Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use excel to solve. Thanks in advance The following information is given to you regarding the decision to either purchase warehouse space on the

Please use excel to solve. Thanks in advance

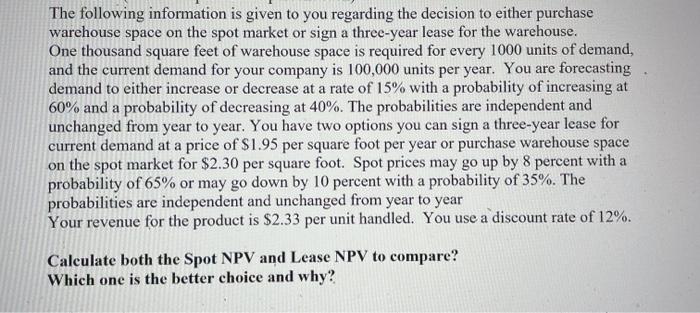

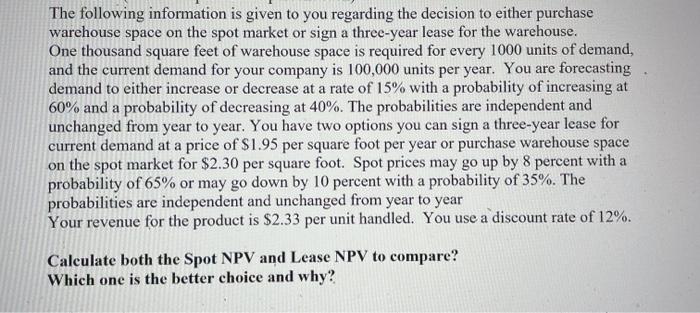

The following information is given to you regarding the decision to either purchase warehouse space on the spot market or sign a three-year lease for the warehouse. One thousand square feet of warehouse space is required for every 1000 units of demand, and the current demand for your company is 100,000 units per year. You are forecasting demand to either increase or decrease at a rate of 15% with a probability of increasing at 60% and a probability of decreasing at 40%. The probabilities are independent and unchanged from year to year. You have two options you can sign a three-year lease for current demand at a price of $1.95 per square foot per year or purchase warehouse space on the spot market for $2.30 per square foot. Spot prices may go up by 8 percent with a probability of 65% or may go down by 10 percent with a probability of 35%. The probabilities are independent and unchanged from year to year Your revenue for the product is $2.33 per unit handled. You use a discount rate of 12%. Calculate both the Spot NPV and Lease NPV to compare? Which one is the better choice and why? The following information is given to you regarding the decision to either purchase warehouse space on the spot market or sign a three-year lease for the warehouse. One thousand square feet of warehouse space is required for every 1000 units of demand, and the current demand for your company is 100,000 units per year. You are forecasting demand to either increase or decrease at a rate of 15% with a probability of increasing at 60% and a probability of decreasing at 40%. The probabilities are independent and unchanged from year to year. You have two options you can sign a three-year lease for current demand at a price of $1.95 per square foot per year or purchase warehouse space on the spot market for $2.30 per square foot. Spot prices may go up by 8 percent with a probability of 65% or may go down by 10 percent with a probability of 35%. The probabilities are independent and unchanged from year to year Your revenue for the product is $2.33 per unit handled. You use a discount rate of 12%. Calculate both the Spot NPV and Lease NPV to compare? Which one is the better choice and why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started