Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please specify how to fill in the exact table Because of the risk level involved in taking on a new product, management is trying to

please specify how to fill in the exact table

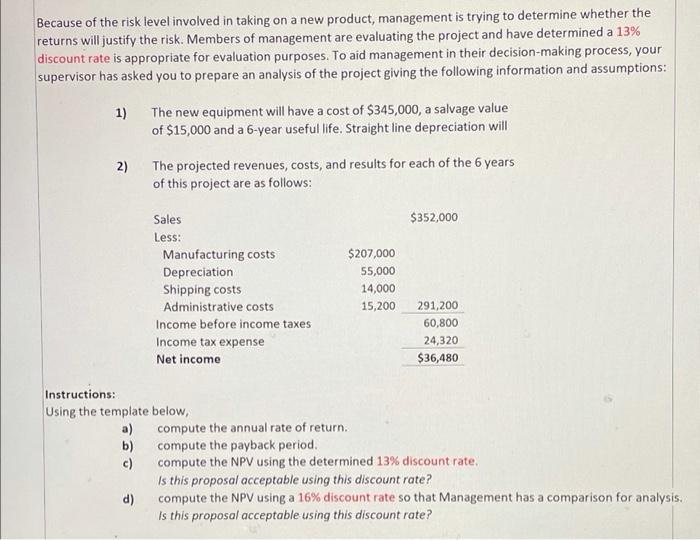

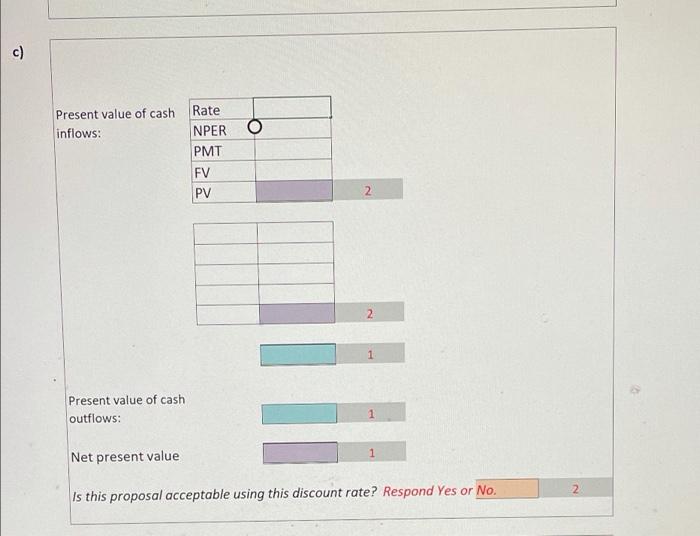

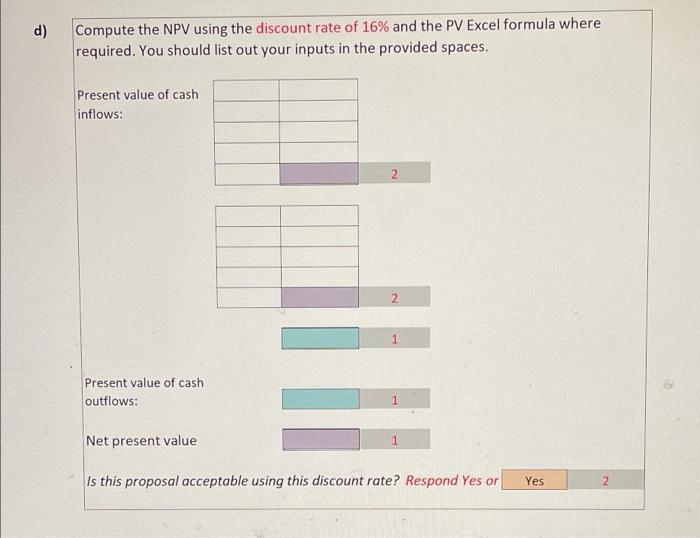

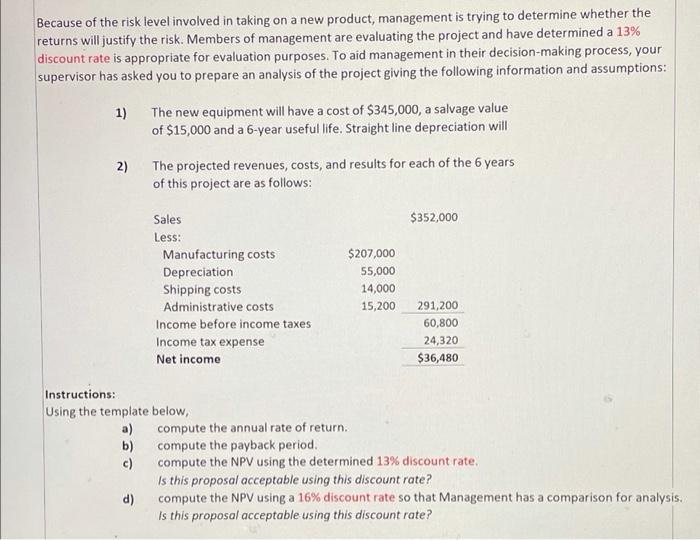

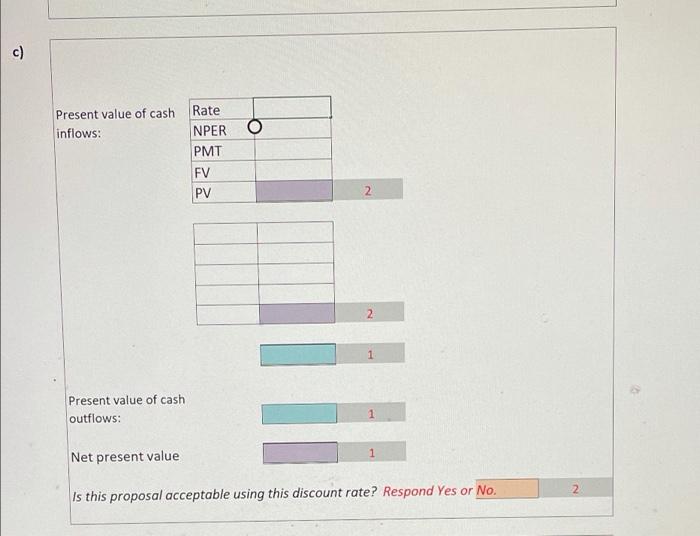

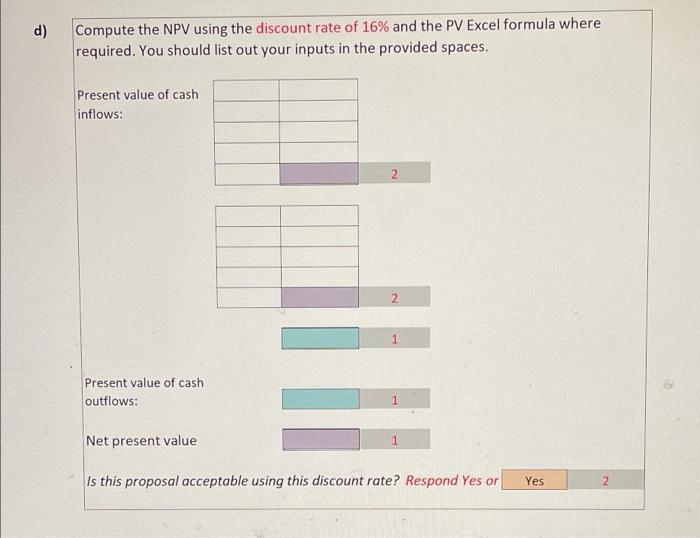

Because of the risk level involved in taking on a new product, management is trying to determine whether the returns will justify the risk. Members of management are evaluating the project and have determined a 13% discount rate is appropriate for evaluation purposes. To aid management in their decision-making process, your supervisor has asked you to prepare an analysis of the project giving the following information and assumptions: 1) The new equipment will have a cost of $345,000, a salvage value of $15,000 and a 6-year useful life. Straight line depreciation will 2) The projected revenues, costs, and results for each of the 6 years of this project are as follows: $352,000 Sales Less: Manufacturing costs Depreciation Shipping costs Administrative costs Income before income taxes Income tax expense Net income $207,000 55,000 14,000 15,200 291,200 60,800 24,320 $36,480 Instructions: Using the template below, a) compute the annual rate of return b) compute the payback period. c) compute the NPV using the determined 13% discount rate, Is this proposal acceptable using this discount rate? d) compute the NPV using a 16% discount rate so that Management has a comparison for analysis. Is this proposal acceptable using this discount rate? c) Present value of cash inflows: O Rate NPER PMT FV PV 2 Present value of cash outflows: 1 1 Net present value 2 2 Is this proposal acceptable using this discount rate? Respond Yes or No. d) Compute the NPV using the discount rate of 16% and the PV Excel formula where required. You should list out your inputs in the provided spaces. Present value of cash inflows: 2 Present value of cash outflows: Net present value Is this proposal acceptable using this discount rate? Respond Yes or Yes N

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started