Answered step by step

Verified Expert Solution

Question

1 Approved Answer

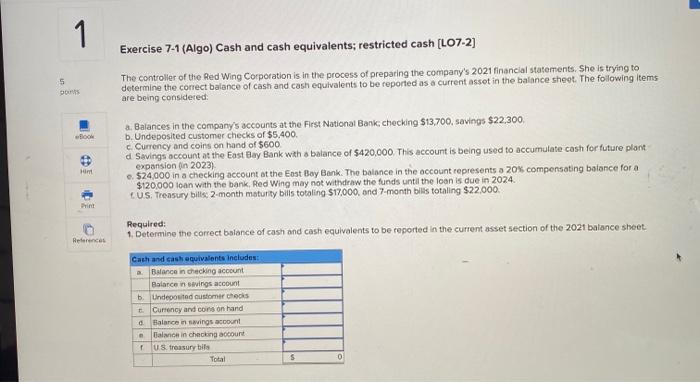

Please type the answers clearly! 1 Exercise 7-1 (Algo) Cash and cash equivalents; restricted cash (LO7-2] 5 The controller of the Red Wing Corporation is

Please type the answers clearly!

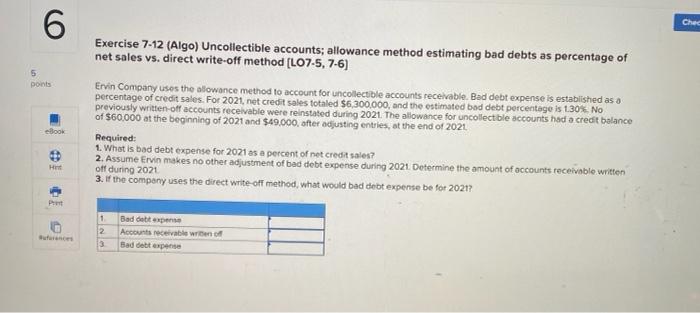

1 Exercise 7-1 (Algo) Cash and cash equivalents; restricted cash (LO7-2] 5 The controller of the Red Wing Corporation is in the process of preparing the company's 2021 financial statements. She is trying to determine the correct balance of cash and cash equivalents to be reported as a current asset in the balance sheet. The following items are being considered wo 3. Balances in the company's accounts at the First National Bank: checking $13,700, savings $22.300, b. Undeposited customer checks of $5,400. Currency and coins on hand of $600 a Savings account at the East Bay Bank with a balance of $420,000. This account is being used to accumulate cash for future plant expansion in 2023) $24.000 in a checking account at the East Bay Bank. The balance in the account represents a 20% compensating balance for a $120,000 loan with the bank. Red Wing may not withdraw the funds until the loan is due in 2024. US Treasury bills: 2 month maturity bills totaling $17,000, and 7-month bills totaling $22.000 o Required: 1. Determine the correct balance of cash and cash equivalents to be reported in the current asset section of the 2021 balance sheet References Cath and cash equivalents includes: a Balance in checking account Balance in savings account b. Undeposited customer checks t. Currency and cons on hand Balance in savings account Valon in checking account UStreasury bits Total O 6 Chec Exercise 7-12 (Algo) Uncollectible accounts; allowance method estimating bad debts as percentage of net sales vs. direct write-off method [L07-5, 7-6) 5 points eBook Ervin Company uses the slowance method to account for uncollectible accounts receivable. Bad debt expense is established as a percentage of credit sales. For 2021, net credit sales totaled $6.300,000, and the estimated bad debt percentage is 1.30%. No previously written off accounts receivable were reinstated during 2021. The allowance for uncollectible accounts had a credit balance of $60.000 at the beginning of 2021 and $49.000 after adjusting entries at the end of 2021 Required: 1. What is bad debt expense for 2021 as a percent of net credit sales? 2. Assume Ervin makes no other adjustment of bad debt expense during 2021. Determine the amount of accounts receivable written off during 2021 3. If the company uses the direct write-off method, what would bad debt expense be for 20217 H 1 2 3 Baddebit pense Accounts receivable en Badebt expecte

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started