Please state the formulas when answering the questions below. Thank you.

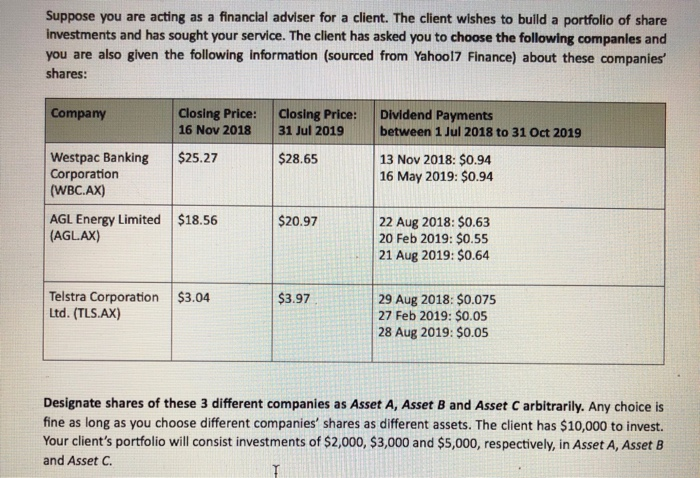

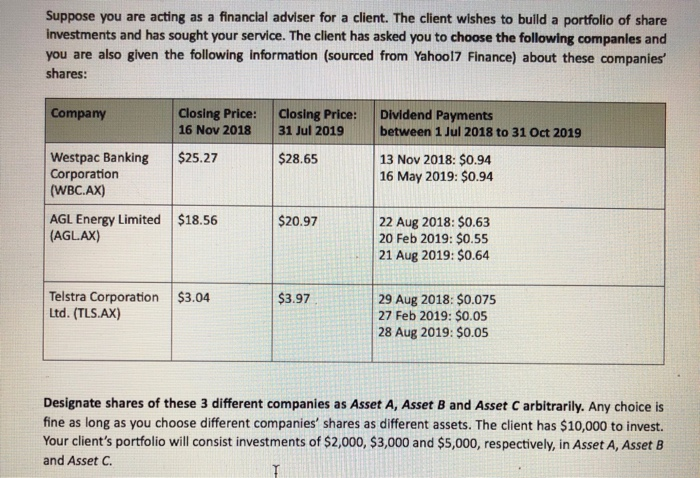

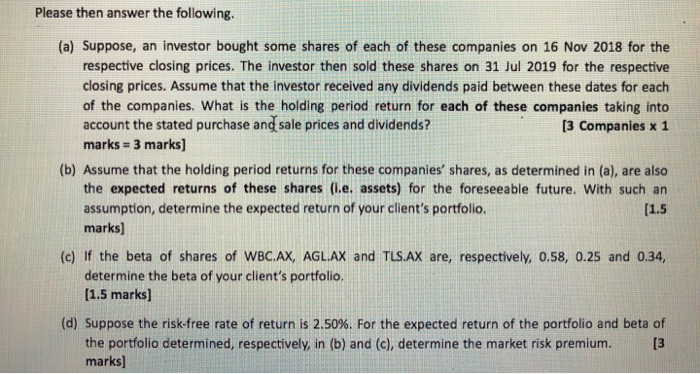

Suppose you are acting as a financial adviser for a client. The client wishes to build a portfolio of share Investments and has sought your service. The client has asked you to choose the following companies and you are also given the following information (sourced from Yahool7 Finance) about these companies shares: Company Closing Price: 16 Nov 2018 $25.27 Closing Price: 31 Jul 2019 $28.65 Dividend Payments between 1 Jul 2018 to 31 Oct 2019 13 Nov 2018: $0.94 16 May 2019: $0.94 Westpac Banking Corporation (WBC.AX) AGL Energy Limited (AGLAX) $18.56 $20.97 22 Aug 2018: $0.63 20 Feb 2019: $0.55 21 Aug 2019: $0.64 Telstra Corporation Ltd. (TLS.AX) $3.04 $3.97 29 Aug 2018: $0.075 27 Feb 2019: $0.05 28 Aug 2019: $0.05 Designate shares of these 3 different companies as Asset A, Asset B and Asset C arbitrarily. Any choice is fine as long as you choose different companies' shares as different assets. The client has $10,000 to invest. Your client's portfolio will consist investments of $2,000, $3,000 and $5,000, respectively, in Asset A, Asset B and Asset C. Please then answer the following. (a) Suppose, an investor bought some shares of each of these companies on 16 Nov 2018 for the respective closing prices. The investor then sold these shares on 31 Jul 2019 for the respective closing prices. Assume that the investor received any dividends paid between these dates for each of the companies. What is the holding period return for each of these companies taking into account the stated purchase and sale prices and dividends? [3 Companies x 1 marks = 3 marks] (b) Assume that the holding period returns for these companies' shares, as determined in (a), are also the expected returns of these shares (i.e. assets) for the foreseeable future. With such an assumption, determine the expected return of your client's portfolio. (1.5 marks) (c) If the beta of shares of WBC.AX, AGL.AX and TLS.AX are, respectively, 0.58, 0.25 and 0.34, determine the beta of your client's portfolio, (1.5 marks] (d) Suppose the risk-free rate of return is 2.50%. For the expected return of the portfolio and beta of the portfolio determined, respectively, in (b) and (c), determine the market risk premium. [3 marks]