Question

Please use Excel and show formulas as well as results. I will upvote the correct answer. Please follow instructions below image Use MS Excel to

Please use Excel and show formulas as well as results. I will upvote the correct answer. Please follow instructions below image

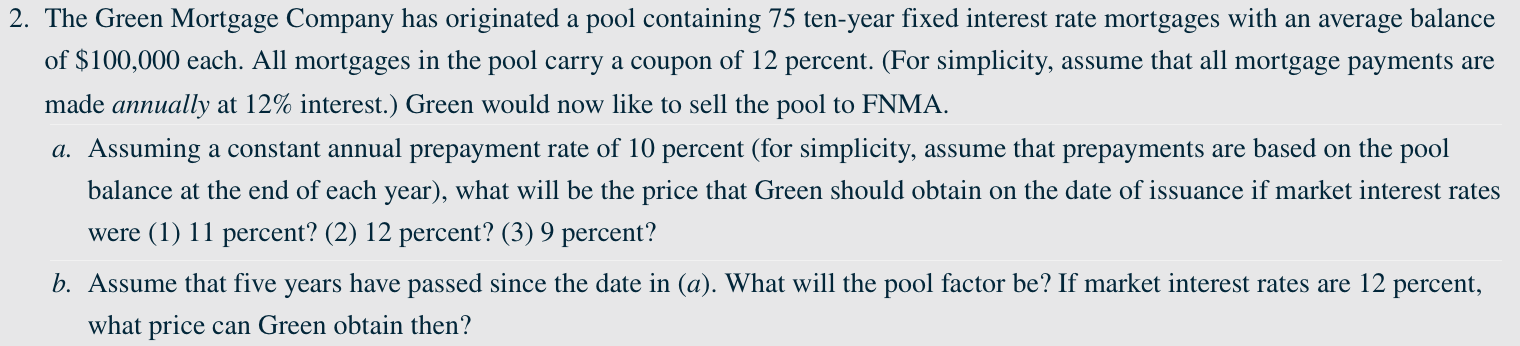

Use MS Excel to set up a 10-year amortization schedule including the following columns: NPER (that is the number of period remaining to maturity), Beginning Balance, Interest Paid, Principal Paid, Principal Prepaid, and Ending Balance. Remember that interest paid does not reduce the loan balance. Also, the total mortgage payment amount will decrease each year due to the prepayments, so it may be helpful to create an extra column in which to calculate the total mortgage payment for each year. If your amortization schedule is set-up correctly the loan balance after ten years will be $0.

Use MS Excel to set up a 10-year amortization schedule including the following columns: NPER (that is the number of period remaining to maturity), Beginning Balance, Interest Paid, Principal Paid, Principal Prepaid, and Ending Balance. Remember that interest paid does not reduce the loan balance. Also, the total mortgage payment amount will decrease each year due to the prepayments, so it may be helpful to create an extra column in which to calculate the total mortgage payment for each year. If your amortization schedule is set-up correctly the loan balance after ten years will be $0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started