Please use information provided to complete:

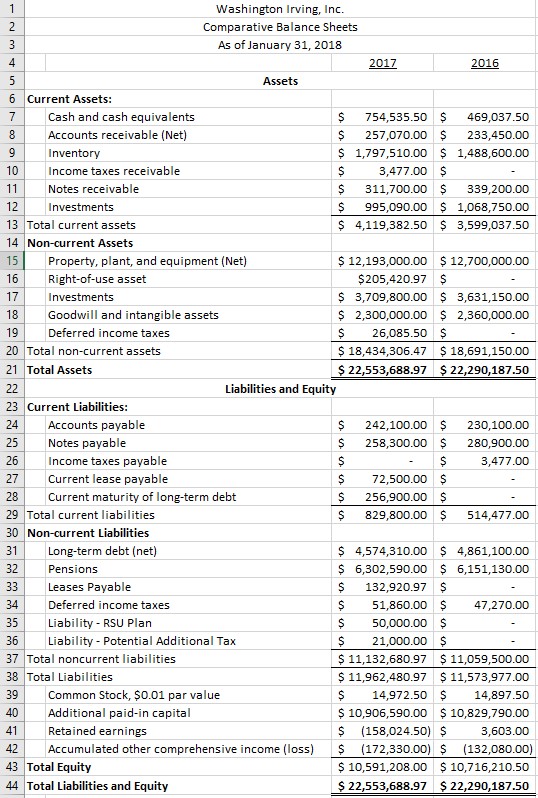

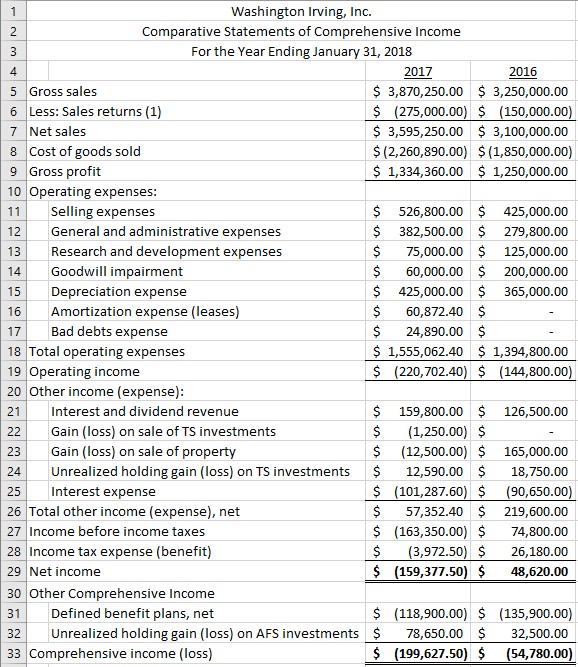

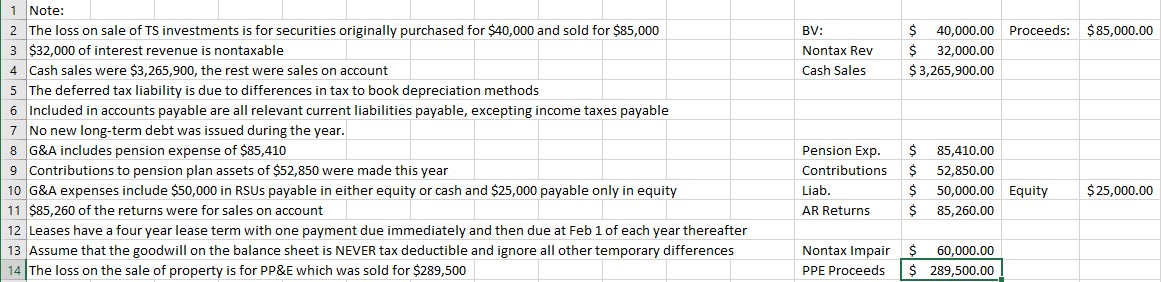

- A direct method statement of cash flow.

Washington Irving, Inc. Comparative Balance Sheets As of January 31, 2018 2017 2016 OutwN. Assets Current Assets: Cash and cash equivalents S 754,535.50 S 469,037.50 Accounts receivable (Net) S 257,070.00 233,450.00 9 Inventory $ 1,797,510.00 $ 1,488,600.00 10 Income taxes receivable S 3,477.00 S 11 Notes receivable 311,700.00 $ 339,200.00 12 Investments S 995,090.00 $ 1,068,750.00 13 Total current assets $ 4,119,382.50 $ 3,599,037.50 14 Non-current Assets 15 Property, plant, and equipment (Net) $ 12,193,000.00 $ 12,700,000.00 16 Right-of-use asset $205,420.97 $ 17 Investments $ 3,709,800.00 $ 3,631,150.00 18 Goodwill and intangible assets $ 2,300,000.00 $ 2,360,000.00 19 Deferred income taxes S 26,085.50 20 Total non-current assets $ 18,434,306.47 $ 18,691,150.00 21 Total Assets $ 22,553,688.97 $ 22,290,187.50 22 Liabilities and Equity 23 Current Liabilities: 24 Accounts payable 242,100.00 S 230,100.00 25 Notes payable 258,300.00 280,900.00 26 Income taxes payable S S 3,477.00 27 Current lease payable S 72,500.00 28 Current maturity of long-term debt S 256,900.00 S 29 Total current liabilities S 829,800.00 S 514,477.00 30 Non-current Liabilities 31 Long-term debt ( net) $ 4,574,310.00 $ 4,861,100.00 32 Pensions 6,302,590.00 $ 6,151,130.00 33 Leases Payable S 132,920.97 34 Deferred income taxes S 51,860.00 47,270.00 35 Liability - RSU Plan 50,000.00 36 Liability - Potential Additional Tax S 21,000.00 S 37 Total noncurrent liabilities $ 11,132,680.97 $ 11,059,500.00 38 Total Liabilities $ 11,962,480.97 $ 11,573,977.00 39 Common Stock, $0.01 par value S 14,972.50 S 14,897.50 40 Additional paid-in capital $ 10,906,590.00 $ 10,829,790.00 41 Retained earnings S (158,024.50) $ 3,603.00 42 Accumulated other comprehensive income (loss) S (172,330.00) $ (132,080.00) 43 Total Equity $ 10,591,208.00 $ 10,716,210.50 44 Total Liabilities and Equity $ 22,553,688.97 $ 22,290,187.50Washington Irving, Inc. Comparative Statements of Comprehensive Income A W N For the Year Ending January 31, 2018 2017 2016 Gross sales $ 3,870,250.00 $ 3,250,000.00 6 Less: Sales returns (1) (275,000.00) $ (150,000.00) 7 Net sales $ 3,595,250.00 $ 3,100,000.00 8 Cost of goods sold $ (2,260,890.00) $ (1,850,000.00) 9 Gross profit $ 1,334,360.00 $ 1,250,000.00 10 Operating expenses: 11 Selling expenses 526,800.00 $ 425,000.00 12 General and administrative expenses S 382,500.00 S 279,800.00 13 Research and development expenses 75,000.00 $ 125,000.00 14 Goodwill impairment 60,000.00 S 200,000.00 15 Depreciation expense S 425,000.00 S 365,000.00 16 Amortization expense (leases) 60,872.40 S 17 Bad debts expense 24,890.00 S 18 Total operating expenses $ 1,555,062.40 $ 1,394,800.00 19 Operating income $ (220,702.40) $ (144,800.00 20 Other income (expense): 21 Interest and dividend revenue 159,800.00 S 126,500.00 22 Gain (loss) on sale of TS investments (1,250.00) $ 23 Gain (loss) on sale of property (12,500.00) 165,000.00 24 Unrealized holding gain (loss) on TS investments 12,590.00 $ 18,750.00 25 Interest expense (101,287.60) $ (90,650.00) 26 Total other income (expense), net 57,352.40 $ 219,600.00 27 Income before income taxes $ (163,350.00) $ 74,800.00 28 Income tax expense (benefit) S (3,972.50) $ 26,180.00 29 Net income $ (159,377.50) $ 48,620.00 30 Other Comprehensive Income 31 Defined benefit plans, net $ (118,900.00) $ (135,900.00) 32 Unrealized holding gain (loss) on AFS investments S 78,650.00 $ 32,500.00 33 Comprehensive income (loss) $ (199,627.50) $ (54,780.001 Note: 2 The loss on sale of TS investments is for securities originally purchased for $40,000 and sold for $85,000 BV: $ 40,000.00 Proceeds: $85,000.00 3 $32,000 of interest revenue is nontaxable Nontax Rev S 32,000.00 4 Cash sales were $3,265,900, the rest were sales on account Cash Sales $ 3,265,900.00 5 The deferred tax liability is due to differences in tax to book depreciation methods 6 Included in accounts payable are all relevant current liabilities payable, excepting income taxes payable 7 No new long-term debt was issued during the year. 8 G&A includes pension expense of $85,410 Pension Exp. S 85,410.00 9 Contributions to pension plan assets of $52,850 were made this year Contributions S 52,850.00 10 G&A expenses include $50,000 in RSUs payable in either equity or cash and $25,000 payable only in equity Liab. 50,000.00 Equity $ 25,000.00 11 $85,260 of the returns were for sales on account AR Returns S 85,260.00 12 Leases have a four year lease term with one payment due immediately and then due at Feb 1 of each year thereafter 13 Assume that the goodwill on the balance sheet is NEVER tax deductible and ignore all other temporary differences Nontax Impair S 60,000.00 The loss on the sale of property is for PP&E which was sold for $289,500 PPE Proceeds $ 289,500.00