Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please with solutions :) In 2021, ABC Co. enters into a construction contract with a customer. The contract price is P10,000,000. Information on the contract

Please with solutions :)

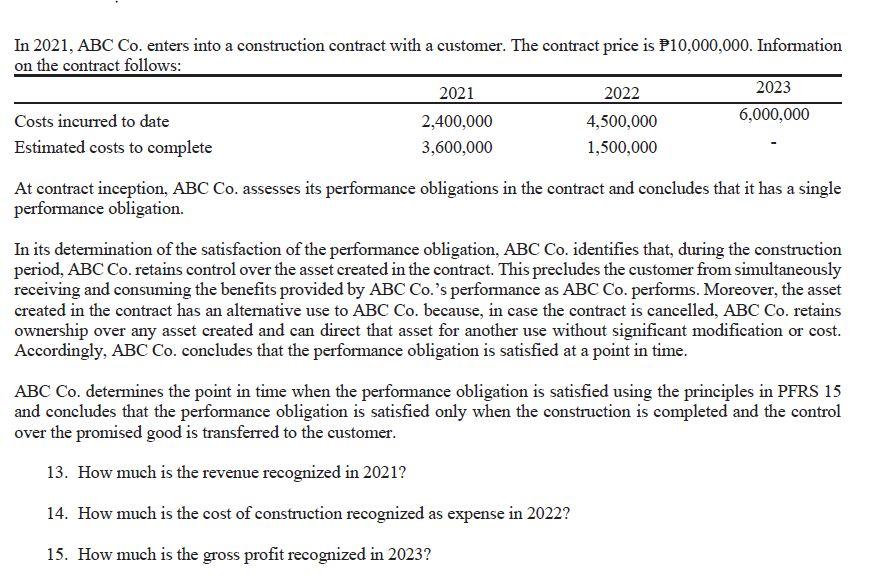

In 2021, ABC Co. enters into a construction contract with a customer. The contract price is P10,000,000. Information on the contract follows: 2021 2022 2023 Costs incurred to date 2,400,000 4,500,000 6,000,000 Estimated costs to complete 3,600,000 1,500,000 At contract inception, ABC Co. assesses its performance obligations in the contract and concludes that it has a single performance obligation. In its determination of the satisfaction of the performance obligation, ABC Co. identifies that, during the construction period, ABC Co. retains control over the asset created in the contract. This precludes the customer from simultaneously receiving and consuming the benefits provided by ABC Co.'s performance as ABC Co. performs. Moreover, the asset created in the contract has an alternative use to ABC Co. because, in case the contract is cancelled, ABC Co. retains ownership over any asset created and can direct that asset for another use without significant modification or cost. Accordingly, ABC Co. concludes that the performance obligation is satisfied at a point in time. ABC Co. determines the point in time when the performance obligation is satisfied using the principles in PFRS 15 and concludes that the performance obligation is satisfied only when the construction is completed and the control over the promised good is transferred to the customer. 13. How much is the revenue recognized in 2021? 14. How much is the cost of construction recognized as expense in 2022? 15. How much is the gross profit recognized in 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started