Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use Excel and upload the excel file and copy the link so I can download it A business firm is contemplating the installation of

Please use Excel and upload the excel file and copy the link so I can download it

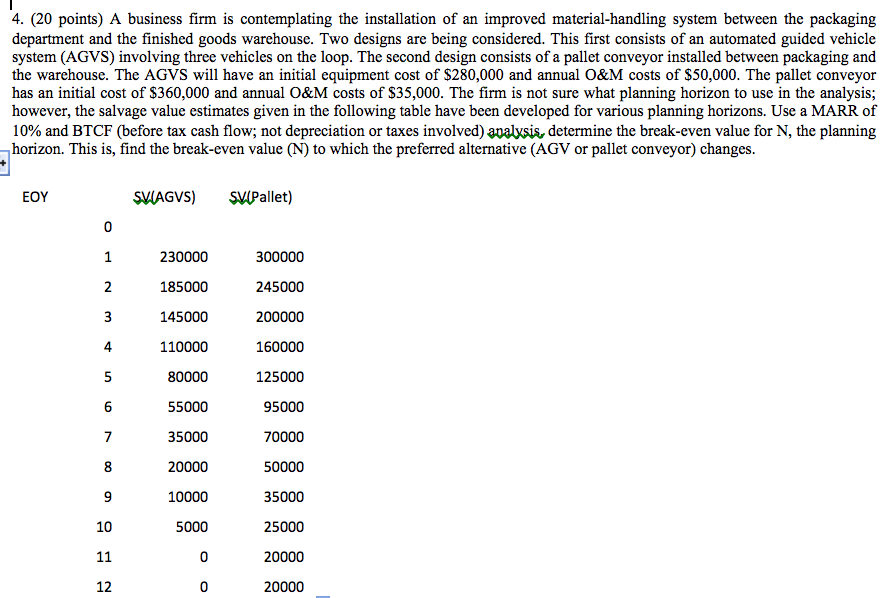

A business firm is contemplating the installation of an improved material-handling system between the packaging department and the finished goods warehouse. Two designs are being considered. This first consists of an automated guided vehicle system (AGVS) involving three vehicles on the loop. The second design consists of a pallet conveyor installed between packaging and the warehouse. The AGVS will have an initial equipment cost of $280,000 and annual O&M costs of $50,000. The pallet conveyor has an initial cost of $360,000 and annual O&M costs of S35,000. The firm is not sure what planning horizon to use in the analysis; however, the salvage value estimates given in the following table have been developed for various planning horizons. Use a MARR of 10% and BTCF (before tax cash flow; not depreciation or taxes involved) analysis, determine the break-even value for N, the planning horizon. This is, find the break-even value (N) to which the preferred alternative (AGV or pallet conveyor) changes. EOY SV(AGVS) SV(Pallet) 0 1 230000 300000 2 185000 245000 3 145000 200000 4 110000 160000 5 80000 125000 6 55000 95000 7 35000 70000 8 20000 50000 9 10000 35000 10 5000 25000 11 0 20000 12 0 20000 A business firm is contemplating the installation of an improved material-handling system between the packaging department and the finished goods warehouse. Two designs are being considered. This first consists of an automated guided vehicle system (AGVS) involving three vehicles on the loop. The second design consists of a pallet conveyor installed between packaging and the warehouse. The AGVS will have an initial equipment cost of $280,000 and annual O&M costs of $50,000. The pallet conveyor has an initial cost of $360,000 and annual O&M costs of S35,000. The firm is not sure what planning horizon to use in the analysis; however, the salvage value estimates given in the following table have been developed for various planning horizons. Use a MARR of 10% and BTCF (before tax cash flow; not depreciation or taxes involved) analysis, determine the break-even value for N, the planning horizon. This is, find the break-even value (N) to which the preferred alternative (AGV or pallet conveyor) changes. EOY SV(AGVS) SV(Pallet) 0 1 230000 300000 2 185000 245000 3 145000 200000 4 110000 160000 5 80000 125000 6 55000 95000 7 35000 70000 8 20000 50000 9 10000 35000 10 5000 25000 11 0 20000 12 0 20000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started