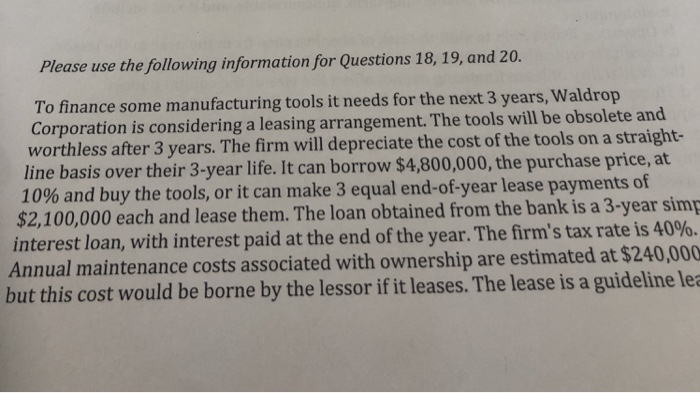

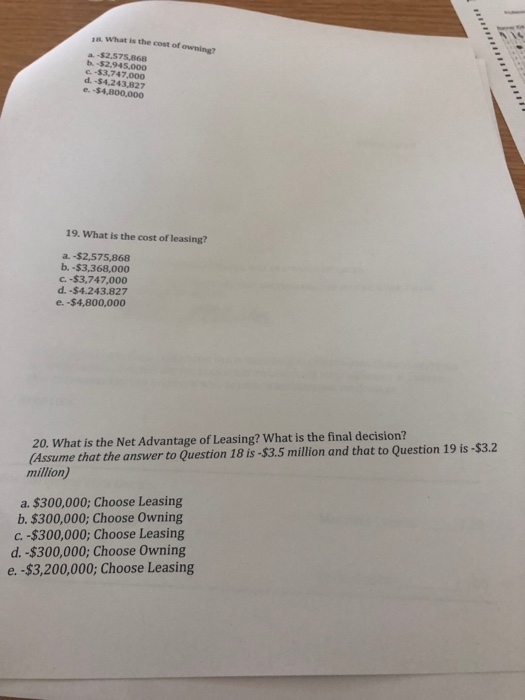

Please use the following information for Questions 18, 19, and 20. To finance some manufacturing tools it needs for the next 3 years, Waldrop Corporation is considering a leasing arrangement. The tools will be obsolete and worthless after 3 years. The firm will depreciate the cost of the tools on a straight- line basis over their 3-year life. It can borrow $4,800,000, the purchase price, at 10% and buy the tools, or it can make 3 equal end-of-year lease payments of $2,100,000 each and lease them. The loan obtained from the bank is a 3-year sim interest loan, with interest paid at the end of the year. The firm's tax rate is 40%. Annual maintenance costs associated with ownership are estimated at $240,000 but this cost would be borne by the lessor if it leases. The lease is a guideline lea 18. What is the cost of owning? b. $2,945,000 C.-$3,747,000 d.-$4,243,827 e. $4,800,000 19. What is the cost of leasing? a. -$2,575,868 b.-$3,368,000 C.-$3,747,000 d.-$4.243.827 e.-$4,800,000 20. What is the Net Advantage of Leasing? What is the final decision? Assume that the answer to Question 18 is -$3.5 million and that to Question 19 is -$3.2 million) a. $300,000; Choose Leasing b. $300,000; Choose Owning c. -$300,000; Choose Leasing d.-$300,000; Choose Owning e.-$3,200,000; Choose Leasing Please use the following information for Questions 18, 19, and 20. To finance some manufacturing tools it needs for the next 3 years, Waldrop Corporation is considering a leasing arrangement. The tools will be obsolete and worthless after 3 years. The firm will depreciate the cost of the tools on a straight- line basis over their 3-year life. It can borrow $4,800,000, the purchase price, at 10% and buy the tools, or it can make 3 equal end-of-year lease payments of $2,100,000 each and lease them. The loan obtained from the bank is a 3-year sim interest loan, with interest paid at the end of the year. The firm's tax rate is 40%. Annual maintenance costs associated with ownership are estimated at $240,000 but this cost would be borne by the lessor if it leases. The lease is a guideline lea 18. What is the cost of owning? b. $2,945,000 C.-$3,747,000 d.-$4,243,827 e. $4,800,000 19. What is the cost of leasing? a. -$2,575,868 b.-$3,368,000 C.-$3,747,000 d.-$4.243.827 e.-$4,800,000 20. What is the Net Advantage of Leasing? What is the final decision? Assume that the answer to Question 18 is -$3.5 million and that to Question 19 is -$3.2 million) a. $300,000; Choose Leasing b. $300,000; Choose Owning c. -$300,000; Choose Leasing d.-$300,000; Choose Owning e.-$3,200,000; Choose Leasing