Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please take your time answering the question thank you! Objective: Consider that you are an analyst at Regeneron Pharmaceuticals. You need to decide how to

please take your time answering the question thank you!

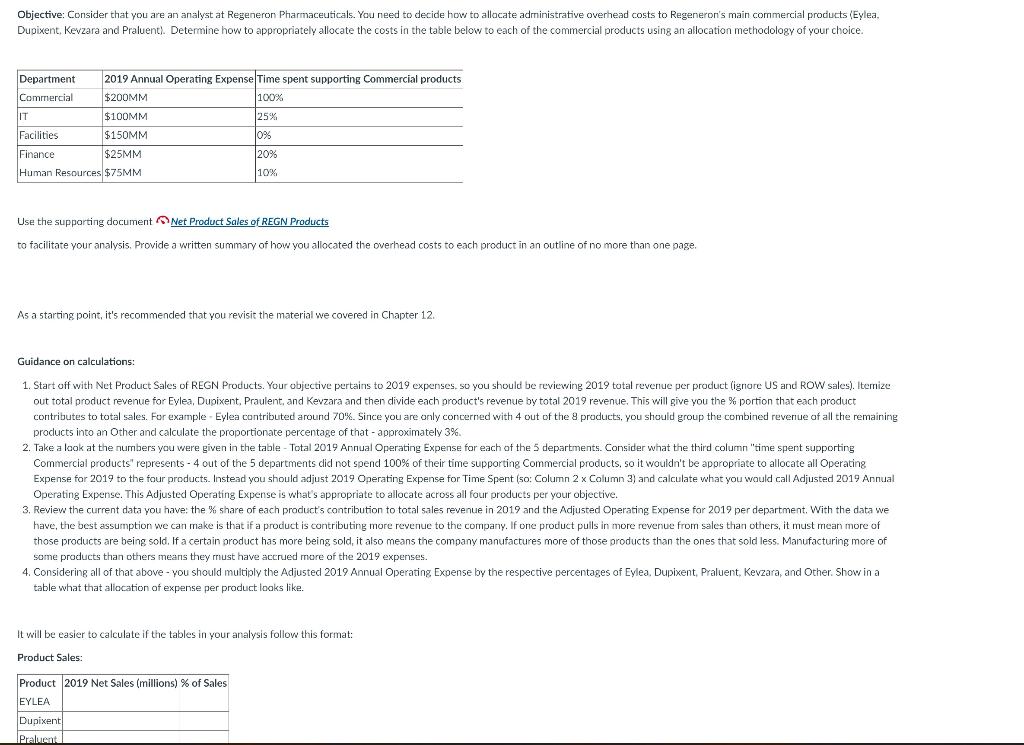

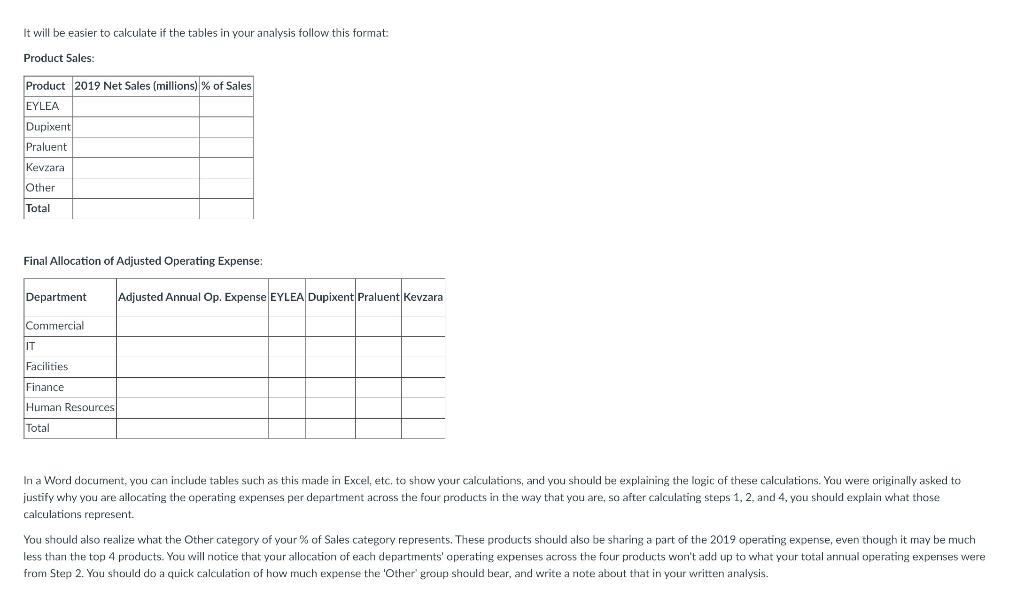

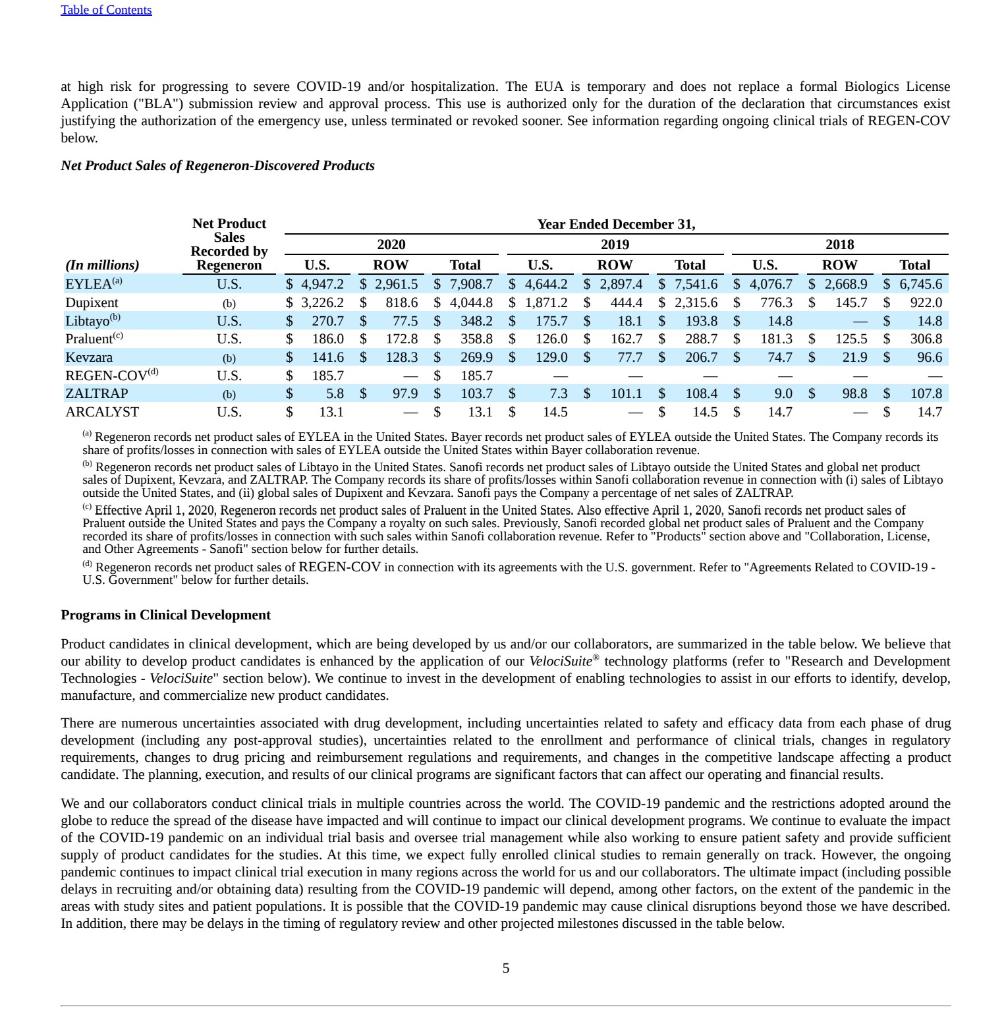

Objective: Consider that you are an analyst at Regeneron Pharmaceuticals. You need to decide how to allocate administrative overhead costs to Regeneron's main commercial products (Eylea. Dupixent Kevzara and Praluent). Determine how to appropriately allocate the costs in the table below to each of the commercial products using an allocation methodology of your choice. Department 2019 Annual Operating Expense Time spent supporting Commercial products Commercial $200MM 100% IT $100MM 25% Facilities $150MM Jons Finance $25MM 20% Human Resources $75MM 10% Use the supporting document Net Product Sales of REGN Products to facilitate your analysis. Provide a written summary of how you allocated the overhead costs to each product in an outline of no more than one page. . As a starting point, it's recommended that you revisit the material we covered in Chapter 12. Guidance on calculations: 1. Start off with Net Product Sales of REGN Products. Your objective pertains to 2019 expenses, so you should be reviewing 2019 total revenue per product (ignore US and ROW sales). Itemize out total product revenue for Eylea, Dupixent. Praulent, and Kevzara and then divide each product's revenue by total 2019 revenue. This will give you the % portion that each product contributes to total sales. For example - Eylea contributed around 70%. Since you are only concerned with 4 out of the 8 products, you should group the combined revenue of all the remaining products into an Other and calculate the proportionate percentage of that - approximately 3%. 2. Take a look at the numbers you were given in the table - Total 2019 Annual Operating Expense for each of the 5 departments. Consider what the third column "time spent supporting Commercial products" represents - 4 out of the 5 departments did not spend 100% of their time supporting Commercial products, so it wouldn't be appropriate to allocate all Operating Expense for 2019 to the four products. Instead you should adjust 2019 Operating Expense for Time Spent (so: Column 2 x Column 3) and calculate what you would call Adjusted 2019 Annual Operating Expense. This Adjusted Operating Expense is what's appropriate to allocate across all four products per your objective. 3. Review the current data you have the share of each product's contribution to total sales revenue in 2019 and the Adjusted Operating Expense for 2019 per department. With the data we have, the best assumption we can make is that if a product is contributing more revenue to the company. If one product pulls in more revenue from sales than others, it must mean more of those products are being sold. If a certain product has more being sold, it also means the company manufactures more of those products than the ones that sold less. Manufacturing more of some products than others means they must have accrued more of the 2019 expenses. 4. Considering all of that above - you should multiply the Adjusted 2019 Annual Operating Expense by the respective percentages of Eylea. DupixentPraluent, Kevzara, and Other. Show in a table what that allocation of expense per product looks like. It will be easier to calculate if the tables in your analysis follow this format: Product Sales: Product 2019 Net Sales (millions) % of Sales EYLEA Dupixent Praluenta It will be easier to calculate if the tables in your analysis follow this format Product Sales Product 2019 Net Sales (millions) % of Sales EYLEA Dupixent Praluent Kevzara Other Total Final Allocation of Adjusted Operating Expense: Department Adjusted Annual Op. Expense EYLEA Dupixent Praluent Kevzara Commercial IT Facilities Finance Human Resources Total In a Word document, you can include tables such as this made in Excel, etc. to show your calculations, and you should be explaining the logic of these calculations. You were originally asked to justify why you are allocating the operating expenses per department across the four products in the way that you are, so after calculating steps 1, 2, and 4, you should explain what those calculations represent. You should also realize what the other category of your % of Sales category represents. These products should also be sharing a part of the 2019 operating expense, even though it may be much less than the top 4 products. You will notice that your allocation of each departments' operating expenses across the four products won't add up to what your total annual operating expenses were from Step 2. You should do a quick calculation of how much expense the 'Other group should bear, and write a note about that in your written analysis. Table of Contents at high risk for progressing to severe COVID-19 and/or hospitalization. The EUA is temporary and does not replace a formal Biologics License Application ("BLA") submission review and approval process. This use is authorized only for the duration of the declaration that circumstances exist justifying the authorization of the emergency use, unless terminated or revoked sooner. See information regarding ongoing clinical trials of REGEN-COV below. Net Product Sales of Regeneron-Discovered Products Net Product Sales Recorded by Regeneron U.S. (b) U.S. (In millions) EYLEA) Dupixent Libtayo) Praluent() Kevzara REGEN-COV(d) ZALTRAP ARCALYST Year Ended December 31, 2020 2019 2018 U.S. ROW Total U.S. ROW Total U.S. ROW Total $ 4,947.2 $ 2,961.5 $ 7,908.7 $ 4,644.2 $ 2,897.4 $ 7,541.6 $ 4,076.7 S 2,668.9 $ 6,745.6 $ 3,226.2 $ 818.6 $ 4,044.8 $ 1,871.2 $ 444.4 $ 2,315.6 $ 776.3 S 145.7 $ 922,0 $ 270.7 $ 77.5 $ 348.2 $ 175.7 $ 18.1 S 193.8 $ 14.8 $ 14.8 $ 186,0 $ 172.8 $ 358.8 $ 126.0 $ 162.7 S 288.7 S 181.3 S 125.5 $ 306.8 $ 141.6 $ 128.3 $ 269.9 $ 129.0 $ 77.7 $ 206.7 $ 74.7 S 21.9 S 96.6 $ 185.7 $ 185.7 $ 5.8 $ 97.9 $ 103.7 $ 7.3 $ 101.1 $ 108.4 $ 9.0 S 98.8 $ 107.8 $ 13.1 $ 13.1 $ 14.5 S 14.5 $ 14.7 S 14.7 U.S. (b) U.S. (b) U.S. Regeneron records net product sales of EYLEA in the United States. Bayer records net product sales of EYLEA outside the United States. The Company records its share of profits/losses in connection with sales of EYLEA outside the United States within Bayer collaboration revenue. Regeneron records net product sales of Libtayo in the United States. Sanofi records net product sales of Libtayo outside the United States and global net product sales of Dupixent, Kevzara, and ZALTRAP. The Company records its share of profits/losses within Sanofi collaboration revenue in connection with (i) sales of Libtayo outside the United States, and (ii) global sales of Dupixent and Kevzara. Sanofi pays the Company a percentage of net sales of ZALTRAP. () Effective April 1, 2020, Regeneron records net product sales of Praluent in the United States. Also effective April 1, 2020, Sanofi records net product sales of Praluent outside the United States and pays the Company a royalty on such sales. Previously, Sanofi recorded global net product sales of Praluent and the Company recorded its share of profits/losses in connection with such sales within Sanofi collaboration revenue. Refer to "Products" section above and "Collaboration, License, and Other Agreements - Sanofi" section below for further details. d. Regeneron records net product sales of REGEN-COV in connection with its agreements with the U.S. government. Refer to "Agreements Related to COVID-19- U.S. Government" below for further details. Programs in Clinical Development Product candidates in clinical development, which are being developed by us and/or our collaborators, are summarized in the table below. We believe that our ability to develop product candidates is enhanced by the application of our VelociSuite technology platforms (refer to "Research and Development Technologies - VelociSuite" section below). We continue to invest in the development of enabling technologies to assist in our efforts to identify, develop, manufacture, and commercialize new product candidates. There are numerous uncertainties associated with drug development, including uncertainties related to safety and efficacy data from each phase of drug development (including any post-approval studies), uncertainties related to the enrollment and performance of clinical trials, changes in regulatory requirements, changes to drug pricing and reimbursement regulations and requirements, and changes in the competitive landscape affecting a product candidate. The planning, execution, and results of our clinical programs are significant factors that can affect our operating and financial results. We and our collaborators conduct clinical trials in multiple countries across the world. The COVID-19 pandemic and the restrictions adopted around the globe to reduce the spread of the disease have impacted and will continue to impact our clinical development programs. We continue to evaluate the impact of the COVID-19 pandemic on an individual trial basis and oversee trial management while also working to ensure patient safety and provide sufficient supply of product candidates for the studies. At this time, we expect fully enrolled clinical studies to remain generally on track. However, the ongoing pandemic continues to impact clinical trial execution in many regions across the world for us and our collaborators. The ultimate impact (including possible delays in recruiting and/or obtaining data) resulting from the COVID-19 pandemic will depend, among other factors, on the extent of the pandemic in the areas with study sites and patient populations. It is possible that the COVID-19 pandemic may cause clinical disruptions beyond those we have described. In addition, there may be delays in the timing of regulatory review and other projected milestones discussed in the table below. 5 Objective: Consider that you are an analyst at Regeneron Pharmaceuticals. You need to decide how to allocate administrative overhead costs to Regeneron's main commercial products (Eylea. Dupixent Kevzara and Praluent). Determine how to appropriately allocate the costs in the table below to each of the commercial products using an allocation methodology of your choice. Department 2019 Annual Operating Expense Time spent supporting Commercial products Commercial $200MM 100% IT $100MM 25% Facilities $150MM Jons Finance $25MM 20% Human Resources $75MM 10% Use the supporting document Net Product Sales of REGN Products to facilitate your analysis. Provide a written summary of how you allocated the overhead costs to each product in an outline of no more than one page. . As a starting point, it's recommended that you revisit the material we covered in Chapter 12. Guidance on calculations: 1. Start off with Net Product Sales of REGN Products. Your objective pertains to 2019 expenses, so you should be reviewing 2019 total revenue per product (ignore US and ROW sales). Itemize out total product revenue for Eylea, Dupixent. Praulent, and Kevzara and then divide each product's revenue by total 2019 revenue. This will give you the % portion that each product contributes to total sales. For example - Eylea contributed around 70%. Since you are only concerned with 4 out of the 8 products, you should group the combined revenue of all the remaining products into an Other and calculate the proportionate percentage of that - approximately 3%. 2. Take a look at the numbers you were given in the table - Total 2019 Annual Operating Expense for each of the 5 departments. Consider what the third column "time spent supporting Commercial products" represents - 4 out of the 5 departments did not spend 100% of their time supporting Commercial products, so it wouldn't be appropriate to allocate all Operating Expense for 2019 to the four products. Instead you should adjust 2019 Operating Expense for Time Spent (so: Column 2 x Column 3) and calculate what you would call Adjusted 2019 Annual Operating Expense. This Adjusted Operating Expense is what's appropriate to allocate across all four products per your objective. 3. Review the current data you have the share of each product's contribution to total sales revenue in 2019 and the Adjusted Operating Expense for 2019 per department. With the data we have, the best assumption we can make is that if a product is contributing more revenue to the company. If one product pulls in more revenue from sales than others, it must mean more of those products are being sold. If a certain product has more being sold, it also means the company manufactures more of those products than the ones that sold less. Manufacturing more of some products than others means they must have accrued more of the 2019 expenses. 4. Considering all of that above - you should multiply the Adjusted 2019 Annual Operating Expense by the respective percentages of Eylea. DupixentPraluent, Kevzara, and Other. Show in a table what that allocation of expense per product looks like. It will be easier to calculate if the tables in your analysis follow this format: Product Sales: Product 2019 Net Sales (millions) % of Sales EYLEA Dupixent Praluenta It will be easier to calculate if the tables in your analysis follow this format Product Sales Product 2019 Net Sales (millions) % of Sales EYLEA Dupixent Praluent Kevzara Other Total Final Allocation of Adjusted Operating Expense: Department Adjusted Annual Op. Expense EYLEA Dupixent Praluent Kevzara Commercial IT Facilities Finance Human Resources Total In a Word document, you can include tables such as this made in Excel, etc. to show your calculations, and you should be explaining the logic of these calculations. You were originally asked to justify why you are allocating the operating expenses per department across the four products in the way that you are, so after calculating steps 1, 2, and 4, you should explain what those calculations represent. You should also realize what the other category of your % of Sales category represents. These products should also be sharing a part of the 2019 operating expense, even though it may be much less than the top 4 products. You will notice that your allocation of each departments' operating expenses across the four products won't add up to what your total annual operating expenses were from Step 2. You should do a quick calculation of how much expense the 'Other group should bear, and write a note about that in your written analysis. Table of Contents at high risk for progressing to severe COVID-19 and/or hospitalization. The EUA is temporary and does not replace a formal Biologics License Application ("BLA") submission review and approval process. This use is authorized only for the duration of the declaration that circumstances exist justifying the authorization of the emergency use, unless terminated or revoked sooner. See information regarding ongoing clinical trials of REGEN-COV below. Net Product Sales of Regeneron-Discovered Products Net Product Sales Recorded by Regeneron U.S. (b) U.S. (In millions) EYLEA) Dupixent Libtayo) Praluent() Kevzara REGEN-COV(d) ZALTRAP ARCALYST Year Ended December 31, 2020 2019 2018 U.S. ROW Total U.S. ROW Total U.S. ROW Total $ 4,947.2 $ 2,961.5 $ 7,908.7 $ 4,644.2 $ 2,897.4 $ 7,541.6 $ 4,076.7 S 2,668.9 $ 6,745.6 $ 3,226.2 $ 818.6 $ 4,044.8 $ 1,871.2 $ 444.4 $ 2,315.6 $ 776.3 S 145.7 $ 922,0 $ 270.7 $ 77.5 $ 348.2 $ 175.7 $ 18.1 S 193.8 $ 14.8 $ 14.8 $ 186,0 $ 172.8 $ 358.8 $ 126.0 $ 162.7 S 288.7 S 181.3 S 125.5 $ 306.8 $ 141.6 $ 128.3 $ 269.9 $ 129.0 $ 77.7 $ 206.7 $ 74.7 S 21.9 S 96.6 $ 185.7 $ 185.7 $ 5.8 $ 97.9 $ 103.7 $ 7.3 $ 101.1 $ 108.4 $ 9.0 S 98.8 $ 107.8 $ 13.1 $ 13.1 $ 14.5 S 14.5 $ 14.7 S 14.7 U.S. (b) U.S. (b) U.S. Regeneron records net product sales of EYLEA in the United States. Bayer records net product sales of EYLEA outside the United States. The Company records its share of profits/losses in connection with sales of EYLEA outside the United States within Bayer collaboration revenue. Regeneron records net product sales of Libtayo in the United States. Sanofi records net product sales of Libtayo outside the United States and global net product sales of Dupixent, Kevzara, and ZALTRAP. The Company records its share of profits/losses within Sanofi collaboration revenue in connection with (i) sales of Libtayo outside the United States, and (ii) global sales of Dupixent and Kevzara. Sanofi pays the Company a percentage of net sales of ZALTRAP. () Effective April 1, 2020, Regeneron records net product sales of Praluent in the United States. Also effective April 1, 2020, Sanofi records net product sales of Praluent outside the United States and pays the Company a royalty on such sales. Previously, Sanofi recorded global net product sales of Praluent and the Company recorded its share of profits/losses in connection with such sales within Sanofi collaboration revenue. Refer to "Products" section above and "Collaboration, License, and Other Agreements - Sanofi" section below for further details. d. Regeneron records net product sales of REGEN-COV in connection with its agreements with the U.S. government. Refer to "Agreements Related to COVID-19- U.S. Government" below for further details. Programs in Clinical Development Product candidates in clinical development, which are being developed by us and/or our collaborators, are summarized in the table below. We believe that our ability to develop product candidates is enhanced by the application of our VelociSuite technology platforms (refer to "Research and Development Technologies - VelociSuite" section below). We continue to invest in the development of enabling technologies to assist in our efforts to identify, develop, manufacture, and commercialize new product candidates. There are numerous uncertainties associated with drug development, including uncertainties related to safety and efficacy data from each phase of drug development (including any post-approval studies), uncertainties related to the enrollment and performance of clinical trials, changes in regulatory requirements, changes to drug pricing and reimbursement regulations and requirements, and changes in the competitive landscape affecting a product candidate. The planning, execution, and results of our clinical programs are significant factors that can affect our operating and financial results. We and our collaborators conduct clinical trials in multiple countries across the world. The COVID-19 pandemic and the restrictions adopted around the globe to reduce the spread of the disease have impacted and will continue to impact our clinical development programs. We continue to evaluate the impact of the COVID-19 pandemic on an individual trial basis and oversee trial management while also working to ensure patient safety and provide sufficient supply of product candidates for the studies. At this time, we expect fully enrolled clinical studies to remain generally on track. However, the ongoing pandemic continues to impact clinical trial execution in many regions across the world for us and our collaborators. The ultimate impact (including possible delays in recruiting and/or obtaining data) resulting from the COVID-19 pandemic will depend, among other factors, on the extent of the pandemic in the areas with study sites and patient populations. It is possible that the COVID-19 pandemic may cause clinical disruptions beyond those we have described. In addition, there may be delays in the timing of regulatory review and other projected milestones discussed in the table below. 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started