Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please write down the problem-solving process! Thank you! Q3) The initial capital investment on assembly equipment is $50 million. There is also need for a

Please write down the problem-solving process! Thank you!

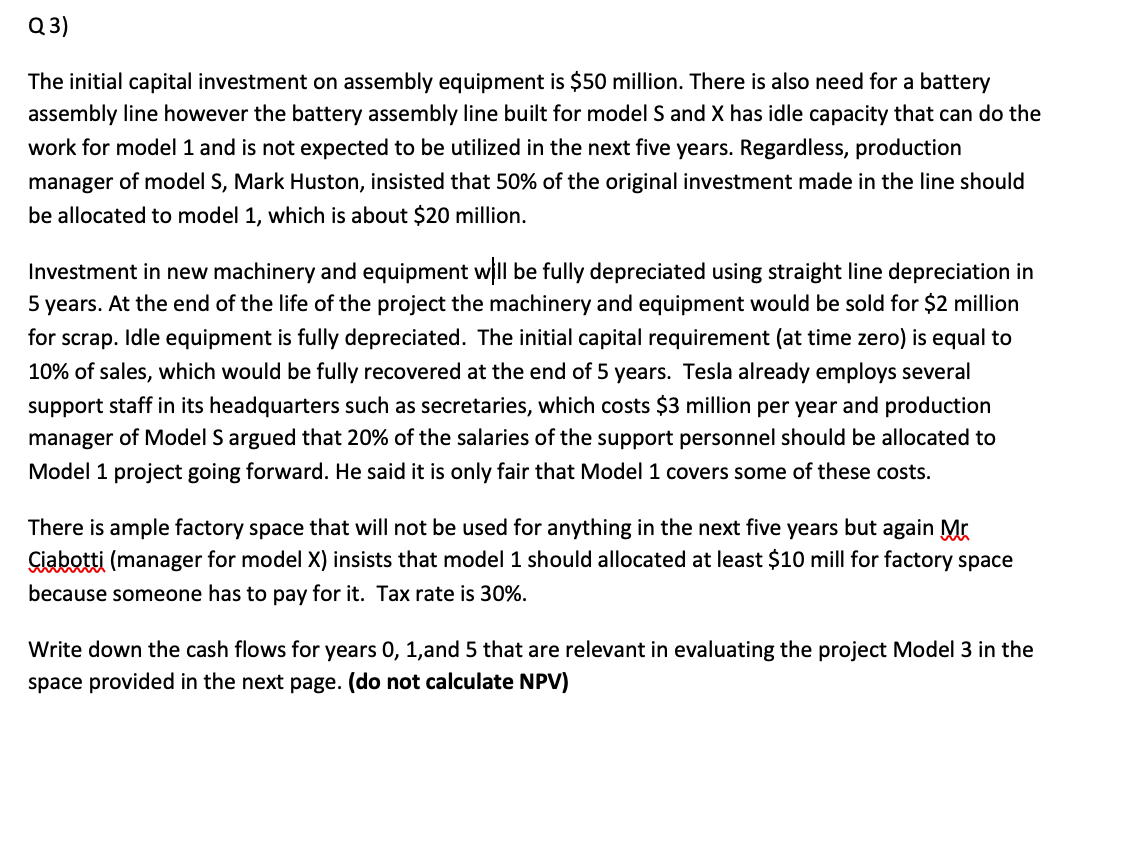

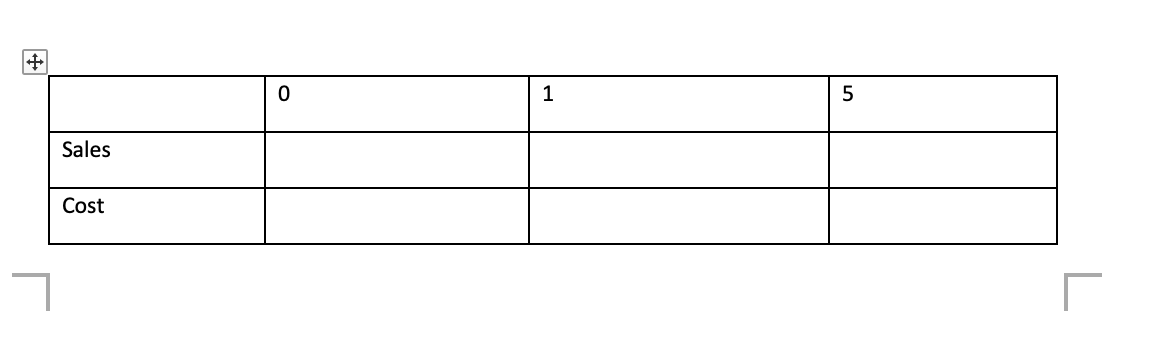

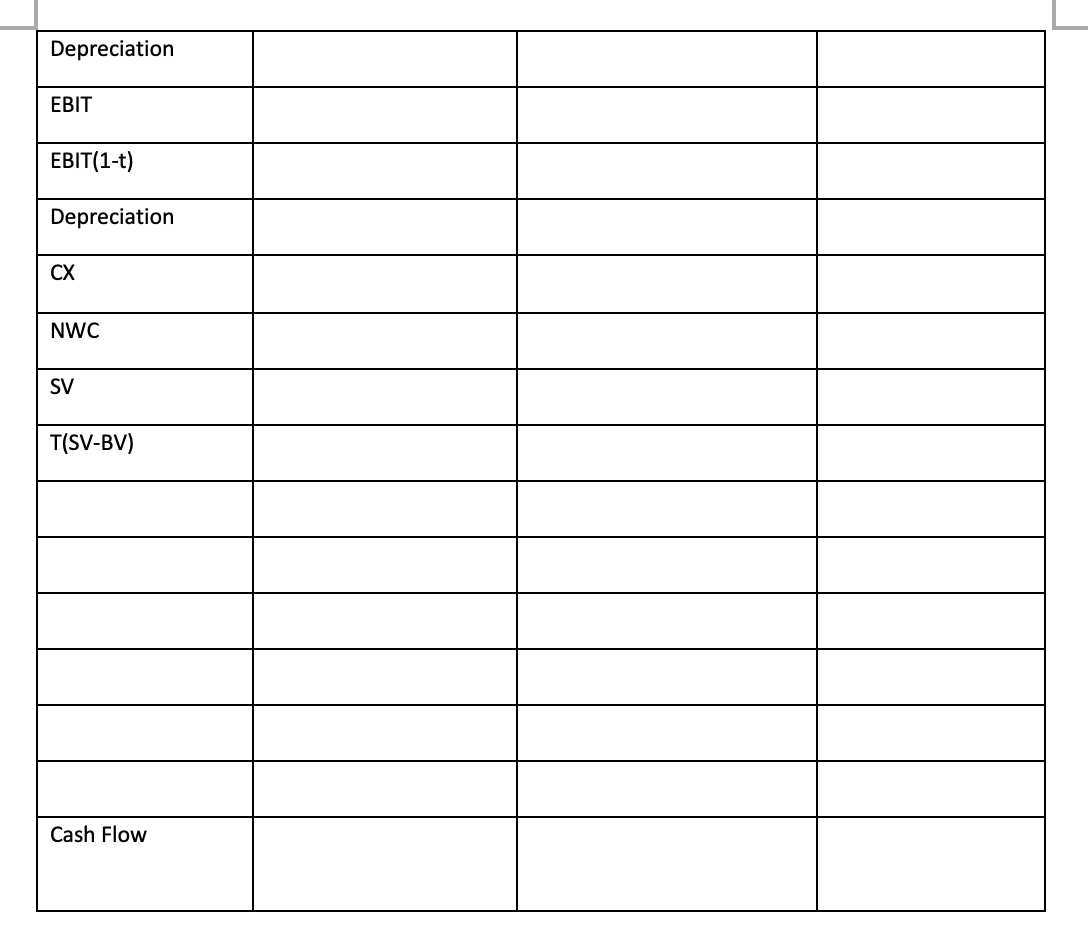

Q3) The initial capital investment on assembly equipment is $50 million. There is also need for a battery assembly line however the battery assembly line built for model S and X has idle capacity that can do the work for model 1 and is not expected to be utilized in the next five years. Regardless, production manager of model S, Mark Huston, insisted that 50% of the original investment made in the line should be allocated to model 1, which is about $20 million. Investment in new machinery and equipment will be fully depreciated using straight line depreciation in 5 years. At the end of the life of the project the machinery and equipment would be sold for $2 million for scrap. Idle equipment is fully depreciated. The initial capital requirement (at time zero) is equal to 10% of sales, which would be fully recovered at the end of 5 years. Tesla already employs several support staff in its headquarters such as secretaries, which costs $3 million per year and production manager of Model S argued that 20% of the salaries of the support personnel should be allocated to Model 1 project going forward. He said it is only fair that Model 1 covers some of these costs. There is ample factory space that will not be used for anything in the next five years but again Mr Ciabotti (manager for model X) insists that model 1 should allocated at least $10 mill for factory space because someone has to pay for it. Tax rate is 30%. Write down the cash flows for years 0, 1,and 5 that are relevant in evaluating the project Model 3 in the space provided in the next page. (do not calculate NPV) o 1 5 Sales Cost T Depreciation EBIT EBIT(1-t) Depreciation CX NWC SV T(SV-BV) Cash Flow Q3) The initial capital investment on assembly equipment is $50 million. There is also need for a battery assembly line however the battery assembly line built for model S and X has idle capacity that can do the work for model 1 and is not expected to be utilized in the next five years. Regardless, production manager of model S, Mark Huston, insisted that 50% of the original investment made in the line should be allocated to model 1, which is about $20 million. Investment in new machinery and equipment will be fully depreciated using straight line depreciation in 5 years. At the end of the life of the project the machinery and equipment would be sold for $2 million for scrap. Idle equipment is fully depreciated. The initial capital requirement (at time zero) is equal to 10% of sales, which would be fully recovered at the end of 5 years. Tesla already employs several support staff in its headquarters such as secretaries, which costs $3 million per year and production manager of Model S argued that 20% of the salaries of the support personnel should be allocated to Model 1 project going forward. He said it is only fair that Model 1 covers some of these costs. There is ample factory space that will not be used for anything in the next five years but again Mr Ciabotti (manager for model X) insists that model 1 should allocated at least $10 mill for factory space because someone has to pay for it. Tax rate is 30%. Write down the cash flows for years 0, 1,and 5 that are relevant in evaluating the project Model 3 in the space provided in the next page. (do not calculate NPV) o 1 5 Sales Cost T Depreciation EBIT EBIT(1-t) Depreciation CX NWC SV T(SV-BV) Cash FlowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started