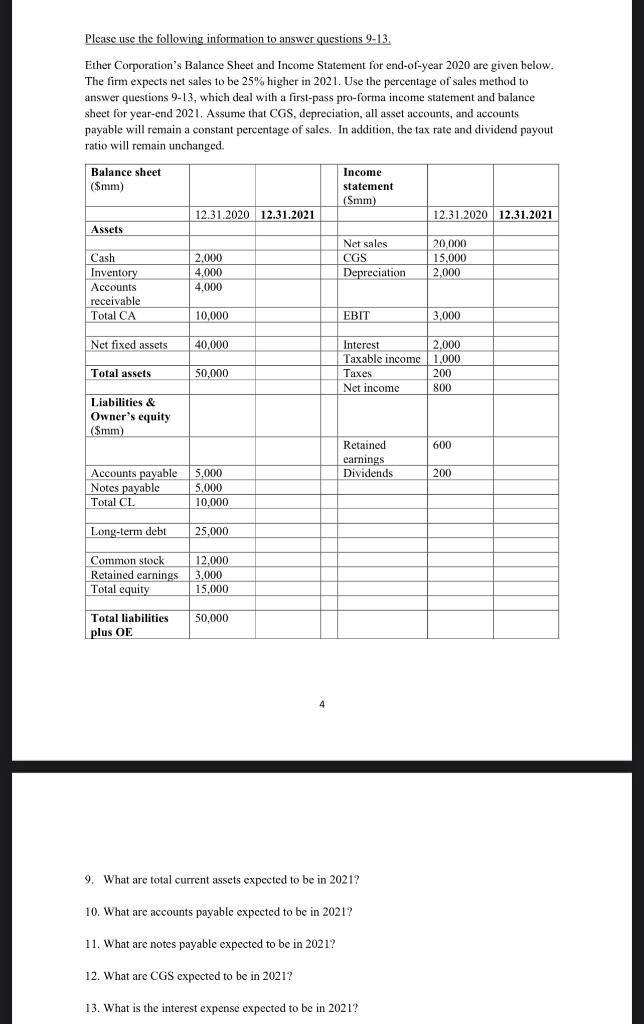

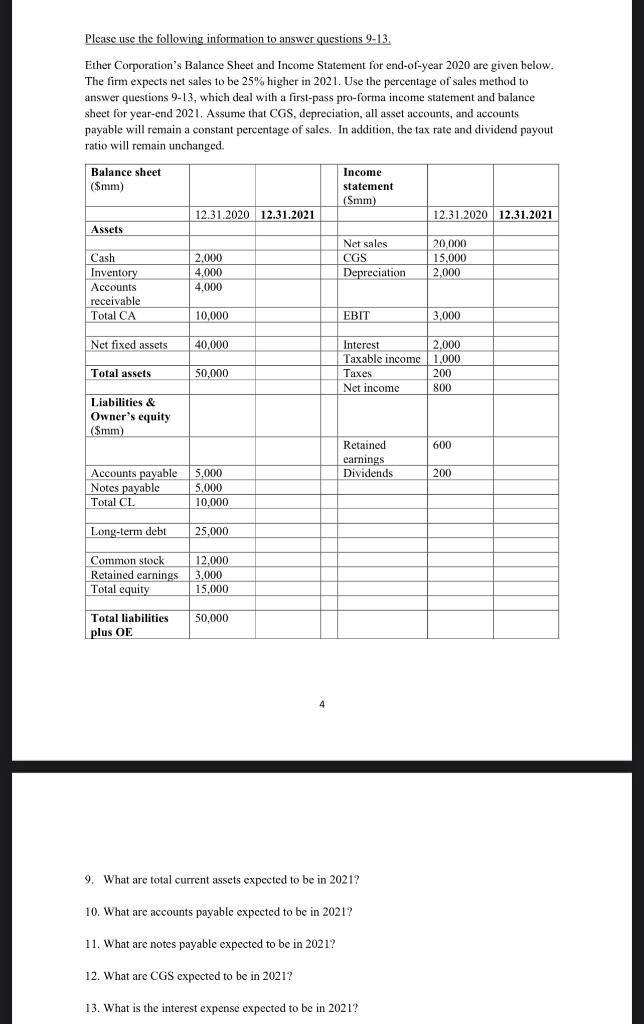

Please use the following information to answer questions 9-13 Ether Corporation's Balance Sheet and Income Statement for end-of-year 2020 are given below. The firm expects net sales to be 25% higher in 2021. Use the percentage of sales method to answer questions 9-13, which deal with a first-pass pro-forma income statement and balance sheet for year-end 2021. Assume that CGS, depreciation, all asset accounts, and accounts payable will remain a constant percentage of sales. In addition, the tax rate and dividend payout ratio will remain unchanged. Balance sheet ($mm) Income statement (Smm) 12.31.2020 12.31.2021 12.31.2020 12.31.2021 Assets Net sales CGS Depreciation 2.000 4,000 4.000 20.000 15,000 2,000 Cash Inventory Accounts receivable Total CA 10,000 EBIT 3.000 Net fixed assets 40,000 Interest 2.000 Taxable income 1,000 Taxes 200 Net income 800 Total assets 50,000 Liabilities & Owner's equity ($mm) 600 Retained earnings Dividends 200 Accounts payable Notes payable Total CL 5,000 5.000 10,000 Long-term debt 25,000 Common stock 12.000 Retained earnings 3,000 Total equity 15.000 Total liabilities plus OE 50,000 9. What are total current assets expected to be in 2021? 10. What are accounts payable expected to be in 2021? 11. What are notes payable expected to be in 2021? 12. What are CGS expected to be in 2021? 13. What is the interest expense expected to be in 2021? Please use the following information to answer questions 9-13 Ether Corporation's Balance Sheet and Income Statement for end-of-year 2020 are given below. The firm expects net sales to be 25% higher in 2021. Use the percentage of sales method to answer questions 9-13, which deal with a first-pass pro-forma income statement and balance sheet for year-end 2021. Assume that CGS, depreciation, all asset accounts, and accounts payable will remain a constant percentage of sales. In addition, the tax rate and dividend payout ratio will remain unchanged. Balance sheet ($mm) Income statement (Smm) 12.31.2020 12.31.2021 12.31.2020 12.31.2021 Assets Net sales CGS Depreciation 2.000 4,000 4.000 20.000 15,000 2,000 Cash Inventory Accounts receivable Total CA 10,000 EBIT 3.000 Net fixed assets 40,000 Interest 2.000 Taxable income 1,000 Taxes 200 Net income 800 Total assets 50,000 Liabilities & Owner's equity ($mm) 600 Retained earnings Dividends 200 Accounts payable Notes payable Total CL 5,000 5.000 10,000 Long-term debt 25,000 Common stock 12.000 Retained earnings 3,000 Total equity 15.000 Total liabilities plus OE 50,000 9. What are total current assets expected to be in 2021? 10. What are accounts payable expected to be in 2021? 11. What are notes payable expected to be in 2021? 12. What are CGS expected to be in 2021? 13. What is the interest expense expected to be in 2021