Answered step by step

Verified Expert Solution

Question

1 Approved Answer

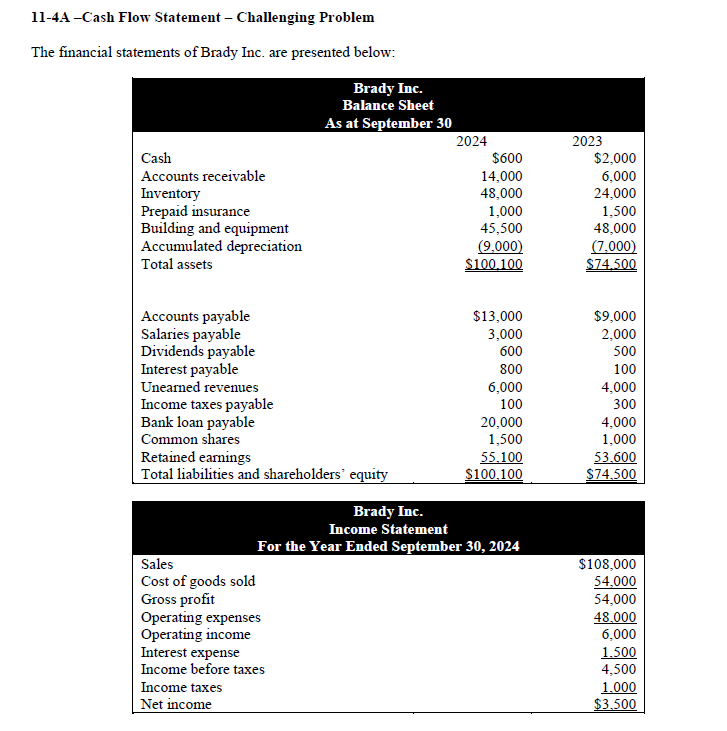

Please use Direct Method 11-4A -Cash Flow Statement - Challenging Problem The financial statements of Brady Inc. are presented below: Cash Accounts receivable Inventory Prepaid

Please use Direct Method

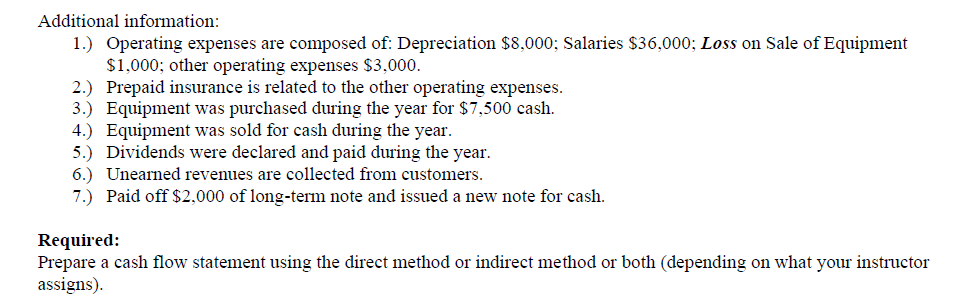

11-4A -Cash Flow Statement - Challenging Problem The financial statements of Brady Inc. are presented below: Cash Accounts receivable Inventory Prepaid insurance Building and equipment Accumulated depreciation Total assets Brady Inc. Balance Sheet As at September 30 2024 $600 14,000 48,000 1,000 45,500 (9,000) $100.100 2023 $2,000 6,000 24,000 1,500 48,000 (7.000) $74.500 Accounts payable Salaries payable Dividends payable Interest payable Unearned revenues Income taxes payable Bank loan payable Common shares Retained earnings Total liabilities and shareholders' equity $13,000 3,000 600 800 6,000 100 20,000 1,500 55.100 $100,100 $9,000 2,000 500 100 4,000 300 4,000 1,000 53.600 $74.500 Brady Inc. Income Statement For the Year Ended September 30, 2024 Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense Income before taxes Income taxes Net income $108,000 54,000 54,000 48.000 6,000 1.500 4,500 1.000 $3.500 Additional information: 1.) Operating expenses are composed of: Depreciation $8,000; Salaries $36,000; Loss on Sale of Equipment $1,000; other operating expenses $3,000. 2.) Prepaid insurance is related to the other operating expenses. 3.) Equipment was purchased during the year for $7,500 cash. 4.) Equipment was sold for cash during the year. 5.) Dividends were declared and paid during the year. 6.) Unearned revenues are collected from customers. 7.) Paid off $2,000 of long-term note and issued a new note for cash. Required: Prepare a cash flow statement using the direct method or indirect method or both (depending on what your instructor assigns)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started