Answered step by step

Verified Expert Solution

Question

1 Approved Answer

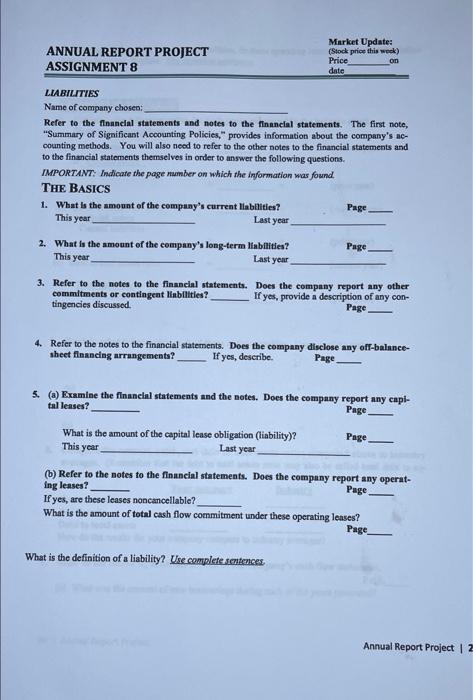

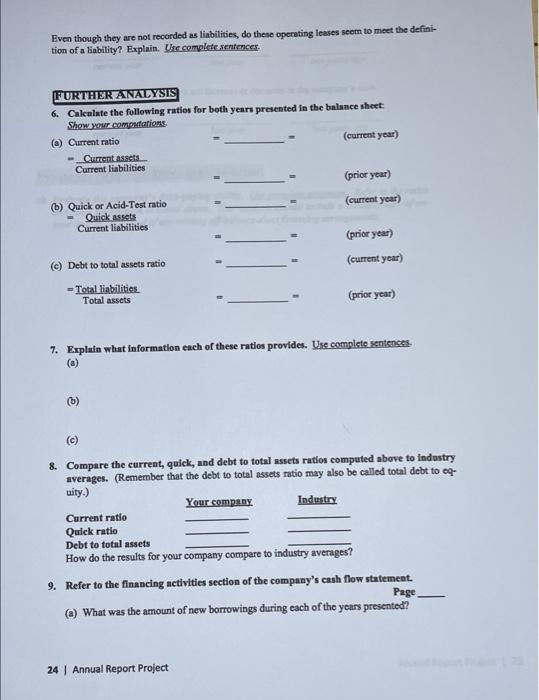

please use Amazon 2020 Annual Report! ANNUAL REPORT PROJECT ASSIGNMENT 8 Market Update: (Stock price this week) Price on date LIABILITIES Name of company chosen:

please use Amazon 2020 Annual Report!

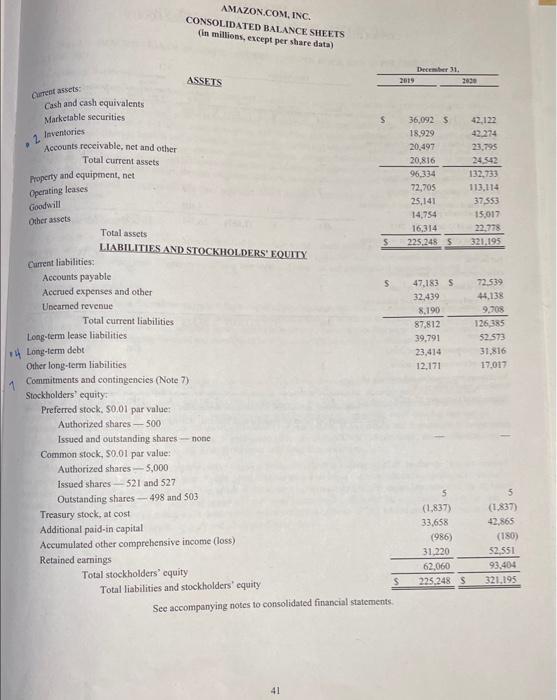

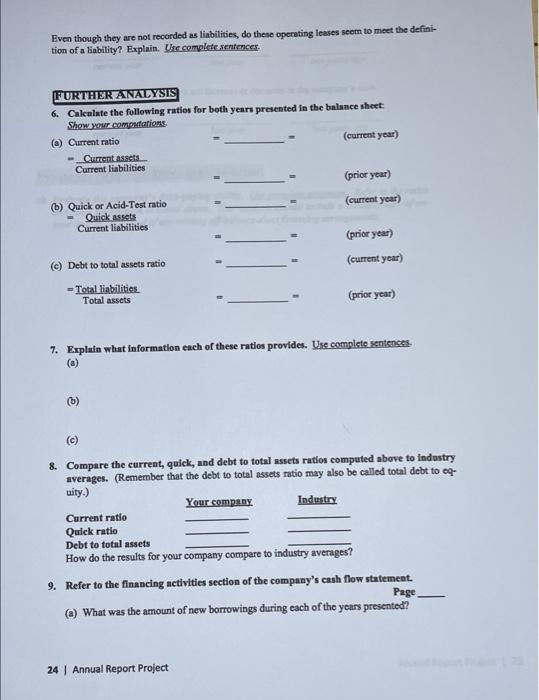

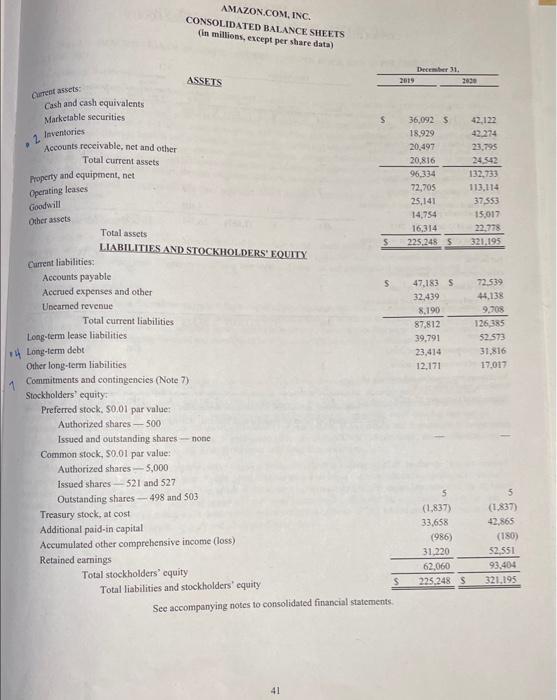

ANNUAL REPORT PROJECT ASSIGNMENT 8 Market Update: (Stock price this week) Price on date LIABILITIES Name of company chosen: Refer to the financial statements and notes to the financial statements. The first note, "Summary of Significant Accounting Policies, provides information about the company's ac- counting methods. You will also need to refer to the other notes to the financial statements and to the financial statements themselves in order to answer the following questions. IMPORTANT: Indicate the page number on which the Information was found THE BASICS 1. What is the amount of the company's current liabilities? Page Last year This year 2. What is the amount of the company's long-term liabilities? This year Last year Page 3. Refer to the notes to the financial statements. Does the company report any other commitments or contingent Habilities? If yes, provide a description of any con- tingencies discussed. Page. 4. Refer to the notes to the financial statements. Does the company disclose any off-balance- sheet financing arrangements ? If yes, describe Page 5. (a) Examine the financial statements and the notes. Does the company report any capl- tal leases? Page What is the amount of the capital lease obligation (liability)? Last year Page This year (b) Refer to the notes to the financial statements. Does the company report any operat- ing leases? Page If yes, are these leases noncancellable? What is the amount of total cash flow commitment under these operating leases? Page What is the definition of a liability? Use complete sentences Annual Report Project 2 Even though they are not recorded as liabilities, do these operating leases seem to meet the defini- tion of a liability? Explain. Use complete sentences FURTHER ANALYSIS 6. Calculate the following ratios for both years presented in the balance sheet: Show your computations (a) Current ratio (current year) Current assets Current liabilities (prior year) . (current year) (b) Quick or Acid-Test ratio Quick assets Current liabilities (prior year) - (current year) (c) Debt to total assets ratio = Total liabilities Total assets (prior year) 7. Explain what information each of these ratios provides. Use complete sentences (c) 8. Compare the current, quick, and debt to total assets ratios computed above to industry averages. (Remember that the debt to total assets ratio may also be called total debt to cq- uity.) Your company Industry Current ratio Quick ratio Debt to total assets How do the results for your company compare to industry averages? 9. Refer to the financing activities section of the company's cash flow statement. Page (2) What was the amount of new borrowings during each of the years presented? 24 Annual Report Project AMAZON.COM, INC. CONSOLIDATED BALANCE SHEETS (in millions, except per share data) ASSETS December 31. 2019 2030 Current assets: Cash and cash equivalents Marketable securities 5 2 Inventories . Accounts receivable, net and other Total current assets Property and equipment, net 36,0925 18.929 20,497 20,816 96.334 72,705 25,141 14,754 16,314 225,2485 42,122 42.274 23,795 24,542 132.733 113.114 37353 15.017 22.778 321,195 Operating leases Goodwill Other assets Total assets LIABILITIES AND STOCKHOLDERS' EQUITY 47,183 S 32.439 8.190 87.812 39,791 23,414 12,171 72.539 44,138 9,705 126,385 52.573 31.816 17,017 Current liabilities: Accounts payable Accrued expenses and other s Uncamed revenue Total current liabilities Long-term lease liabilities Long-term debt Other long-term liabilities Commitments and contingencies (Note 7) Stockholders' equity Preferred stock. 50.01 par values Authorized shares - 500 Issued and outstanding shares -- none Common stock, 30.01 par value: Authorized shares - 5,000 Issued shares 521 and 527 Outstanding shares - 498 and 503 Treasury stock, at cost Additional paid-in capital Accumulated other comprehensive income (loss) Retained earnings Total stockholders' cquity Total liabilities and stockholders' equity s See accompanying notes to consolidated financial statements. (1.837) 33,658 (986) 31.220 62,060 225.248 S (1.837) 42,865 (180) 52,551 93.404 321.195 41

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started