Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please type your answer here. 8, Assume the interest rate is 4% per annum with semiannual compounding, the 6- month forward price for company XYZ

Please type your answer here.

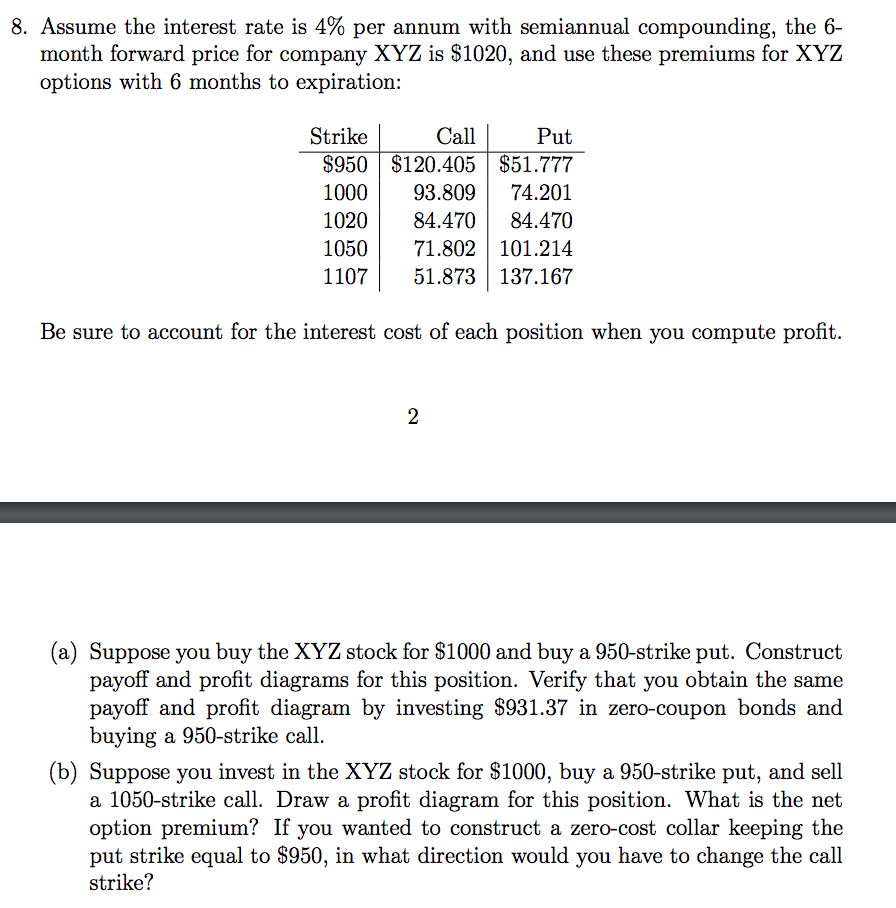

8, Assume the interest rate is 4% per annum with semiannual compounding, the 6- month forward price for company XYZ is S1020, and use these premiums for XYZ options with 6 months to expiration: Strike Call Put $950 $120.405$51.777 100093.80974.201 102084.470 84.470 105071.802 101.214 110751.873 137.167 Be sure to account for the interest cost of each position when you compute profit. 2 (a) Suppose you buy the XYZ stock for S1000 and buy a 950-strike put. Construct payoff and profit diagrams for this position. Verify that you obtain the same payoff and profit diagram by investing S931.37 in zero-coupon bonds and buying a 950-strike call. (b) Suppose you invest in the XYZ stock for S1000, buy a 950-strike put, and sell a 1050-strike call. Draw a profit diagram for this position. What is the net option premium? If you wanted to construct a zero-cost collar keeping the put strike equal to S950, in what direction would you have to change the call strikeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started