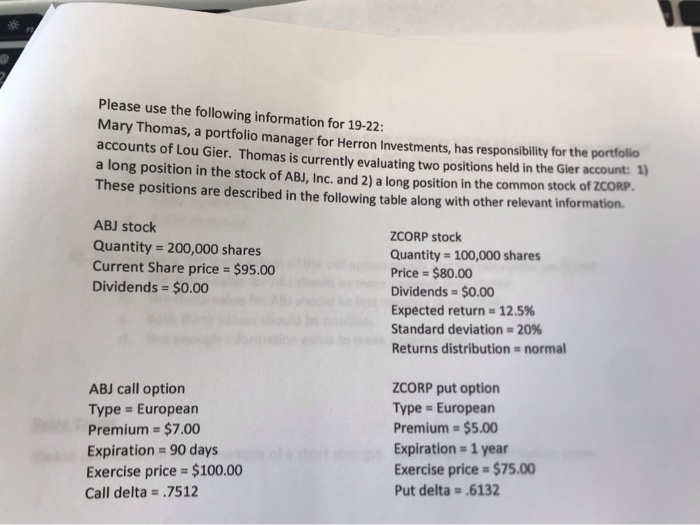

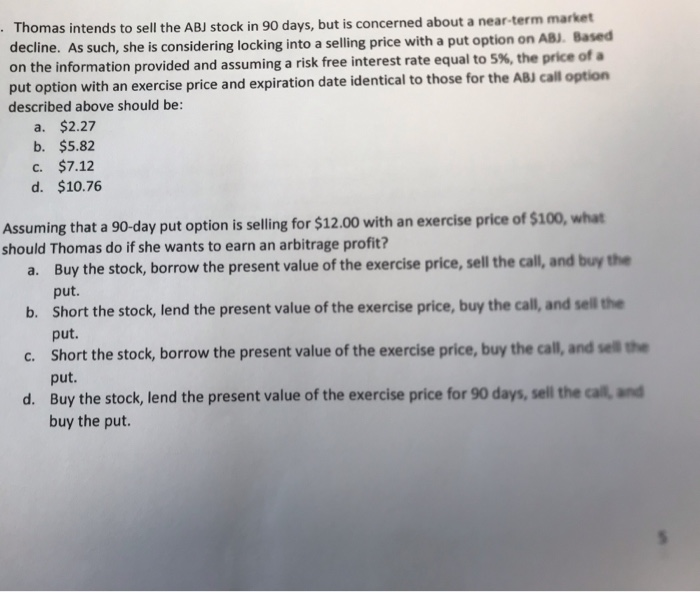

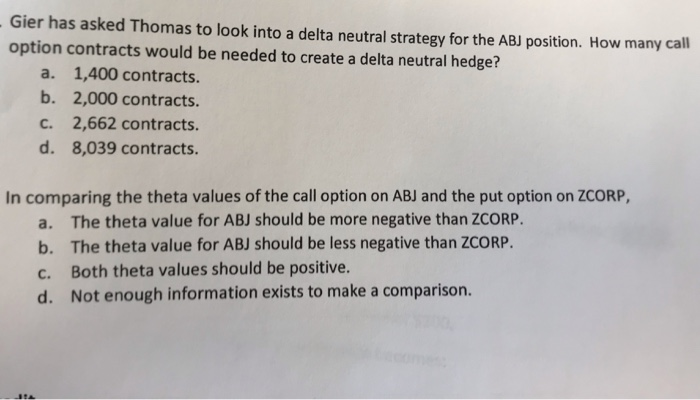

Please use the following information for 19-22: Mary Thomas, a portfolio manager for Herron Investments, has responsibility for the portfolo accounts of Lou Gier. Thomas is currently evaluating two positions held in the Gier account: 1) long position in the stock of ABJ, Inc. and 2) a long position in the common stock of ZCORP These positions are described in the following table along with other relevant information. a ABJ stock ZCORP stock Quantity 200,000 shares Current Share price $95.00 Dividends $0.00 Quantity 100,000 shares Price= $80.00 Dividends-$0.00 Expected return 12.5% Standard deviation =20% Returns distribution = normal ZCORP put option Type= European Premium - $5.00 Expiration 1 year Exercise price= $75.00 Put delta .6132 ABJ call option Type = European Premium = $7.00 Expiration 90 days Exercise price $100.00 Call delta = .7512 . Thomas intends to sell the ABJ stock in 90 days, but is concerned about a near-term market decline. As such, she is considering locking into a selling price with a put option on ABJ. Based on the information provided and assuming a risk free interest rate equal to 5%, the price of a put option with an exercise price and expiration date identical to those for the ABJ call option described above should be: a. $2.27 b. $5.82 $7.12 C. d. $10.76 Assuming that a 90-day put option is selling for $12.00 with an exercise price of $100, what should Thomas do if she wants to earn an arbitrage profit? a. Buy the stock, borrow the present value of the exercise price, sell the call, and buy the put. Short the stock, lend the present value of the exercise price, buy the call, and sell the b. put. c. Short the stock, borrow the present value of the exercise price, buy the call, and sell the put. Buy the stock, lend the present value of the exercise price for 90 days, sell the call, and buy the put. d. Gier has asked Thomas to look into a delta neutral strategy for the ABJ position. How many call option contracts would be needed to create a delta neutral hedge? a. 1,400 contracts. b. 2,000 contracts. c. 2,662 contracts. d. 8,039 contracts. In comparing the theta values of the call option on ABJ and the put option on ZCORP, a. The theta value for ABJ should be more negative than ZCORP. b. The theta value for ABJ should be less negative than ZCORP. c. Both theta values should be positive. d. Not enough information exists to make a comparison