please type the answer by computer, so i can see it clearly, thank you!!!

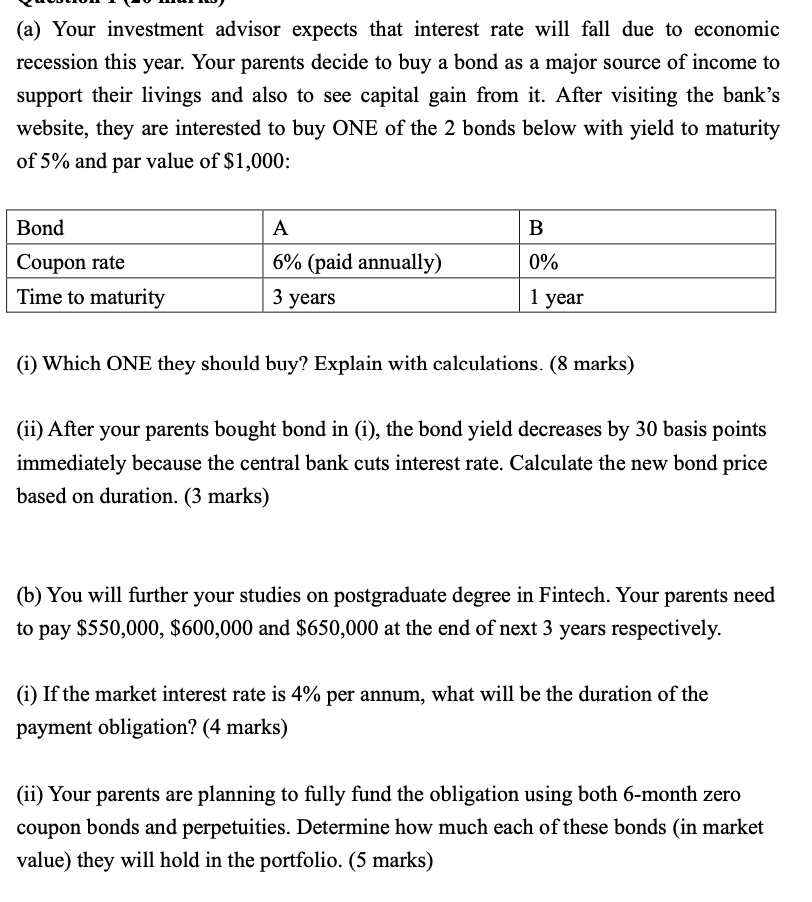

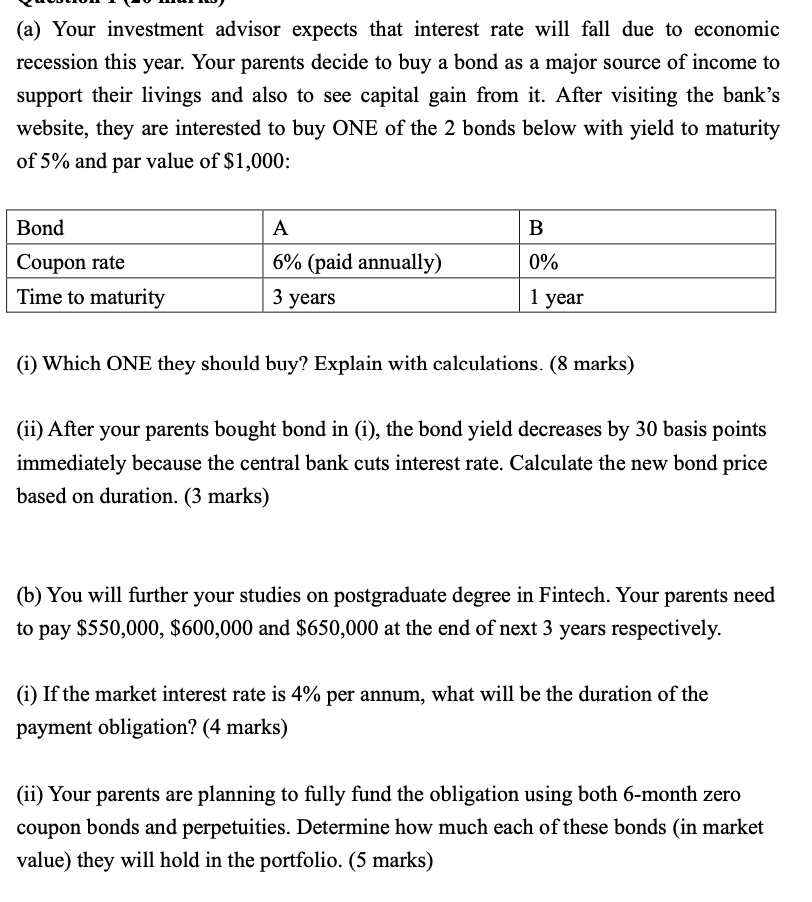

(a) Your investment advisor expects that interest rate will fall due to economic recession this year. Your parents decide to buy a bond as a major source of income to support their livings and also to see capital gain from it. After visiting the bank's website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000: B Bond Coupon rate Time to maturity A 6% (paid annually) 0% 3 years 1 year (i) Which ONE they should buy? Explain with calculations. (8 marks) (ii) After your parents bought bond in (i), the bond yield decreases by 30 basis points immediately because the central bank cuts interest rate. Calculate the new bond price based on duration. (3 marks) (b) You will further your studies on postgraduate degree in Fintech. Your parents need to pay $550,000, $600,000 and $650,000 at the end of next 3 years respectively. (i) If the market interest rate is 4% per annum, what will be the duration of the payment obligation? (4 marks) (ii) Your parents are planning to fully fund the obligation using both 6-month zero coupon bonds and perpetuities. Determine how much each of these bonds (in market value) they will hold in the portfolio. (5 marks) (a) Your investment advisor expects that interest rate will fall due to economic recession this year. Your parents decide to buy a bond as a major source of income to support their livings and also to see capital gain from it. After visiting the bank's website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000: B Bond Coupon rate Time to maturity A 6% (paid annually) 0% 3 years 1 year (i) Which ONE they should buy? Explain with calculations. (8 marks) (ii) After your parents bought bond in (i), the bond yield decreases by 30 basis points immediately because the central bank cuts interest rate. Calculate the new bond price based on duration. (3 marks) (b) You will further your studies on postgraduate degree in Fintech. Your parents need to pay $550,000, $600,000 and $650,000 at the end of next 3 years respectively. (i) If the market interest rate is 4% per annum, what will be the duration of the payment obligation? (4 marks) (ii) Your parents are planning to fully fund the obligation using both 6-month zero coupon bonds and perpetuities. Determine how much each of these bonds (in market value) they will hold in the portfolio