Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kobe and Jacinda are looking at JADC which releases earnings in 1 month. They agree the earnings announcement will either be really good, or really

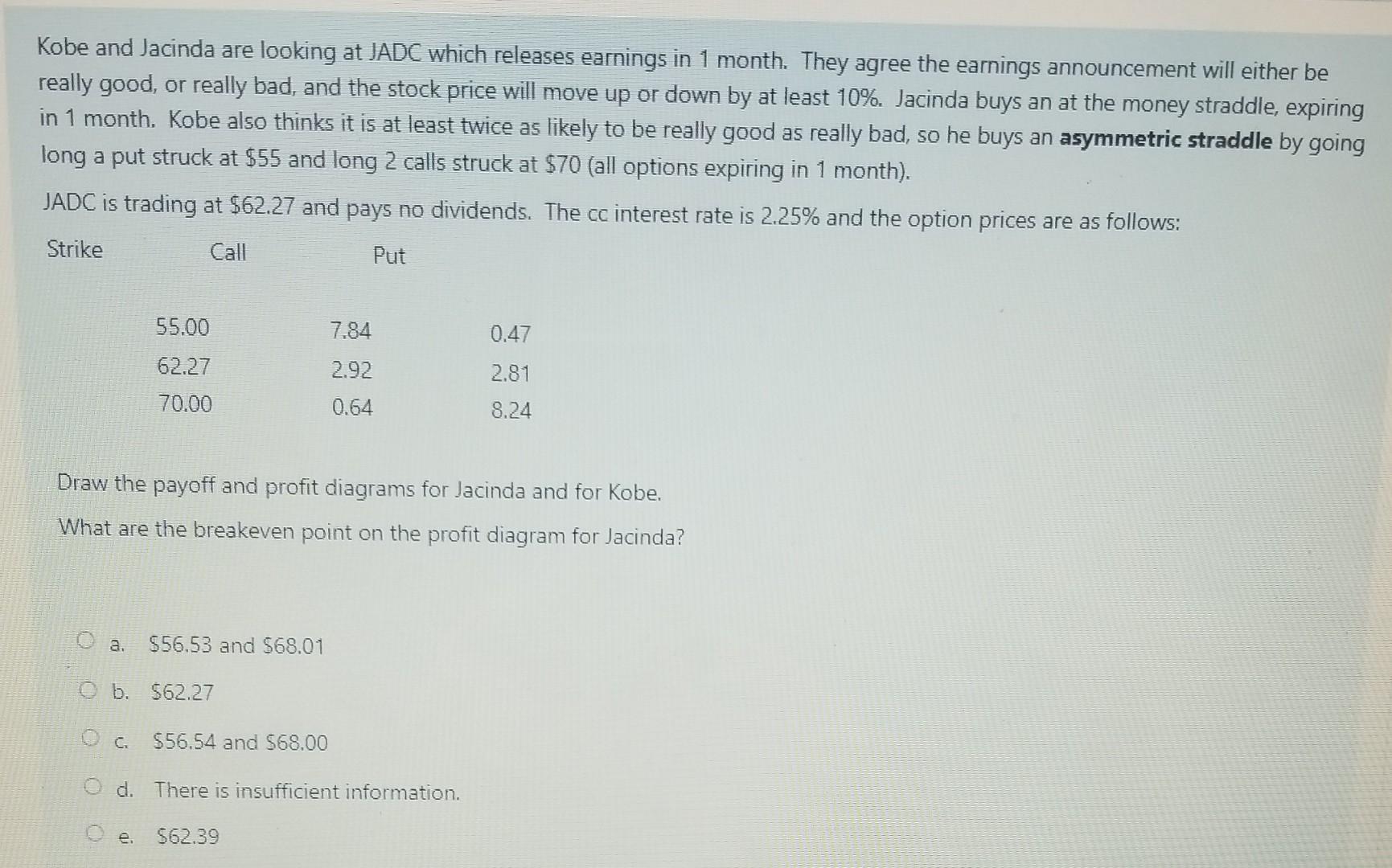

Kobe and Jacinda are looking at JADC which releases earnings in 1 month. They agree the earnings announcement will either be really good, or really bad, and the stock price will move up or down by at least 10%. Jacinda buys an at the money straddle, expiring in 1 month. Kobe also thinks it is at least twice as likely to be really good as really bad, so he buys an asymmetric straddle by going long a put struck at $55 and long 2 calls struck at $70 (all options expiring in 1 month). JADC is trading at $62.27 and pays no dividends. The cc interest rate is 2.25% and the option prices are as follows: Strike Call Put 55.00 7.84 0.47 62.27 2.92 2.81 70.00 0.64 8.24 Draw the payoff and profit diagrams for Jacinda and for Kobe. What are the breakeven point on the profit diagram for Jacinda? a. $56.53 and 568.01 b. $62.27 OC $56.54 and 568.00 O d. There is insufficient information. Oe $62.39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started