Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use excel Thanks! Haden Company's CFO has collected the following information: The company estimates that its EBIT for the upcoming year will be $102

Please use excel

Thanks!

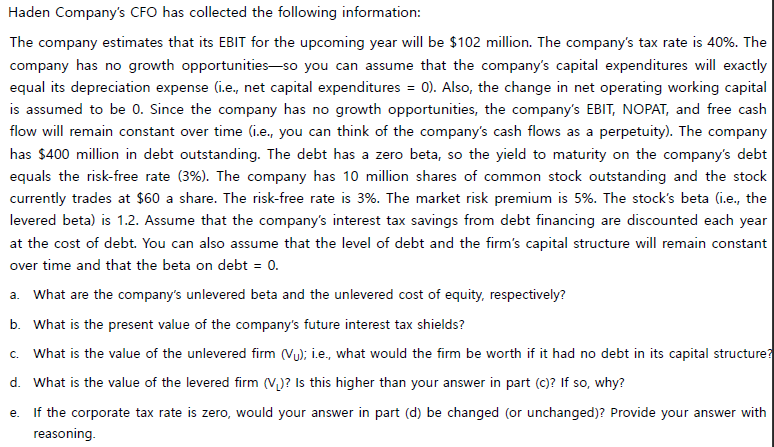

Haden Company's CFO has collected the following information: The company estimates that its EBIT for the upcoming year will be $102 million. The company's tax rate is 40%. The company has no growth opportunitiesso you can assun sume that the company's capital expenditures will exactly equal its depreciation expense (i.e., net capital expenditures = 0). Also, the change in net operating working capital is assumed to be 0. Since the company has no growth opportunities, the company's EBIT, NOPAT, and free cash flow will remain constant over time (i.e., you can think of the company's cash flows as a perpetuity). The company has $400 million in debt outstanding. The debt has a zero beta, so the yield to maturity on the company's debt equals the risk-free rate (3%). The company has 10 million shares of common stock outstanding and the stock currently trades at $60 a share. The risk-free rate is 3%. The market risk premium is 5%. The stock's beta (i.e., the levered beta) is 1.2. Assume that the company's interest tax savings from debt financing are discounted each year at the cost of debt. You can also assume that the level of debt and the firm's capital structure will remain constant over time and that the beta on debt = 0. a. What are the company's unlevered beta and the unlevered cost of equity, respectively? b. What is the present value of the company's future interest tax shields? c. What is the value of the unlevered firm (Vu); i.e., what would the firm be worth if it had no debt in its capital structure? d. What is the value of the levered firm (V.)? Is this higher than your answer in part (c)? If so, why? If the corporate tax rate is zero, would your answer in part (d) be changed or unchanged)? Provide your answer with reasoning e. Haden Company's CFO has collected the following information: The company estimates that its EBIT for the upcoming year will be $102 million. The company's tax rate is 40%. The company has no growth opportunitiesso you can assun sume that the company's capital expenditures will exactly equal its depreciation expense (i.e., net capital expenditures = 0). Also, the change in net operating working capital is assumed to be 0. Since the company has no growth opportunities, the company's EBIT, NOPAT, and free cash flow will remain constant over time (i.e., you can think of the company's cash flows as a perpetuity). The company has $400 million in debt outstanding. The debt has a zero beta, so the yield to maturity on the company's debt equals the risk-free rate (3%). The company has 10 million shares of common stock outstanding and the stock currently trades at $60 a share. The risk-free rate is 3%. The market risk premium is 5%. The stock's beta (i.e., the levered beta) is 1.2. Assume that the company's interest tax savings from debt financing are discounted each year at the cost of debt. You can also assume that the level of debt and the firm's capital structure will remain constant over time and that the beta on debt = 0. a. What are the company's unlevered beta and the unlevered cost of equity, respectively? b. What is the present value of the company's future interest tax shields? c. What is the value of the unlevered firm (Vu); i.e., what would the firm be worth if it had no debt in its capital structure? d. What is the value of the levered firm (V.)? Is this higher than your answer in part (c)? If so, why? If the corporate tax rate is zero, would your answer in part (d) be changed or unchanged)? Provide your answer with reasoning eStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started