Question

Please use the information provided below to develop a fully allocated monthly income statement for Mayflower Hotel. The allocation is based on numbers of employees

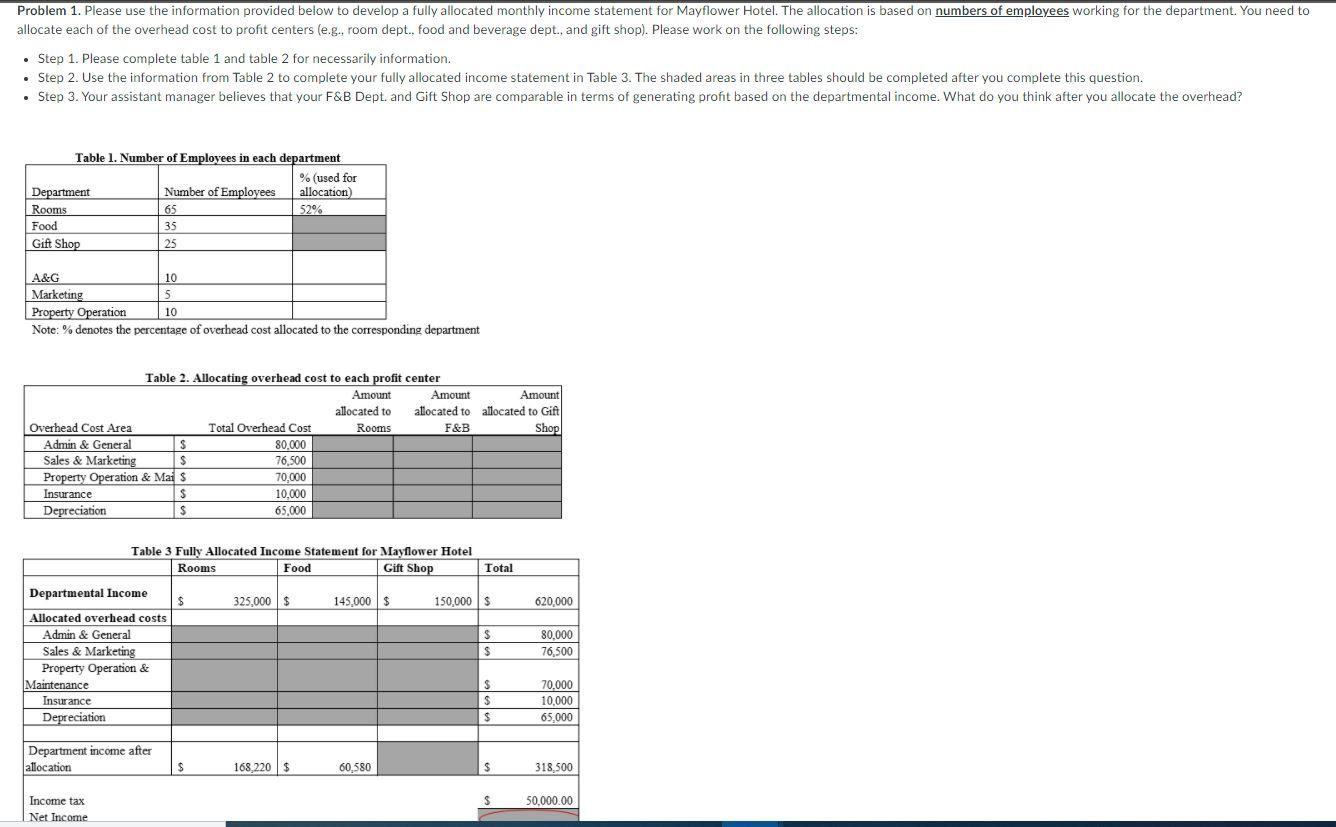

Please use the information provided below to develop a fully allocated monthly income statement for Mayflower Hotel. The allocation is based on numbers of employees working for the department. You need to allocate each of the overhead cost to profit centers (e.g., room dept., food and beverage dept., and gift shop). Please work on the following steps: Step 1. Please complete table 1 and table 2 for necessarily information. Step 2. Use the information from Table 2 to complete your fully allocated income statement in Table 3. The shaded areas in three tables should be completed after you complete this question. Step 3. Your assistant manager believes that your F&B Dept. and Gift Shop are comparable in terms of generating profit based on the departmental income. What do you think after you allocate the overhead?

Please use the information provided below to develop a fully allocated monthly income statement for Mayflower Hotel. The allocation is based on numbers of employees working for the department. You need to allocate each of the overhead cost to profit centers (e.g., room dept., food and beverage dept., and gift shop). Please work on the following steps: Step 1. Please complete table 1 and table 2 for necessarily information. Step 2. Use the information from Table 2 to complete your fully allocated income statement in Table 3. The shaded areas in three tables should be completed after you complete this question. Step 3. Your assistant manager believes that your F&B Dept. and Gift Shop are comparable in terms of generating profit based on the departmental income. What do you think after you allocate the overhead?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started