Answered step by step

Verified Expert Solution

Question

1 Approved Answer

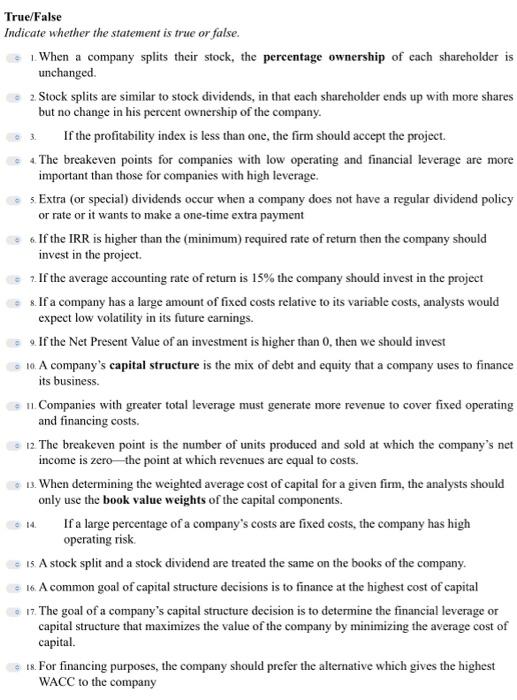

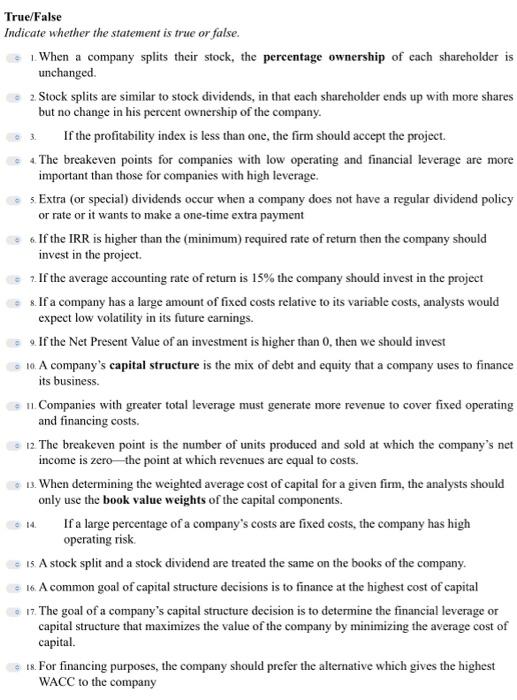

Please tell me the answer as soon as possible. true or false True/False Indicate whether the statement is true or false. 1. When a company

Please tell me the answer as soon as possible. true or false

True/False Indicate whether the statement is true or false. 1. When a company splits their stock, the percentage ownership of each shareholder is unchanged. 2. Stock splits are similar to stock dividends, in that each shareholder ends up with more shares but no change in his percent ownership of the company. 3. If the profitability index is less than one, the firm should accept the project. 4. The breakeven points for companies with low operating and financial leverage are more important than those for companies with high leverage. 5. Extra (or special) dividends occur when a company does not have a regular dividend policy or rate or it wants to make a one-time extra payment 6. If the IRR is higher than the (minimum) required rate of return then the company should invest in the project. 7. If the average accounting rate of return is 15% the company should invest in the project 8. If a company has a large amount of fixed costs relative to its variable costs, analysts would expect low volatility in its future earnings. 9. If the Net Present Value of an investment is higher than 0 , then we should invest 10. A company's capital structure is the mix of debt and equity that a company uses to finance its business. 11. Companies with greater total leverage must generate more revenue to cover fixed operating and financing costs. 12. The breakeven point is the number of units produced and sold at which the company's net income is zero-the point at which revenues are equal to costs. 13. When determining the weighted average cost of capital for a given firm, the analysts should only use the book value weights of the capital components. 14. If a large percentage of a company's costs are fixed costs, the company has high operating risk. 15. A stock split and a stock dividend are treated the same on the books of the company. 16. A common goal of capital structure decisions is to finance at the highest cost of capital 17. The goal of a company's capital structure decision is to determine the financial leverage or capital structure that maximizes the value of the company by minimizing the average cost of capital. 18. For financing purposes, the company should prefer the alternative which gives the highest WACC to the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started