Question

(PLEASE USE TABLE ATTACHED) 1. What is the annual percentage rate of interest on terms: 7/11, net 31?* A.1.28 B.1.58 C.1.38 D.1.48 2. What is

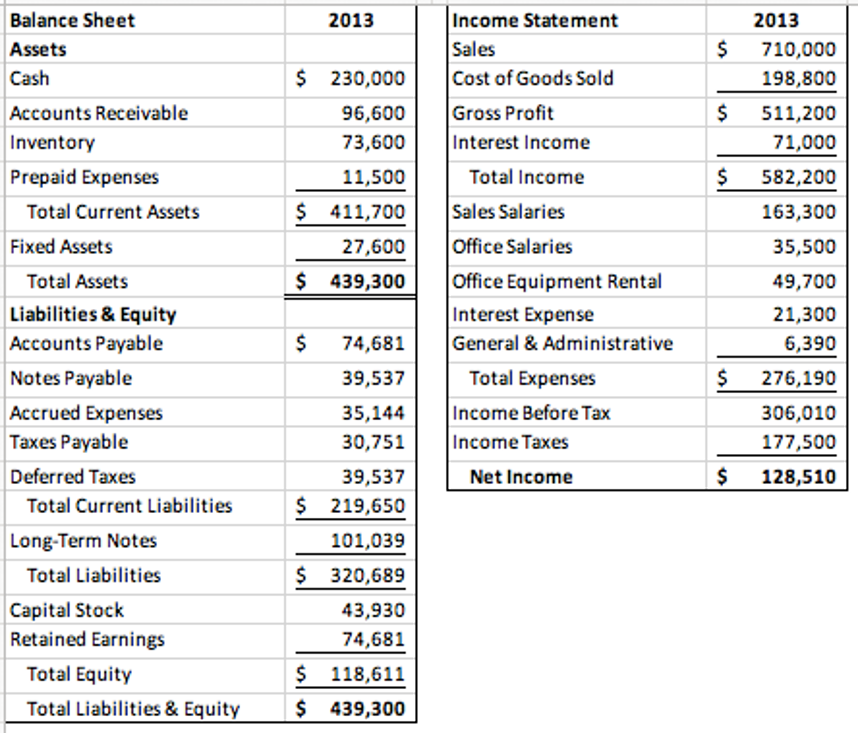

(PLEASE USE TABLE ATTACHED)

1. What is the annual percentage rate of interest on terms: 7/11, net 31?*

A.1.28

B.1.58

C.1.38

D.1.48

2. What is the annual percentage rate of interest on terms: 5/9, net 29?*

A.0.91

B.0.81

C.0.61

D.0.71

3. What is the break-even point in units if fixed costs are $1400, variable costs are $112, and the selling price is $322?*

A.9.67

B.8.67

C.6.67

D.7.67

4. What is the contribution margin if fixed costs are $1400, variable costs are $112, and the selling price is $322?*

A.410

B.310

C.210

D.510

5. How many units in sales are required to earn a target profit of $3900 if fixed costs are $1400, variable costs are $112, and selling price is $322?*

A.35.24

B.15.24

C.45.24

D.25.24

6. What sales price is required to earn a target profit of $3900 if fixed costs are $1400, variable costs are $112, and sales in units are 300?*

A.129.67

B.229.67

C.329.67

D.429.67

7. Using the financial statements provided, calculate the financial ratio: return on sales for the year 2013.*

A.0.18

B.0.08

C.0.38

D.0.28

8. Using the financial statements provided, calculate the financial ratio: sales to working capital for the year 2013.*

A.1.93

B.4.93

C.3.93

D.2.93

9. Using the financial statements provided, calculate the financial ratio: return on assets for the year 2013.*

A.0.49

B.0.29

C.0.39

D.0.19

10. Using the financial statements provided, calculate the financial ratio: current ratio for the year 2013.*

A.4.82

B.2.82

C.1.82

D.3.82

11. Using the financial statements provided, calculate the financial ratio: sales to total assets for the year 2013.*

A.1.72

B.1.82

C.1.62

D.1.52

12. Using the financial statements provided, calculate the financial ratio: return on equity for the year 2013.*

A.1.08

B.3.08

C.2.08

D.0.08

13. Using the financial statements provided, calculate the financial ratio: quick ratio for the year 2013.*

A.1.49

B.4.49

C.2.49

D.3.49

14. Using the financial statements provided, calculate the financial ratio: debt ratio for the year 2013.*

A.0.53

B.0.63

C.0.83

D.0.73

15. Using the financial statements provided, calculate the financial ratio: debt equity ratio for the year 2013.*

A.0.70

B.1.70

C.3.70

D.2.70

16. Using the financial statements provided, calculate the financial ratio: long-term debt to total assets for the year 2013.*

A.0.33

B.0.13

C.0.43

D.0.23

17. Using the financial statements provided, calculate the financial ratio: times interest earned for the year 2013.*

A.15.37

B.5.37

C.9.37

D.25.37

18. Using the financial statements provided, calculate average daily sales for the year 2013.*

A.2,945.21

B.1,945.21

C.3,945.21

D.4,945.21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started