Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please utilize the P&G 10-K for the physical year ended June 30, 2020 on the SEC website when providing references within the question's answer. INSTRUCTIONS:

Please utilize the P&G 10-K for the physical year ended June 30, 2020 on the SEC website when providing references within the question's answer.

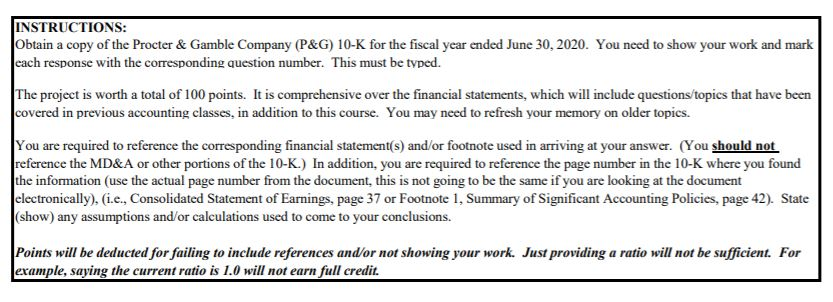

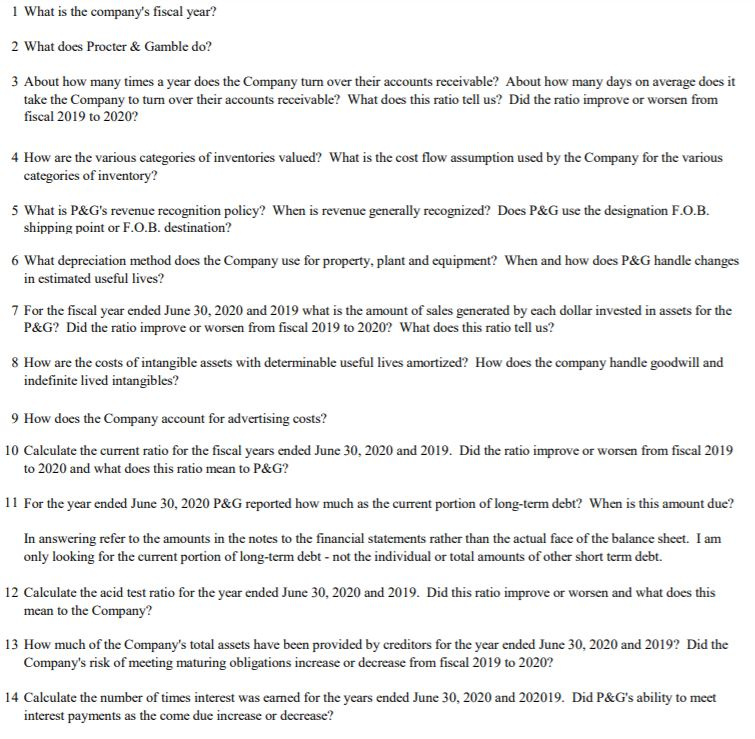

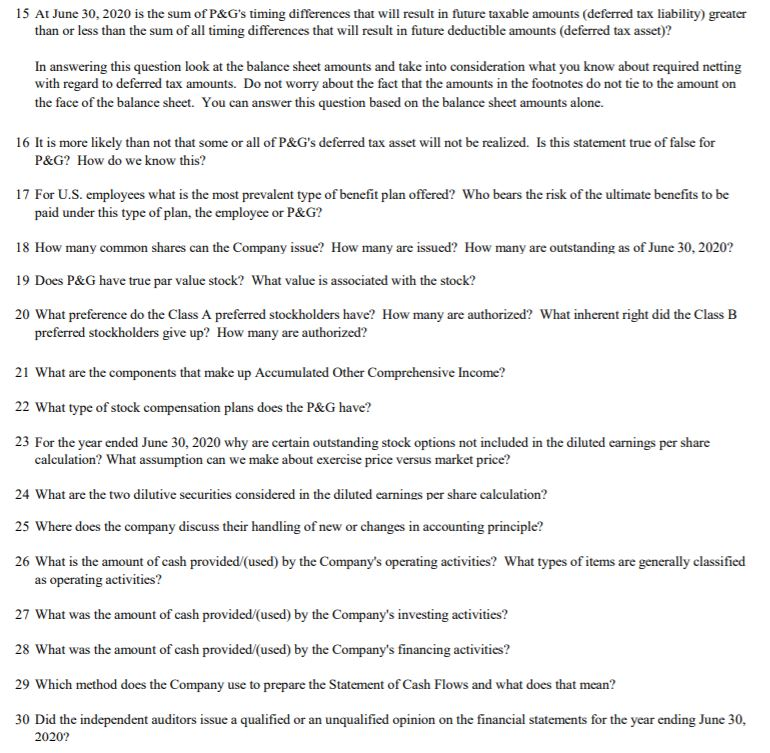

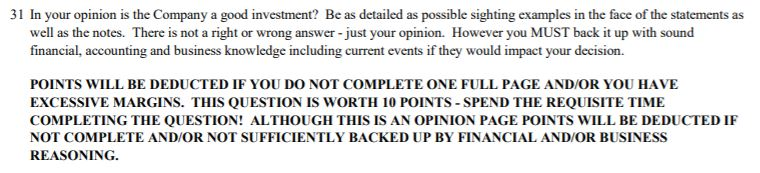

INSTRUCTIONS: Obtain a copy of the Procter & Gamble Company (P&G) 10-K for the fiscal year ended June 30, 2020. You need to show your work and mark each response with the corresponding question number. This must be typed. The project is worth a total of 100 points. It is comprehensive over the financial statements, which will include questions/topics that have been covered in previous accounting classes, in addition to this course. You may need to refresh your memory on older topics. You are required to reference the corresponding financial statement(s) and/or footnote used in arriving at your answer. (You should not reference the MD&A or other portions of the 10-K.) In addition, you are required to reference the page number in the 10-K where you found the information (use the actual page number from the document, this is not going to be the same if you are looking at the document electronically), (i.e., Consolidated Statement of Earnings, page 37 or Footnote 1, Summary of Significant Accounting Policies, page 42). State (show) any assumptions and/or calculations used to come to your conclusions. Points will be deducted for failing to include references and/or not showing your work. Just providing a ratio will not be sufficient. For example, saying the current ratio is 1.0 will not earn full credit 1 What is the company's fiscal year? 2 What does Procter & Gamble do? 3 About how many times a year does the Company turn over their accounts receivable? About how many days on average does it take the Company to turn over their accounts receivable? What does this ratio tell us? Did the ratio improve or worsen from fiscal 2019 to 2020? 4 How are the various categories of inventories valued? What is the cost flow assumption used by the Company for the various categories of inventory? 5 What is P&G's revenue recognition policy? When is revenue generally recognized? Does P&G use the designation F.O.B. shipping point or F.O.B. destination? 6 What depreciation method does the Company use for property, plant and equipment? When and how does P&G handle changes in estimated useful lives? 7 For the fiscal year ended June 30, 2020 and 2019 what is the amount of sales generated by each dollar invested in assets for the P&G? Did the ratio improve or worsen from fiscal 2019 to 2020? What does this ratio tell us? 8 How are the costs of intangible assets with determinable useful lives amortized? How does the company handle goodwill and indefinite lived intangibles? 9 How does the Company account for advertising costs? 10 Calculate the current ratio for the fiscal years ended June 30, 2020 and 2019. Did the ratio improve or worsen from fiscal 2019 to 2020 and what does this ratio mean to P&G? 11 For the year ended June 30, 2020 P&G reported how much as the current portion of long-term debt? When is this amount due? In answering refer to the amounts in the notes to the financial statements rather than the actual face of the balance sheet. I am only looking for the current portion of long-term debt - not the individual or total amounts of other short term debt. 12 Calculate the acid test ratio for the year ended June 30, 2020 and 2019. Did this ratio improve or worsen and what does this mean to the Company? 13 How much of the Company's total assets have been provided by creditors for the year ended June 30, 2020 and 2019? Did the Company's risk of meeting maturing obligations increase or decrease from fiscal 2019 to 2020? 14 Calculate the number of times interest was earned for the years ended June 30, 2020 and 202019. Did P&G's ability to meet interest payments as the come due increase or decrease? 15 A1 June 30, 2020 is the sum of P&G's timing differences that will result in future taxable amounts (deferred tax liability) greater than or less than the sum of all timing differences that will result in future deductible amounts (deferred tax asset)? In answering this question look at the balance sheet amounts and take into consideration what you know about required netting with regard to deferred tax amounts. Do not worry about the fact that the amounts in the footnotes do not tie to the amount on the face of the balance sheet. You can answer this question based on the balance sheet amounts alone. 16 It is more likely than not that some or all of P&G's deferred tax asset will not be realized. Is this statement true of false for P&G? How do we know this? 17 For U.S. employees what is the most prevalent type of benefit plan offered? Who bears the risk of the ultimate benefits to be paid under this type of plan, the employee or P&G? 18 How many common shares can the Company issue? How many are issued? How many are outstanding as of June 30, 2020? 19 Does P&G have true par value stock? What value is associated with the stock? 20 What preference do the Class A preferred stockholders have? How many are authorized? What inherent right did the Class B preferred stockholders give up? How many are authorized? 21 What are the components that make up Accumulated Other Comprehensive Income? 22 What type of stock compensation plans does the P&G have? 23 For the year ended June 30, 2020 why are certain outstanding stock options not included in the diluted earnings per share calculation? What assumption can we make about exercise price versus market price? 24 What are the two dilutive securities considered in the diluted earnings per share calculation? 25 Where does the company discuss their handling of new or changes in accounting principle? 26 What is the amount of cash provided/(used) by the Company's operating activities? What types of items are generally classified as operating activities? 27 What was the amount of cash provided(used) by the Company's investing activities? 28 What was the amount of cash provided/(used) by the Company's financing activities? 29 Which method does the Company use to prepare the Statement of Cash Flows and what does that mean? 30 Did the independent auditors issue a qualified or an unqualified opinion on the financial statements for the year ending June 30, 2020? 31 In your opinion is the Company a good investment? Be as detailed as possible sighting examples in the face of the statements as well as the notes. There is not a right or wrong answer - just your opinion. However you MUST back it up with sound financial, accounting and business knowledge including current events if they would impact your decision. POINTS WILL BE DEDUCTED IF YOU DO NOT COMPLETE ONE FULL PAGE AND/OR YOU HAVE EXCESSIVE MARGINS. THIS QUESTION IS WORTH 10 POINTS - SPEND THE REQUISITE TIME COMPLETING THE QUESTION! ALTHOUGH THIS IS AN OPINION PAGE POINTS WILL BE DEDUCTED IF NOT COMPLETE AND/OR NOT SUFFICIENTLY BACKED UP BY FINANCIAL AND/OR BUSINESS REASONING. INSTRUCTIONS: Obtain a copy of the Procter & Gamble Company (P&G) 10-K for the fiscal year ended June 30, 2020. You need to show your work and mark each response with the corresponding question number. This must be typed. The project is worth a total of 100 points. It is comprehensive over the financial statements, which will include questions/topics that have been covered in previous accounting classes, in addition to this course. You may need to refresh your memory on older topics. You are required to reference the corresponding financial statement(s) and/or footnote used in arriving at your answer. (You should not reference the MD&A or other portions of the 10-K.) In addition, you are required to reference the page number in the 10-K where you found the information (use the actual page number from the document, this is not going to be the same if you are looking at the document electronically), (i.e., Consolidated Statement of Earnings, page 37 or Footnote 1, Summary of Significant Accounting Policies, page 42). State (show) any assumptions and/or calculations used to come to your conclusions. Points will be deducted for failing to include references and/or not showing your work. Just providing a ratio will not be sufficient. For example, saying the current ratio is 1.0 will not earn full credit 1 What is the company's fiscal year? 2 What does Procter & Gamble do? 3 About how many times a year does the Company turn over their accounts receivable? About how many days on average does it take the Company to turn over their accounts receivable? What does this ratio tell us? Did the ratio improve or worsen from fiscal 2019 to 2020? 4 How are the various categories of inventories valued? What is the cost flow assumption used by the Company for the various categories of inventory? 5 What is P&G's revenue recognition policy? When is revenue generally recognized? Does P&G use the designation F.O.B. shipping point or F.O.B. destination? 6 What depreciation method does the Company use for property, plant and equipment? When and how does P&G handle changes in estimated useful lives? 7 For the fiscal year ended June 30, 2020 and 2019 what is the amount of sales generated by each dollar invested in assets for the P&G? Did the ratio improve or worsen from fiscal 2019 to 2020? What does this ratio tell us? 8 How are the costs of intangible assets with determinable useful lives amortized? How does the company handle goodwill and indefinite lived intangibles? 9 How does the Company account for advertising costs? 10 Calculate the current ratio for the fiscal years ended June 30, 2020 and 2019. Did the ratio improve or worsen from fiscal 2019 to 2020 and what does this ratio mean to P&G? 11 For the year ended June 30, 2020 P&G reported how much as the current portion of long-term debt? When is this amount due? In answering refer to the amounts in the notes to the financial statements rather than the actual face of the balance sheet. I am only looking for the current portion of long-term debt - not the individual or total amounts of other short term debt. 12 Calculate the acid test ratio for the year ended June 30, 2020 and 2019. Did this ratio improve or worsen and what does this mean to the Company? 13 How much of the Company's total assets have been provided by creditors for the year ended June 30, 2020 and 2019? Did the Company's risk of meeting maturing obligations increase or decrease from fiscal 2019 to 2020? 14 Calculate the number of times interest was earned for the years ended June 30, 2020 and 202019. Did P&G's ability to meet interest payments as the come due increase or decrease? 15 A1 June 30, 2020 is the sum of P&G's timing differences that will result in future taxable amounts (deferred tax liability) greater than or less than the sum of all timing differences that will result in future deductible amounts (deferred tax asset)? In answering this question look at the balance sheet amounts and take into consideration what you know about required netting with regard to deferred tax amounts. Do not worry about the fact that the amounts in the footnotes do not tie to the amount on the face of the balance sheet. You can answer this question based on the balance sheet amounts alone. 16 It is more likely than not that some or all of P&G's deferred tax asset will not be realized. Is this statement true of false for P&G? How do we know this? 17 For U.S. employees what is the most prevalent type of benefit plan offered? Who bears the risk of the ultimate benefits to be paid under this type of plan, the employee or P&G? 18 How many common shares can the Company issue? How many are issued? How many are outstanding as of June 30, 2020? 19 Does P&G have true par value stock? What value is associated with the stock? 20 What preference do the Class A preferred stockholders have? How many are authorized? What inherent right did the Class B preferred stockholders give up? How many are authorized? 21 What are the components that make up Accumulated Other Comprehensive Income? 22 What type of stock compensation plans does the P&G have? 23 For the year ended June 30, 2020 why are certain outstanding stock options not included in the diluted earnings per share calculation? What assumption can we make about exercise price versus market price? 24 What are the two dilutive securities considered in the diluted earnings per share calculation? 25 Where does the company discuss their handling of new or changes in accounting principle? 26 What is the amount of cash provided/(used) by the Company's operating activities? What types of items are generally classified as operating activities? 27 What was the amount of cash provided(used) by the Company's investing activities? 28 What was the amount of cash provided/(used) by the Company's financing activities? 29 Which method does the Company use to prepare the Statement of Cash Flows and what does that mean? 30 Did the independent auditors issue a qualified or an unqualified opinion on the financial statements for the year ending June 30, 2020? 31 In your opinion is the Company a good investment? Be as detailed as possible sighting examples in the face of the statements as well as the notes. There is not a right or wrong answer - just your opinion. However you MUST back it up with sound financial, accounting and business knowledge including current events if they would impact your decision. POINTS WILL BE DEDUCTED IF YOU DO NOT COMPLETE ONE FULL PAGE AND/OR YOU HAVE EXCESSIVE MARGINS. THIS QUESTION IS WORTH 10 POINTS - SPEND THE REQUISITE TIME COMPLETING THE QUESTION! ALTHOUGH THIS IS AN OPINION PAGE POINTS WILL BE DEDUCTED IF NOT COMPLETE AND/OR NOT SUFFICIENTLY BACKED UP BY FINANCIAL AND/OR BUSINESS REASONINGStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started