please use these new images

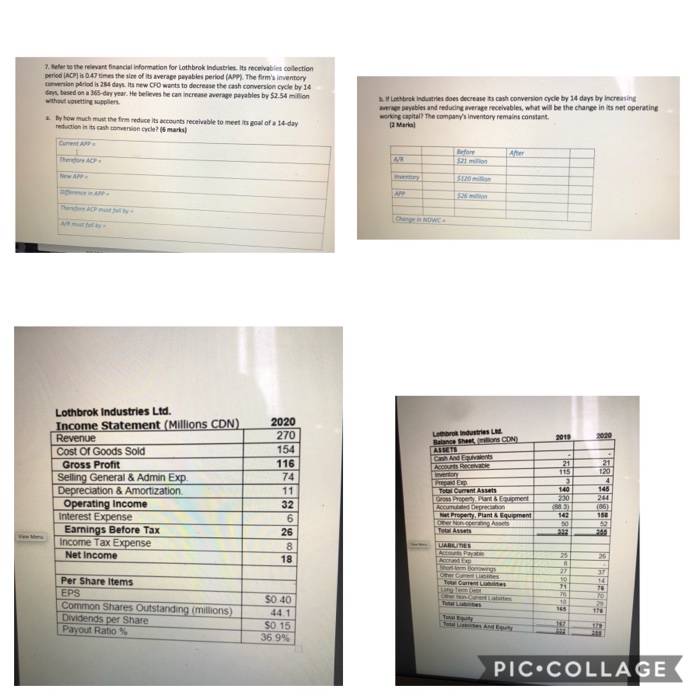

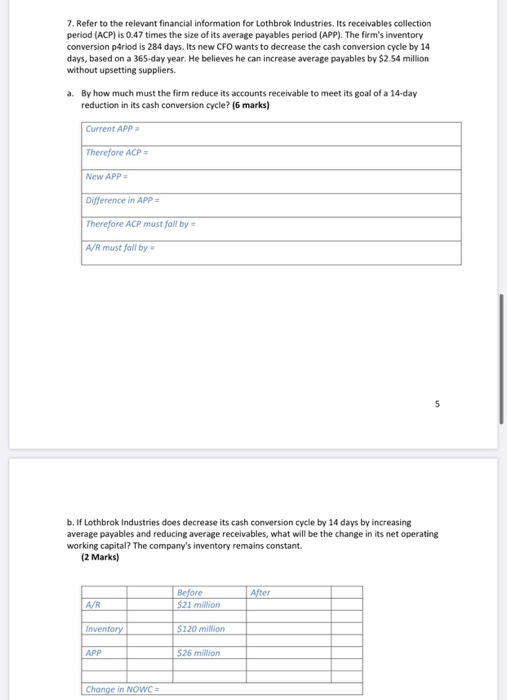

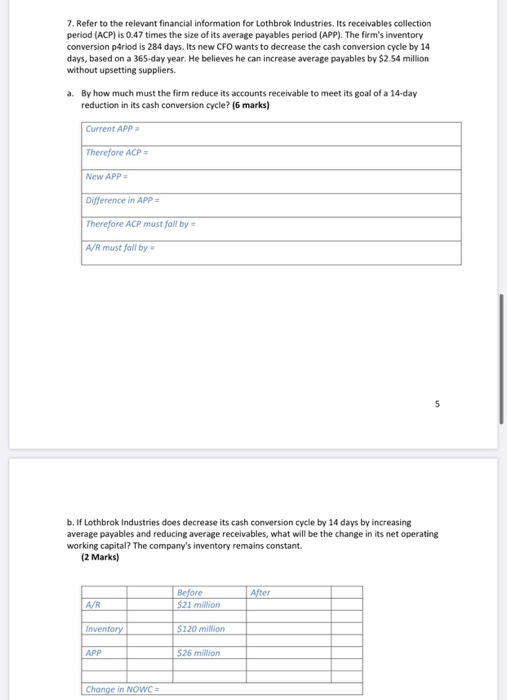

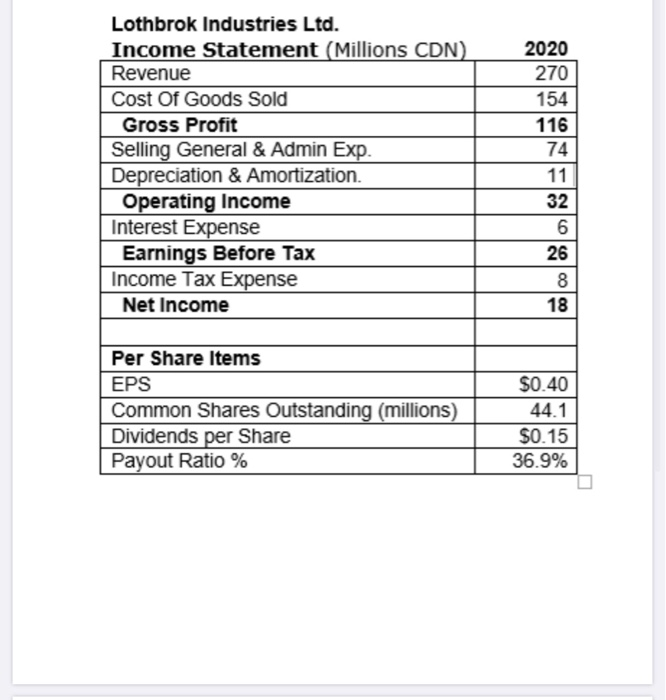

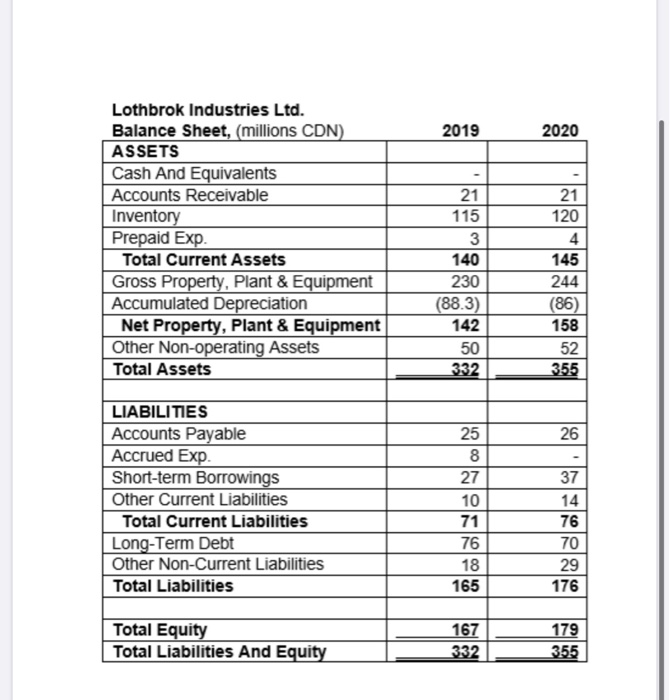

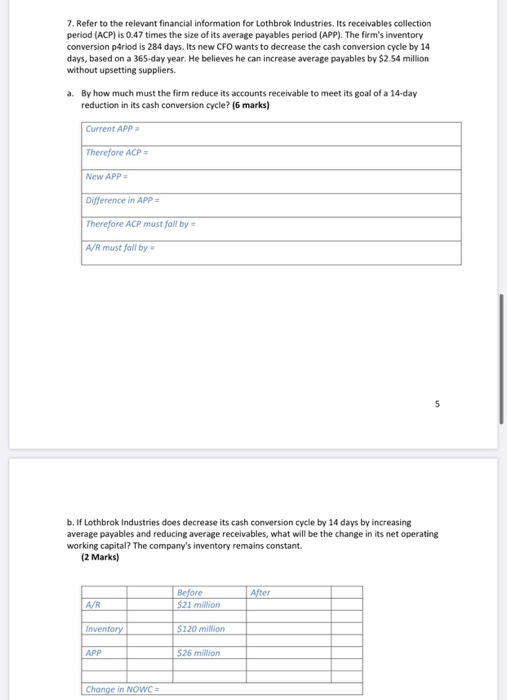

7. Refer to the relevant financial information for Lothbrok Industries. Its receivables collection period (ACP) is 047 times the size of its average payables period (APP). The firm's inventory conversion period is 24 days. Its new CFO wants to decrease the cash conversion cycle by 14 days, based on a 365 day year. He believes he can increase average payables by $2.54 million without outting suppliers If Lothbrok Industries does decrease its cash conversion cycle by 14 days by increasing werage payables and reducing average receivables, what will be the change in its net operating working capital? The company's inventory remains constant 12 Marta! 2. hy how much must the firm reduce its accounts receivable to meet its goal of a 14-day reduction in its cash conversion cycle? (6 marts Current APP After Therefore ACP AVR 5.21 min MAPP Inventory $120 APY ES Change Is NOW La Industries Ltd Balance Sheets CON ASTS Cash And Equivalents Inventor Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income grandes 2020 270 154 116 74 11 32 6 26 8 18 120 4 145 Total Current Assets Property and quipment Accued prechon Net Property Plant & Equipment 21 115 31 140 20 83) 142 50 06 150 View More LIABILITIES 25 help 9 27 10 71 716 18 37 14 Per Share Items EPS Common Shares Outstanding millions) Dividends per Share Payout Ratio 29 SO 40 44.1 SO 15 36.9% 167 PIC.COLLAGE 7. Refer to the relevant financial information for Lothbrok Industries. Its receivables collection period (ACP) is 0.47 times the size of its average payables period (APP). The firm's inventory conversion priod is 284 days. Its new CFO wants to decrease the cash conversion cycle by 14 days, based on a 365-day year. He believes he can increase average payables by $2.54 million without upsetting suppliers. a. By how much must the firm reduce its accounts receivable to meet its goal of a 14-day reduction in its cash conversion cycle? (6 marks) Current APP Therefore ACP New APP Difference in APP Therefore ACP must fall by A/R must fall by 5 b. If Lothbrok Industries does decrease its cash conversion cycle by 14 days by increasing average payables and reducing average receivables, what will be the change in its net operating working capital? The company's inventory remains constant. (2 Marks) After Before $21 million AR Inventory $120 million APP $26 million Change in NOWC = Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 6 26 8 18 Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp. Total Current Assets Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4. 145 244 (86) 158 52 355 26 LIABILITIES Accounts Payable Accrued Exp. Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355 7. Refer to the relevant financial information for Lothbrok Industries. Its receivables collection period (ACP) is 047 times the size of its average payables period (APP). The firm's inventory conversion period is 24 days. Its new CFO wants to decrease the cash conversion cycle by 14 days, based on a 365 day year. He believes he can increase average payables by $2.54 million without outting suppliers If Lothbrok Industries does decrease its cash conversion cycle by 14 days by increasing werage payables and reducing average receivables, what will be the change in its net operating working capital? The company's inventory remains constant 12 Marta! 2. hy how much must the firm reduce its accounts receivable to meet its goal of a 14-day reduction in its cash conversion cycle? (6 marts Current APP After Therefore ACP AVR 5.21 min MAPP Inventory $120 APY ES Change Is NOW La Industries Ltd Balance Sheets CON ASTS Cash And Equivalents Inventor Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income grandes 2020 270 154 116 74 11 32 6 26 8 18 120 4 145 Total Current Assets Property and quipment Accued prechon Net Property Plant & Equipment 21 115 31 140 20 83) 142 50 06 150 View More LIABILITIES 25 help 9 27 10 71 716 18 37 14 Per Share Items EPS Common Shares Outstanding millions) Dividends per Share Payout Ratio 29 SO 40 44.1 SO 15 36.9% 167 PIC.COLLAGE 7. Refer to the relevant financial information for Lothbrok Industries. Its receivables collection period (ACP) is 0.47 times the size of its average payables period (APP). The firm's inventory conversion priod is 284 days. Its new CFO wants to decrease the cash conversion cycle by 14 days, based on a 365-day year. He believes he can increase average payables by $2.54 million without upsetting suppliers. a. By how much must the firm reduce its accounts receivable to meet its goal of a 14-day reduction in its cash conversion cycle? (6 marks) Current APP Therefore ACP New APP Difference in APP Therefore ACP must fall by A/R must fall by 5 b. If Lothbrok Industries does decrease its cash conversion cycle by 14 days by increasing average payables and reducing average receivables, what will be the change in its net operating working capital? The company's inventory remains constant. (2 Marks) After Before $21 million AR Inventory $120 million APP $26 million Change in NOWC = Lothbrok Industries Ltd. Income Statement (Millions CDN) Revenue Cost Of Goods Sold Gross Profit Selling General & Admin Exp. Depreciation & Amortization. Operating Income Interest Expense Earnings Before Tax Income Tax Expense Net Income 2020 270 154 116 74 11 32 6 26 8 18 Per Share Items EPS Common Shares Outstanding (millions) Dividends per Share Payout Ratio % $0.40 44.1 $0.15 36.9% 2019 2020 Lothbrok Industries Ltd. Balance Sheet, (millions CDN) ASSETS Cash And Equivalents Accounts Receivable Inventory Prepaid Exp. Total Current Assets Gross Property, Plant & Equipment Accumulated Depreciation Net Property, Plant & Equipment Other Non-operating Assets Total Assets 21 115 3 140 230 (88.3) 142 50 332 21 120 4. 145 244 (86) 158 52 355 26 LIABILITIES Accounts Payable Accrued Exp. Short-term Borrowings Other Current Liabilities Total Current Liabilities Long-Term Debt Other Non-Current Liabilities Total Liabilities 25 8 27 10 71 76 18 165 37 14 76 70 29 176 Total Equity Total Liabilities And Equity 167 332 179 355