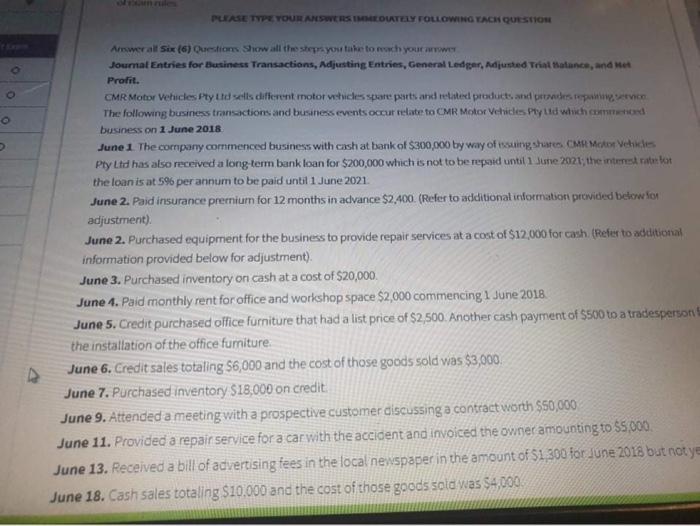

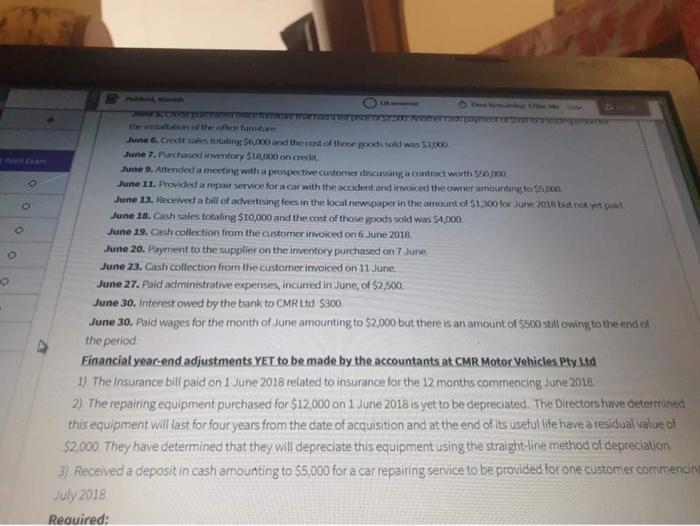

PLEASE TYPE YOUR ANSWERS IMEOUTELY FOLLOWING TACH QUESTION O business on 1 June 2018 Answer alt Six (6) Questions Show all the steps youtube to moh your www Journal Entries for Business Transactions, Adjusting Entries, General Ledger, Adjusted Trial atunce, and me Profit. CMR Motor Vehicles Pty Ltd seis different motor vehicles spare parts and related products and peacestepanovic The following business transactions and business events occur relate to CMR Motor Vehicles Pty Ltd which con June 1. The company commenced business with cash at bank of $300,000 by way of essuing shoes CME MAH Vehicles Pty Ltd has also received a long-term bank loan for $200,000 which is not to be repaid until 1 June 2021; the interest ratelor the loan is at 5% per annum to be paid until 1 June 2021 June 2. Paid insurance premium for 12 months in advance $2,400. (Refer to additional information provided belowion adjustment). June 2. Purchased equipment for the business to provide repair services at a cost of $12,000 for cash (Refer to additional information provided below for adjustment). June 3. Purchased inventory on cash at a cost of $20,000. June 1. Paid monthly rent for office and workshop space $2,000 commencing 1 June 2018 June 5. Credit purchased office furniture that had a list price of $2,500. Another cash payment of $500 to a tradesperson the installation of the office fumiture June 6. Credit sales totaling $6,000 and the cost of those goods sold was $3,000. June 7. Purchased inventory S18,000 on credit June 9. Attended a meeting with a prospective customer discussing a contract worth $50,000 June 11. Provided a repair service for a car with the accident and invoiced the owner amounting to $5.000 June 13. Received a bill of advertising fees in the local newspaper in the amount of $1,300 for June 2018 but not ye June 18. Cash sales totaling $10,000 and the cost of those goods sold was $4,000 O O O TOT TISSOT then the other future June. Credit alles totaling 5.000 and the cost of these pooh sold was $3,000 June 7. Purchased inventory $12,000 on credit June 9. Attended a meeting with a prospective customer discussing a contrad worth 550 DOO June 11. Provided a repair service for a car with the accident and invoiced the owner amounting to SA June 13. Recewed a bill of advertising fees in the local newspaper in the amount of $1.200 for June 2011 byd June 18. Cesh sales totaling $10,000 and the cost of those goods sold was $4,000 June 19. Cash collection from the customer invoiced on 6 June 2018 June 20. Payment to the supplier on the inventory purchased on 7 June June 23. Cash collection from the customer invoiced on 11 June June 27. Paid administrative expenses, incurred in June, of $2,500 June 30. Interest owed by the bank to CMR Ltd $300, June 30. Pald wages for the month of June amounting to $2,000 but there is an amount of $500 still owing to the end of the period Financial year-end adjustments YET to be made by the accountants at CMR Motor Vehicles Pty Ltd 1) The Insurance bill paid on 1 June 2018 related to insurance for the 12 months commencing June 2018 2). The repairing equipment purchased for $12,000 on 1 June 2018 is yet to be depreciated. The Directors have determined this equipment will last for four years from the date of acquisition and at the end of its useful life have a residual value of $2,000. They have determined that they will depreciate this equipment using the straight-line method of depreciation 3) Received a deposit in cash amounting to $5,000 for a car repairing service to be provided for one customer commencin July 2018 Required: V Required: Question 1 Record the journal entries for the business transaction that occurred in June 2018 @ Question 1 Type your answer here. [21 marks)