Question

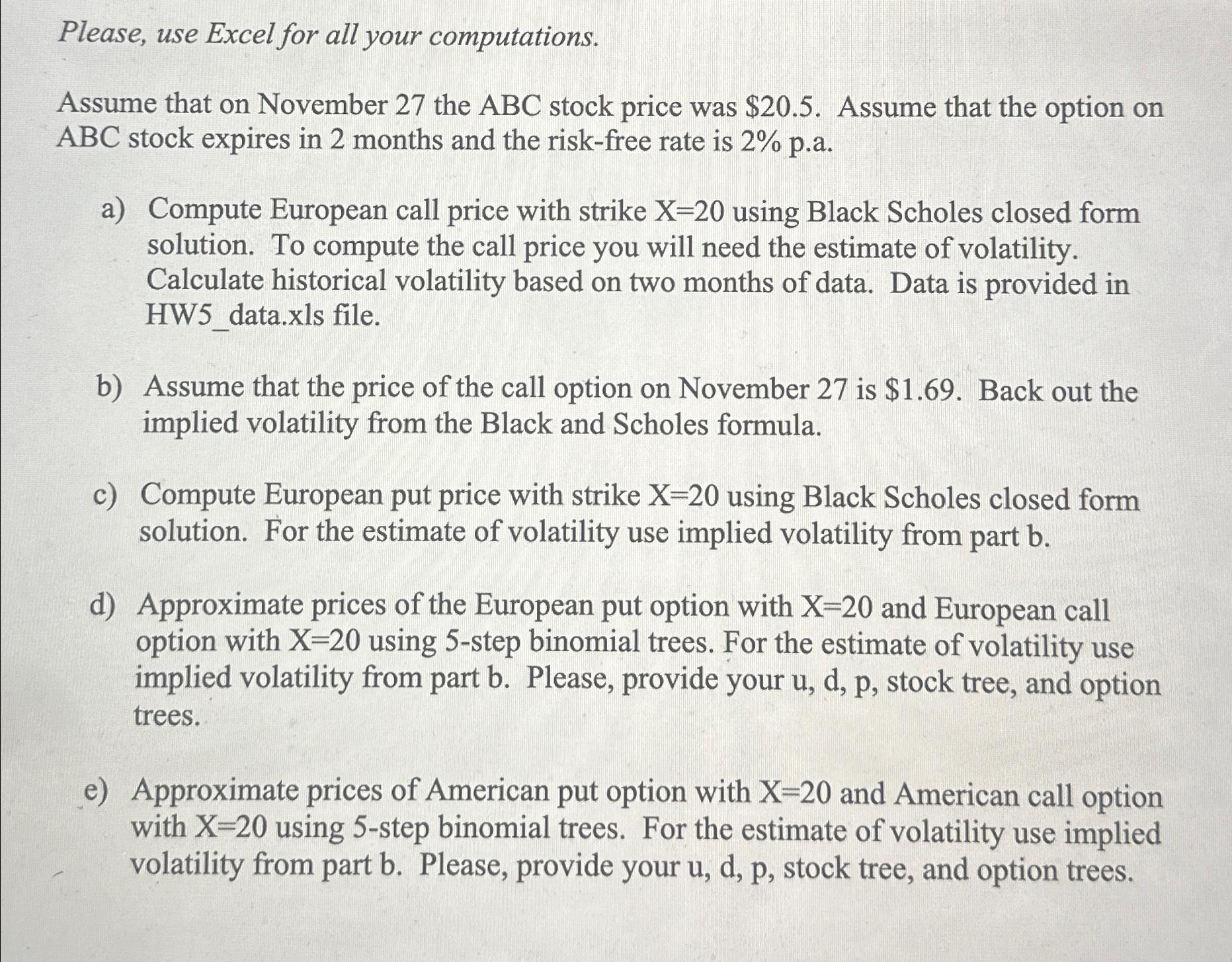

Please, use Excel for all your computations. Assume that on November 27 the ABC stock price was $20.5 . Assume that the option on ABC

Please, use Excel for all your computations.\ Assume that on November 27 the ABC stock price was

$20.5. Assume that the option on

ABCstock expires in 2 months and the risk-free rate is

2%p.a.\ a) Compute European call price with strike

x=20using Black Scholes closed form solution. To compute the call price you will need the estimate of volatility. Calculate historical volatility based on two months of data. Data is provided in HW5_data.xls file.\ b) Assume that the price of the call option on November 27 is

$1.69. Back out the implied volatility from the Black and Scholes formula.\ c) Compute European put price with strike

x=20using Black Scholes closed form solution. For the estimate of volatility use implied volatility from part

b.\ d) Approximate prices of the European put option with

x=20and European call option with

x=20using 5-step binomial trees. For the estimate of volatility use implied volatility from part b. Please, provide your

u,d,p, stock tree, and option trees.\ e) Approximate prices of American put option with

x=20and American call option with

x=20using 5-step binomial trees. For the estimate of volatility use implied volatility from part

b. Please, provide your

u,d,p, stock tree, and option trees.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started