Answered step by step

Verified Expert Solution

Question

1 Approved Answer

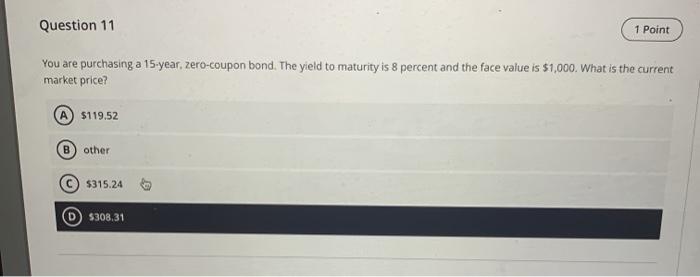

please use detialed answer thank you Question 11 1 Point You are purchasing a 15-year, zero-coupon bond. The yield to maturity is 8 percent and

please use detialed answer thank you

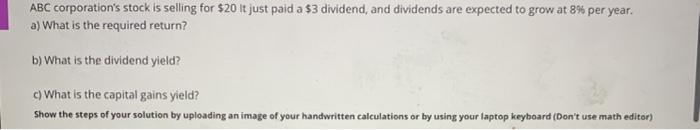

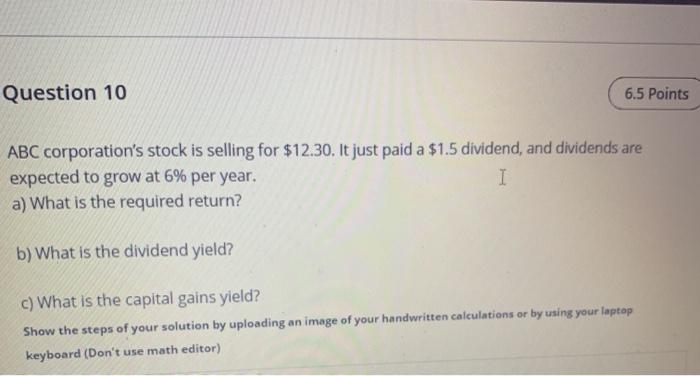

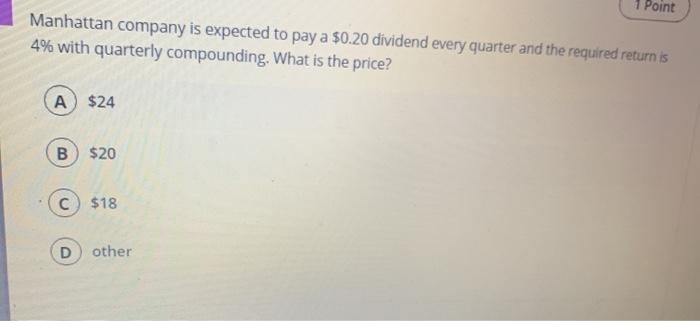

Question 11 1 Point You are purchasing a 15-year, zero-coupon bond. The yield to maturity is 8 percent and the face value is $1,000. What is the current market price? $119.52 B other $315.24 $308.31 ABC corporation's stock is selling for $20 lt just paid a $3 dividend, and dividends are expected to grow at 8% per year. a) What is the required return? b) What is the dividend yield? c) What is the capital gains yield? Show the steps of your solution by uploading an image of your handwritten calculations or by using your laptop keyboard (Don't use math editor) Question 10 6.5 Points ABC corporation's stock is selling for $12.30. It just paid a $1.5 dividend, and dividends are expected to grow at 6% per year. I a) What is the required return? b) What is the dividend yield? c) What is the capital gains yield? Show the steps of your solution by uploading an image of your handwritten calculations or by using your laptop keyboard (Don't use math editor) 1 Point Manhattan company is expected to pay a $0.20 dividend every quarter and the required return is 4% with quarterly compounding. What is the price? A $24 B $20 C) $18 D other Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started