Answered step by step

Verified Expert Solution

Question

1 Approved Answer

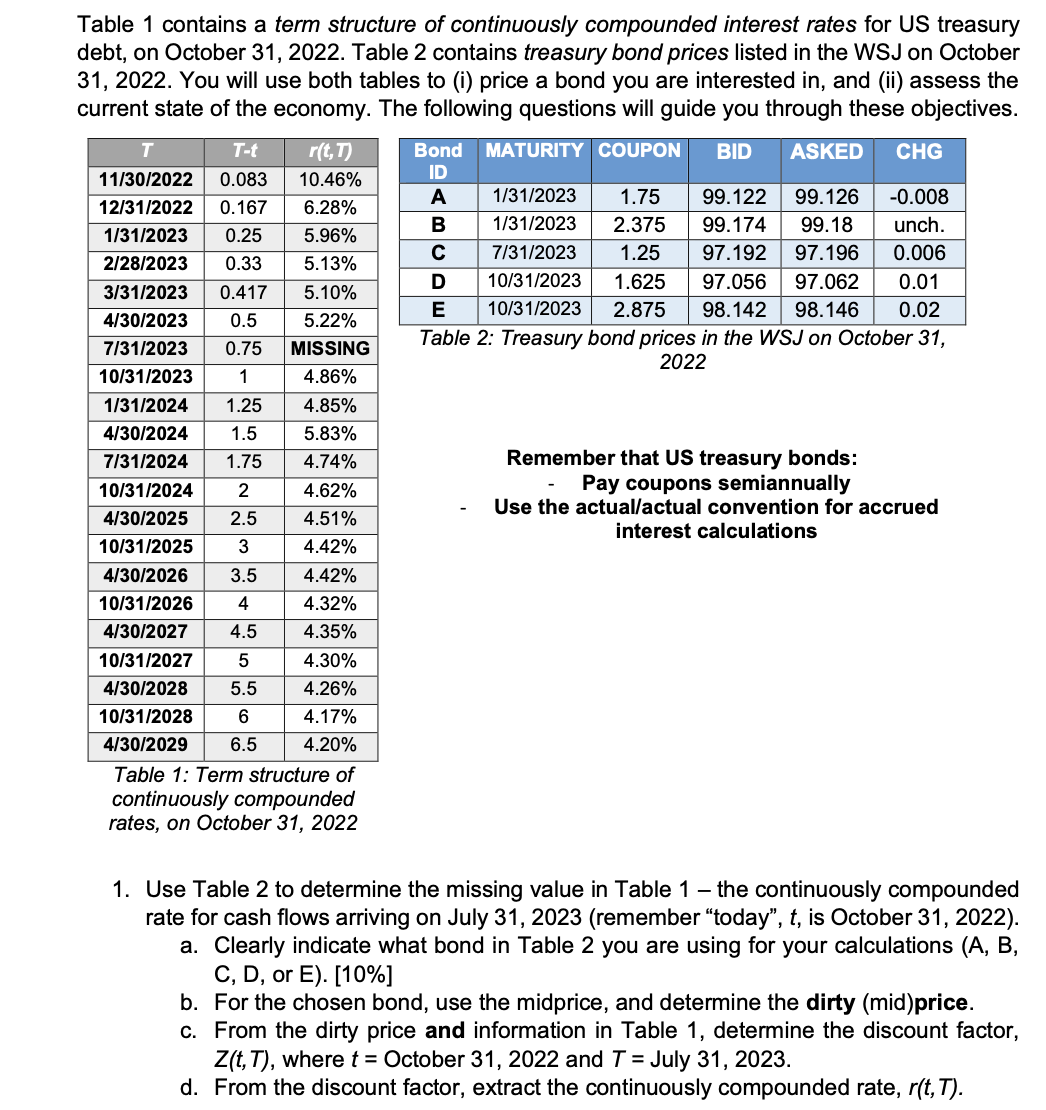

**********Please use excel **********. Table 1 contains a term structure of continuously compounded interest rates for US treasury debt, on October 31, 2022. Table 2

**********Please use excel **********.

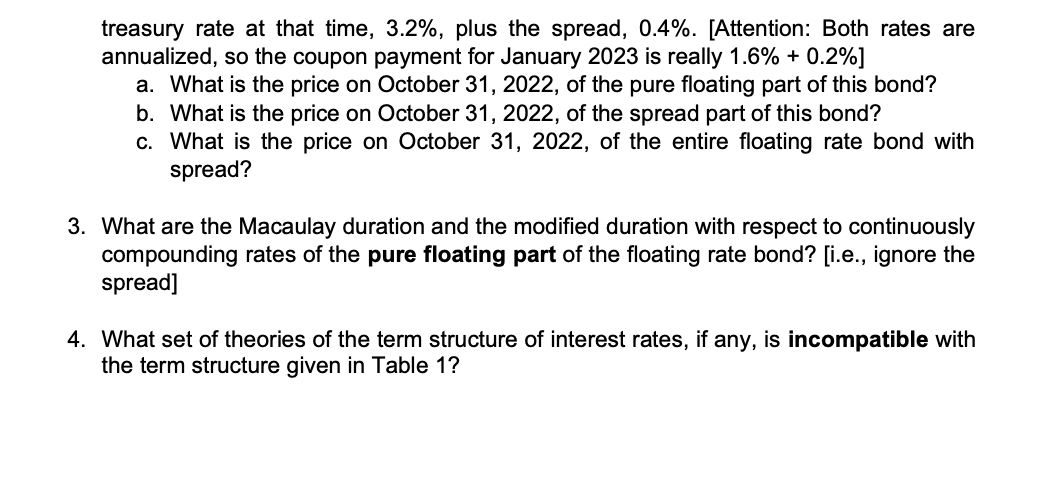

Table 1 contains a term structure of continuously compounded interest rates for US treasury debt, on October 31, 2022. Table 2 contains treasury bond prices listed in the WSJ on October 31,2022 . You will use both tables to (i) price a bond you are interested in, and (ii) assess the current state of the economy. The following questions will guide you through these objectives. Table 2: Treasury bond prices in the WSJ on October 31, 2022 Remember that US treasury bonds: - Pay coupons semiannually - Use the actual/actual convention for accrued interest calculations continuously compounded rates, on October 31, 2022 1. Use Table 2 to determine the missing value in Table 1 - the continuously compounded rate for cash flows arriving on July 31, 2023 (remember "today", t, is October 31, 2022). a. Clearly indicate what bond in Table 2 you are using for your calculations (A, B, C,D, or E). [10\%] b. For the chosen bond, use the midprice, and determine the dirty (mid)price. c. From the dirty price and information in Table 1, determine the discount factor, Z(t,T), where t= October 31,2022 and T= July 31,2023. d. From the discount factor, extract the continuously compounded rate, r(t,T). treasury rate at that time, 3.2%, plus the spread, 0.4%. [Attention: Both rates are annualized, so the coupon payment for January 2023 is really 1.6%+0.2% ] a. What is the price on October 31,2022 , of the pure floating part of this bond? b. What is the price on October 31,2022 , of the spread part of this bond? c. What is the price on October 31,2022 , of the entire floating rate bond with spread? 3. What are the Macaulay duration and the modified duration with respect to continuously compounding rates of the pure floating part of the floating rate bond? [i.e., ignore the spread] 4. What set of theories of the term structure of interest rates, if any, is incompatible with the term structure given in Table 1? Table 1 contains a term structure of continuously compounded interest rates for US treasury debt, on October 31, 2022. Table 2 contains treasury bond prices listed in the WSJ on October 31,2022 . You will use both tables to (i) price a bond you are interested in, and (ii) assess the current state of the economy. The following questions will guide you through these objectives. Table 2: Treasury bond prices in the WSJ on October 31, 2022 Remember that US treasury bonds: - Pay coupons semiannually - Use the actual/actual convention for accrued interest calculations continuously compounded rates, on October 31, 2022 1. Use Table 2 to determine the missing value in Table 1 - the continuously compounded rate for cash flows arriving on July 31, 2023 (remember "today", t, is October 31, 2022). a. Clearly indicate what bond in Table 2 you are using for your calculations (A, B, C,D, or E). [10\%] b. For the chosen bond, use the midprice, and determine the dirty (mid)price. c. From the dirty price and information in Table 1, determine the discount factor, Z(t,T), where t= October 31,2022 and T= July 31,2023. d. From the discount factor, extract the continuously compounded rate, r(t,T). treasury rate at that time, 3.2%, plus the spread, 0.4%. [Attention: Both rates are annualized, so the coupon payment for January 2023 is really 1.6%+0.2% ] a. What is the price on October 31,2022 , of the pure floating part of this bond? b. What is the price on October 31,2022 , of the spread part of this bond? c. What is the price on October 31,2022 , of the entire floating rate bond with spread? 3. What are the Macaulay duration and the modified duration with respect to continuously compounding rates of the pure floating part of the floating rate bond? [i.e., ignore the spread] 4. What set of theories of the term structure of interest rates, if any, is incompatible with the term structure given in Table 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started