that the following direct labor costs were incurred: Parts Department Fabrication Assembly Department Job #1 Job #2 $1,400 3,500 5,700 $2,700 3,800Activate Go to Setting Job #3 9,700 (4) The following indirect costs were incurred in each department: Fabrication Parts Department Assembly Department Labor $ 4,300 $4,400 5,800 2,600 Utilities/Fuel Depreciation 10,50 3,700 The labor and utilities/fuel costs were accrued at the time of the journal entry. (5) Overhead was applied based on the predetermined rates in eff est in each department. The Parts Fabrication Department had 200 MHS (20 MHs on Job #1, 35 MHs on Job #2, and 145 MHs on Job #3), and the Assembly Department worked 950 DLHs (40 DLHs on Job #1, 110 DLHs on Job #2, and 800 DLHs on Job #3) for the month. (6) Job #1 was completed and sold for cash in the amount of the cost-plus contract. At month-end, Jobs #2 and #3 were only partially complete. Required: a. Record the journal entries for transactions 1-6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started