Answered step by step

Verified Expert Solution

Question

1 Approved Answer

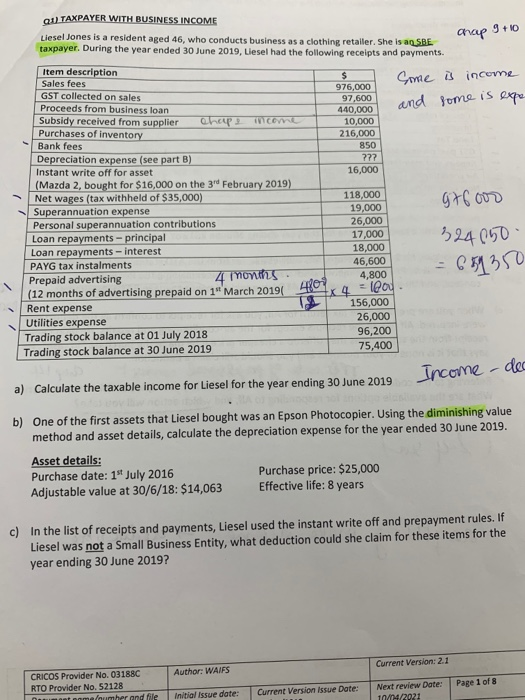

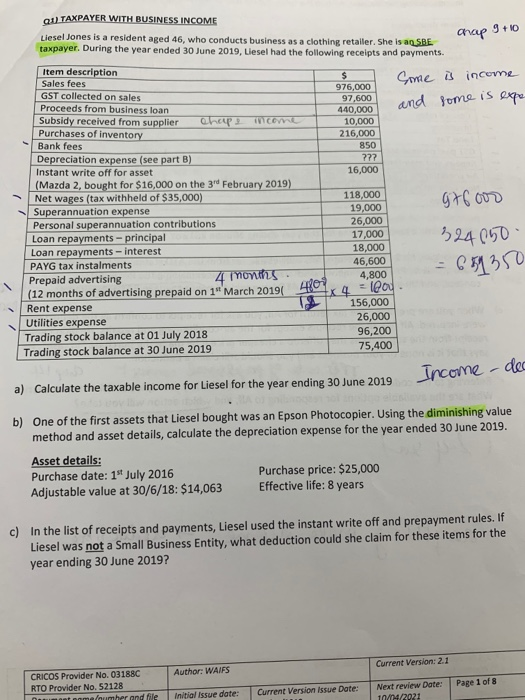

please working according to Australia law and the price without GST QI) TAXPAYER WITH BUSINESS INCOME chap 9+10 Liesel Jones is a resident aged 46,

please working according to Australia law and the price without GST

QI) TAXPAYER WITH BUSINESS INCOME chap 9+10 Liesel Jones is a resident aged 46, who conducts business as a clothing retailer. She is an SBE taxpayer. During the year ended 30 June 2019, Liesel had the following receipts and payments. Some and is income some is expe 976,000 97,600 440,000 10,000 216,000 850 222 16,000 976000 Item description Sales fees GST collected on sales Proceeds from business loan Subsidy received from supplier P i co Purchases of inventory Bank fees Depreciation expense (see part B) Instant write off for asset (Mazda 2, bought for $16,000 on the 3rd February 2019) Net wages (tax withheld of $35,000) Superannuation expense Personal superannuation contributions Loan repayments - principal Loan repayments - interest PAYG tax instalments Prepaid advertising - 4 months. (12 months of advertising prepaid on 1 March 2019 401 Rent expense Utilities expense S Trading stock balance at 01 July 2018 Trading stock balance at 30 June 2019 118,000 19,000 26,000 17,000 18,000 46,600 4,800 324 050 = 659350 4x4 = leo * 156,000 2 6,000 96,200 75,400 Income - dec a) Calculate the taxable income for Liesel for the year ending 30 June 2019 year ending 30 June 2019 b) One of the first assets that Liesel bought was an Epson Photocopier. Using the diminishing value method and asset details, calculate the depreciation expense for the year ended 30 June 2019. Asset details: Purchase date: 1" July 2016 Purchase price: $25,000 Adjustable value at 30/6/18: $14,063 Effective life: 8 years c) In the list of receipts and payments, Liesel used the instant write off and prepayment rules. If Liesel was not a Small Business Entity, what deduction could she claim for these items for the year ending 30 June 2019? Current Version: 2.1 Author: WAIFS CRICOS Provider No. 03188C RTO Provider No. 52128 efnumher end file Page 1 of 8 Initial Issue date: Current Version Issue Date: Next review Date: 10/04/2021 QI) TAXPAYER WITH BUSINESS INCOME chap 9+10 Liesel Jones is a resident aged 46, who conducts business as a clothing retailer. She is an SBE taxpayer. During the year ended 30 June 2019, Liesel had the following receipts and payments. Some and is income some is expe 976,000 97,600 440,000 10,000 216,000 850 222 16,000 976000 Item description Sales fees GST collected on sales Proceeds from business loan Subsidy received from supplier P i co Purchases of inventory Bank fees Depreciation expense (see part B) Instant write off for asset (Mazda 2, bought for $16,000 on the 3rd February 2019) Net wages (tax withheld of $35,000) Superannuation expense Personal superannuation contributions Loan repayments - principal Loan repayments - interest PAYG tax instalments Prepaid advertising - 4 months. (12 months of advertising prepaid on 1 March 2019 401 Rent expense Utilities expense S Trading stock balance at 01 July 2018 Trading stock balance at 30 June 2019 118,000 19,000 26,000 17,000 18,000 46,600 4,800 324 050 = 659350 4x4 = leo * 156,000 2 6,000 96,200 75,400 Income - dec a) Calculate the taxable income for Liesel for the year ending 30 June 2019 year ending 30 June 2019 b) One of the first assets that Liesel bought was an Epson Photocopier. Using the diminishing value method and asset details, calculate the depreciation expense for the year ended 30 June 2019. Asset details: Purchase date: 1" July 2016 Purchase price: $25,000 Adjustable value at 30/6/18: $14,063 Effective life: 8 years c) In the list of receipts and payments, Liesel used the instant write off and prepayment rules. If Liesel was not a Small Business Entity, what deduction could she claim for these items for the year ending 30 June 2019? Current Version: 2.1 Author: WAIFS CRICOS Provider No. 03188C RTO Provider No. 52128 efnumher end file Page 1 of 8 Initial Issue date: Current Version Issue Date: Next review Date: 10/04/2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started