PLEASE WRITE ALL ANSWERS IS EXCEL FORMAT. NO VALUES!

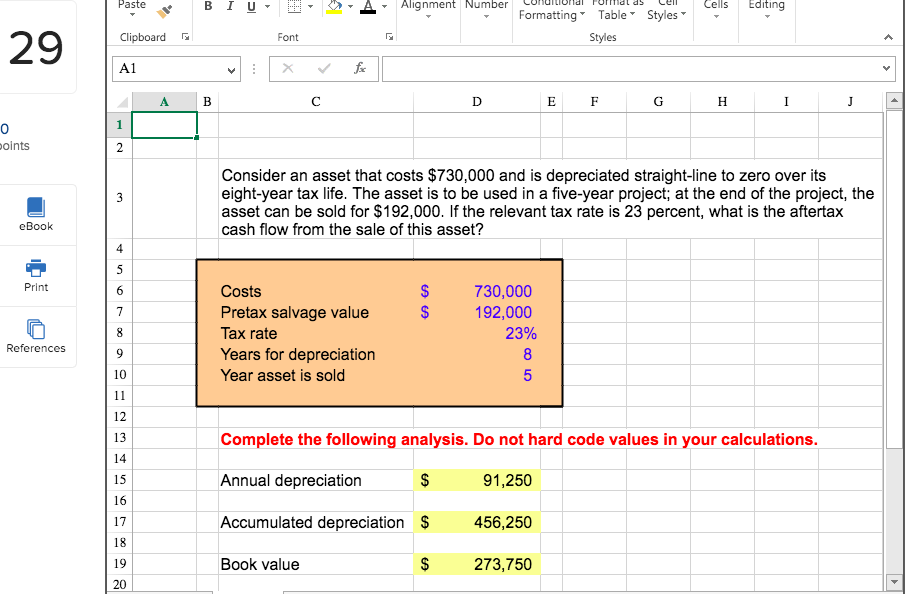

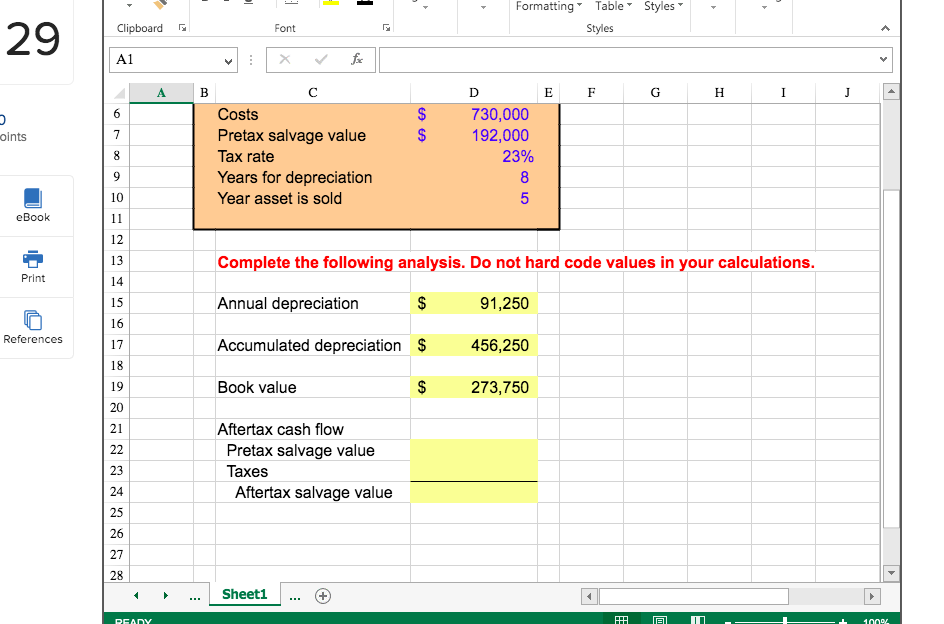

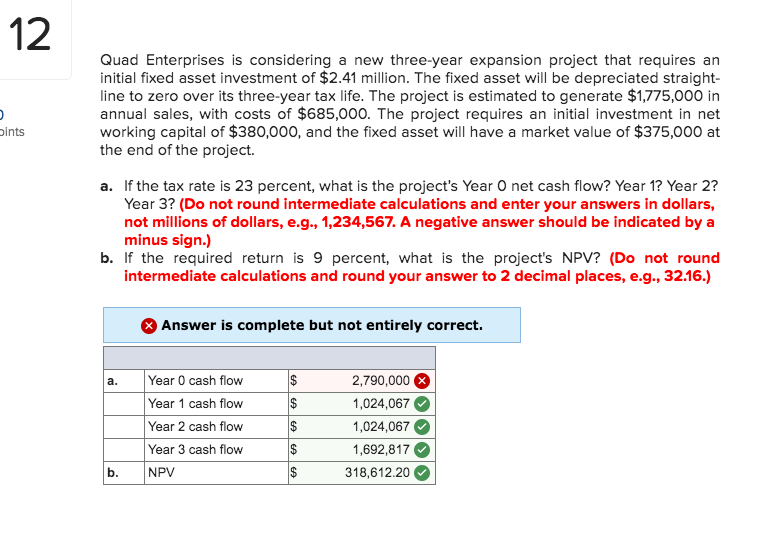

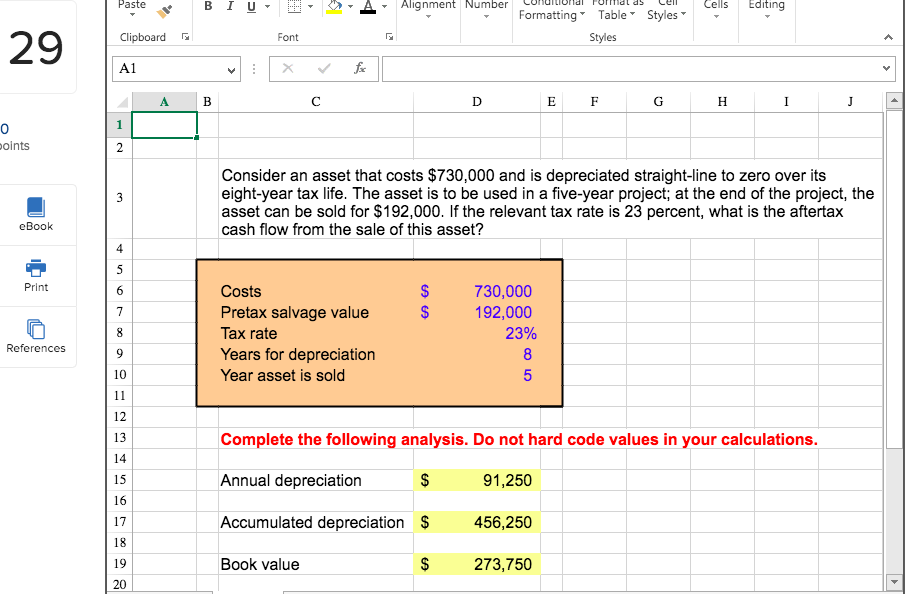

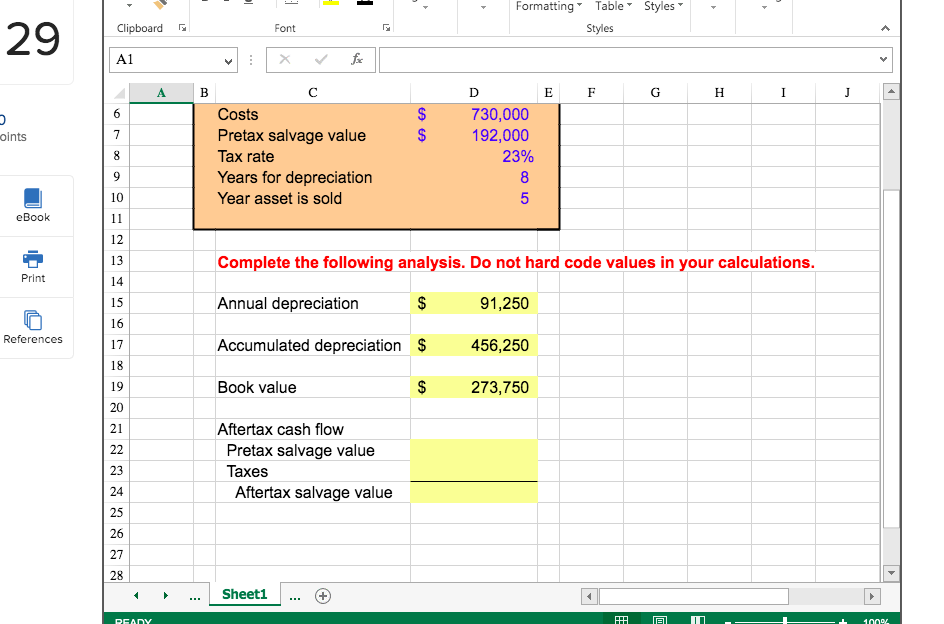

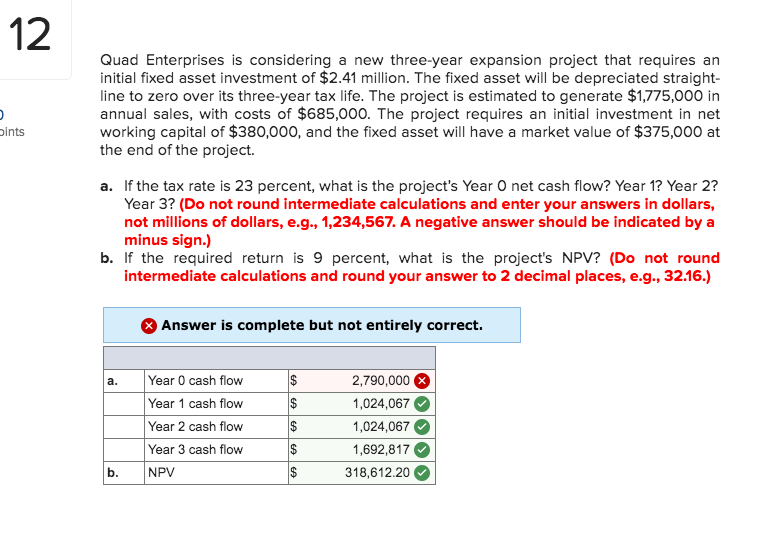

Paste BIU - - - A Alignment Number - Conditional pomal as cel Formatting Table Styles Cells Editing Clipboard Font Styles A1 D E F G H I J points Consider an asset that costs $730,000 and is depreciated straight-line to zero over its eight-year tax life. The asset is to be used in a five-year project; at the end of the project, the asset can be sold for $192,000. If the relevant tax rate is 23 percent, what is the aftertax cash flow from the sale of this asset? eBook Print $ $ Costs Pretax salvage value Tax rate Years for depreciation Year asset is sold 730,000 192,000 23% References Complete the following analysis. Do not hard code values in your calculations. Annual depreciation $ 91,250 Accumulated depreciation $ 456,250 Book value $ 273,750 Formatting Styles Table Styles Clipboard Font 29 A1 E F G H I J - oints Costs Pretax salvage value Tax rate Years for depreciation Year asset is sold 730,000 192,000 23% eBook Complete the following analysis. Do not hard code values in your calculations. Print Annual depreciation $ 91,250 References Accumulated depreciation $ 456,250 Book value $ 273,750 Aftertax cash flow Pretax salvage value Taxes Aftertax salvage value ... Sheet1 ... + PEADY M - 1 1000 12 Quad Enterprises is considering a new three-year expansion project that requires an initial fixed asset investment of $2.41 million. The fixed asset will be depreciated straight- line to zero over its three-year tax life. The project is estimated to generate $1,775,000 in annual sales, with costs of $685,000. The project requires an initial investment in net working capital of $380,000, and the fixed asset will have a market value of $375,000 at the end of the project. pints a. If the tax rate is 23 percent, what is the project's Year O net cash flow? Year 1? Year 2? Year 3? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, e.g., 1,234,567. A negative answer should be indicated by a minus sign.) b. If the required return is 9 percent, what is the project's NPV? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. $ Year 0 cash flow Year 1 cash flow Year 2 cash flow Year 3 cash flow NPV $ $ 2,790,000 X 1,024,067 1,024,067 1,692,817 318,612.20