Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. Please Upload the paper / excel sheet used in solving questions 2. Suppose that you deposit semi-annual payment of $2000 over a 2-year period.

. Please Upload the paper / excel sheet used in solving questions

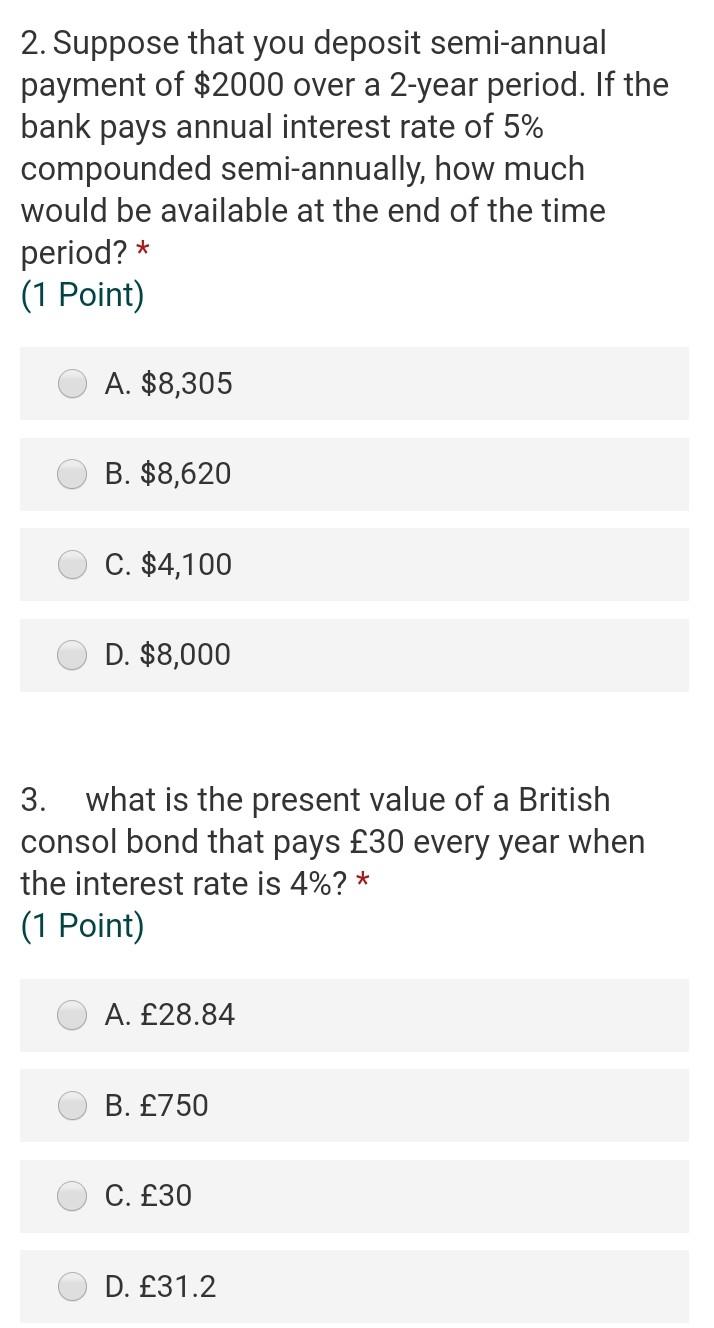

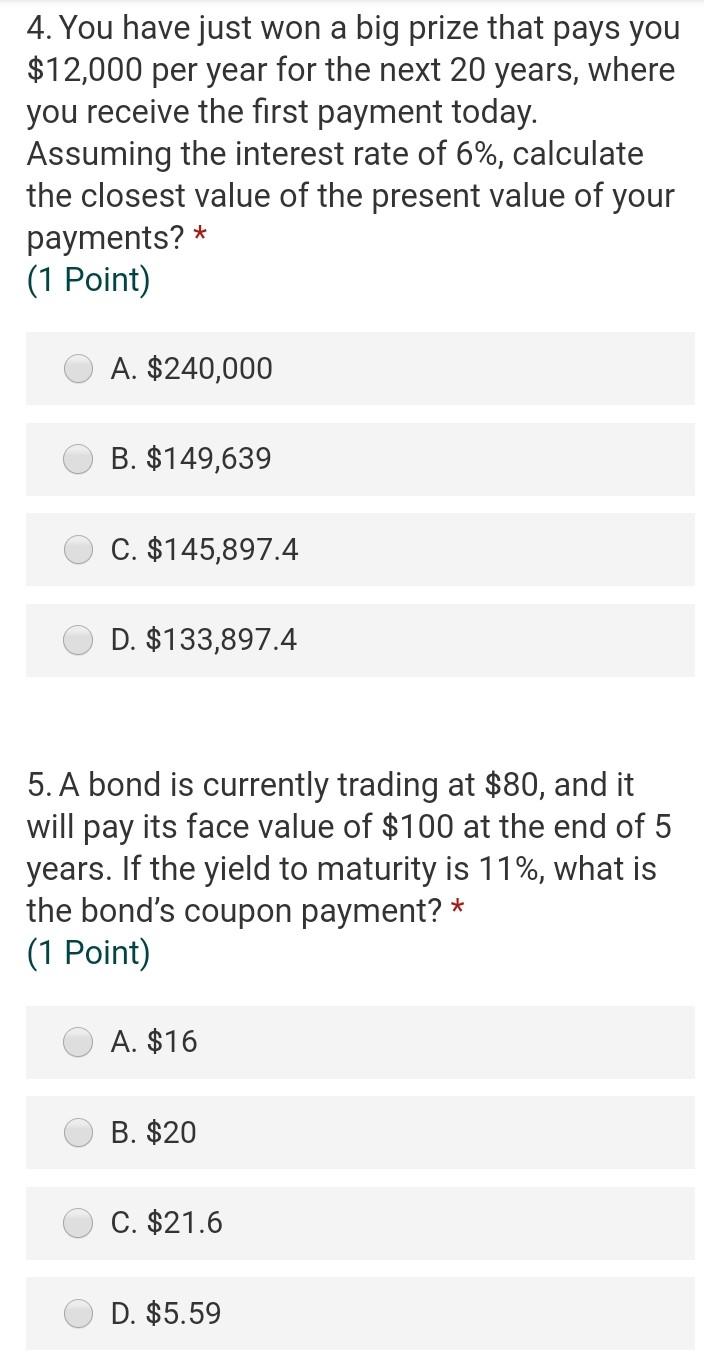

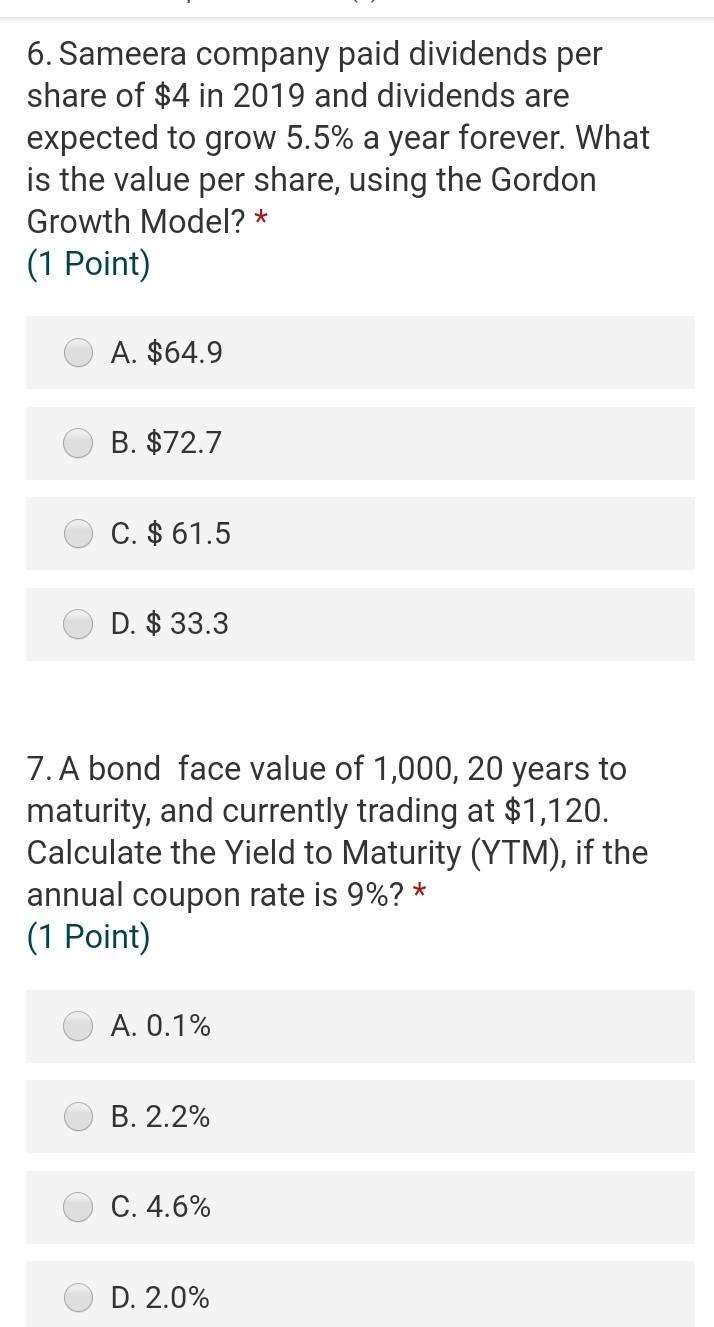

2. Suppose that you deposit semi-annual payment of $2000 over a 2-year period. If the bank pays annual interest rate of 5% compounded semi-annually, how much would be available at the end of the time period? * (1 Point) A. $8,305 B. $8,620 C. $4,100 D. $8,000 3. what is the present value of a British consol bond that pays 30 every year when the interest rate is 4%?* (1 Point) A. 28.84 B. 750 C. 30 D. 31.2 4. You have just won a big prize that pays you $12,000 per year for the next 20 years, where you receive the first payment today. Assuming the interest rate of 6%, calculate the closest value of the present value of your payments? * (1 Point) A. $240,000 B. $149,639 C. $145,897.4 D. $133,897.4 5. A bond is currently trading at $80, and it will pay its face value of $100 at the end of 5 years. If the yield to maturity is 11%, what is the bond's coupon payment? * (1 Point) A. $16 B. $20 C. $21.6 D. $5.59 6. Sameera company paid dividends per share of $4 in 2019 and dividends are expected to grow 5.5% a year forever. What is the value per share, using the Gordon Growth Model? * (1 Point) A. $64.9 B. $72.7 C. $ 61.5 D. $ 33.3 7. A bond face value of 1,000, 20 years to maturity, and currently trading at $1,120. Calculate the Yield to Maturity (YTM), if the annual coupon rate is 9%?* (1 Point) A. 0.1% B. 2.2% C. 4.6% D. 2.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started