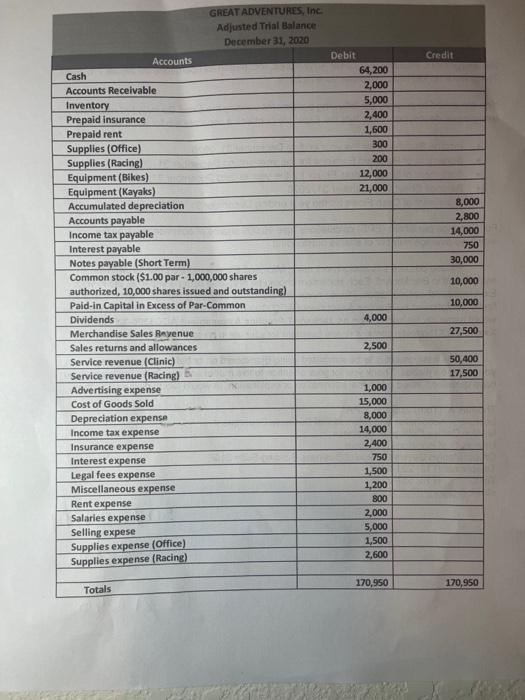

Please use the following adjusted Trial Balance for Great Adventures, Inc. to complete this assignment. Assume that Great Adventures, Inc. began its operations on January 1, 2020. There were no identifiable transactions in 2019. You are asked to prepare the following statements utilizing the Excel file included with this assignment description. Note that the Excel file contains a separate tab for each statement: . . . Income Statement for the year ending December 31, 2020 (Multi Step format) Statement of Retained Earnings for the year ending December 31, 2020 Statement of Stockholders Equity for the year ending December 31, 2020 Balance Sheet at December 31, 2020 Statement of Cash Flows for the year ending December 31, 2020 For Earnings per Share (EPS) calculations, use 10,000 shares of common stock as the weighted average number of shares outstanding. . Please prepare this assignment using Microsoft Excel template provided with the assignment in Blackboard. Each statement should be prepared using a separate tab in your Excel spreadsheet workbook. Please name the workbook beginning with your last name then first initial followed by Practice Assessment ACC3300-07 (10273) Spring 2021 (as an example, would name my file submission as Jackson Practice Assessment ACC3300-XX (XXXXX) Xxxxx 202XThis folder contains review questions for your use in preparation for Examination II.) This assignment is to be submitted using Blackboard on or before the date specified in your course syllabus. Thank you for your attention to this matter and please let me know if you have questions, need additional information or explanation, or would like to discuss it further. Credit Debit 64,200 2,000 5,000 2,400 1,600 300 200 12,000 21,000 8,000 2,800 14,000 750 30,000 GREAT ADVENTURES, Inc. Adjusted Trial Balance December 31, 2020 Accounts Cash Accounts Receivable Inventory Prepaid Insurance Prepaid rent Supplies (Office) Supplies (Racing) Equipment (Bikes) Equipment (Kayaks) Accumulated depreciation Accounts payable Income tax payable Interest payable Notes payable (Short Term) Common stock ($1.00 par - 1,000,000 shares authorized, 10,000 shares issued and outstanding) Paid-in Capital in Excess of Par-Common Dividends Merchandise Sales Revenue Sales returns and allowances Service revenue (Clinic) Service revenue (Racing) Advertising expense Cost of Goods Sold Depreciation expense Income tax expense Insurance expense Interest expense Legal fees expense Miscellaneous expense Rent expense Salaries expense Selling expese Supplies expense (Office) Supplies expense (Racing) 10,000 10,000 4,000 27,500 2,500 50,400 17,500 1,000 15,000 8,000 14,000 2,400 750 1,500 1,200 800 2,000 5,000 1,500 2,600 170,950 170,950 Totals