Answered step by step

Verified Expert Solution

Question

1 Approved Answer

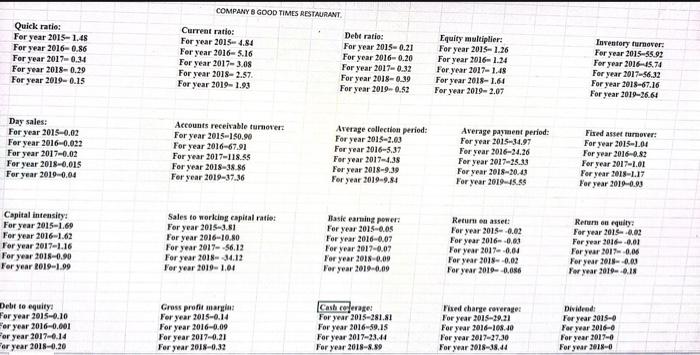

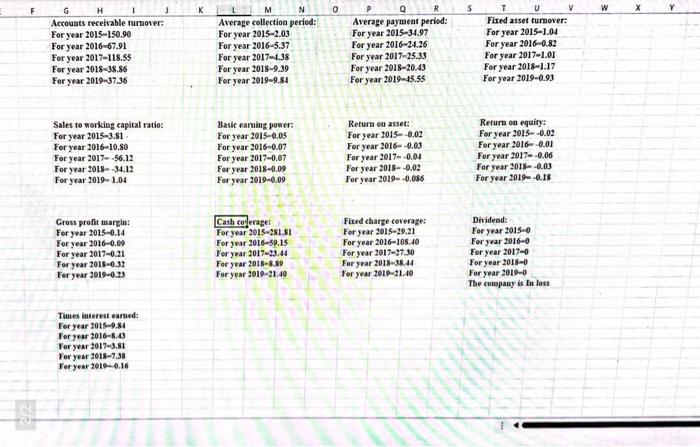

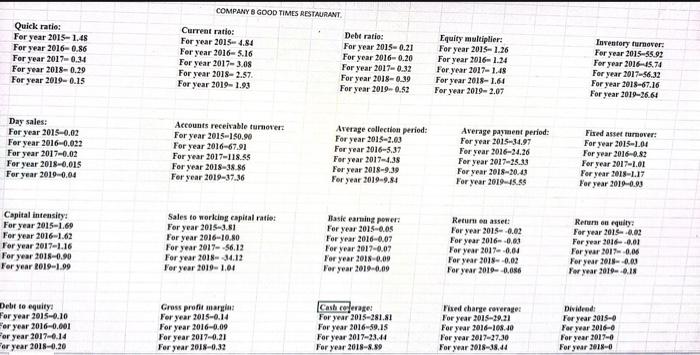

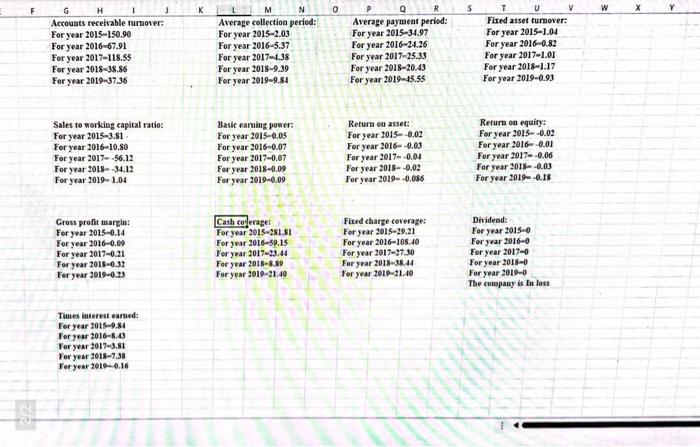

please write recommendation strategies to improve the company Quick ratio: For year 2015-1.48 For year 2016-0.86 For year 2017-0.34 For year 2018- 0.29 For year

please write recommendation strategies to improve the company

Quick ratio: For year 2015-1.48 For year 2016-0.86 For year 2017-0.34 For year 2018- 0.29 For year 2019-0.15 Day sales: For year 2015-0.02 For year 2016-0.022 For year 2017-0.02 For year 2018-0.015 For year 2019-0.04 Capital intensity: For year 2015-1.69 For year 2016-1.62 For year 2017-1.16 For year 2018-0.90 For year 2019-1.99 Debt to equity: For year 2015-0.10 For year 2016-0.001 For year 2017-0.14 for year 2018-0.20 COMPANY B GOOD TIMES RESTAURANT Current ratio: For year 2015- 4.84 For year 2016- 5.16 For year 2017-3.08 For year 2018-2.57. For year 2019- 1.93 Accounts receivable turnover: For year 2015-150.90 For year 2016-67.91 For year 2017-118.55 For year 2018-38.86 For year 2019-37.36 Sales to working capital ratio: For year 2015-3.81 For year 2016-10.80 For year 2017--56.12 For year 2018 -34.12 For year 2019- 1.01 Gross profit margin: For year 2015-0.14 For year 2016-0.09 For year 2017-0.21 For year 2018-0.32 Debe ratio: For year 2015-0.21 For year 2016-0.20 For year 2017-0.32 For year 2018-0.39 For year 2019-0.52 Average collection period: For year 2015-2.03 For year 2016-5.37 For year 2017-4.38 For year 2018-9.39 For year 2019-9.84 Basic earning power: For year 2015-0.05 For year 2016-0.07 For year 2017-0.07 For year 2018-0.09 For year 2019-0.09 Cash coverage: For year 2015-281.81 For year 2016-59.15 For year 2017-23.44 For year 2018-8.59 Equity multiplier: For year 2015- 1.26 For year 2016- 1.24 For year 2017-1.48 For year 2018-1.61 For year 2019- 2.07 Average payment period: For year 2015-34.97 For year 2016-24.26 For year 2017-25.33 For year 2018-20.43 For year 2019-45.55 Return on asset: For year 2015--0.02 For year 2016 -0.03 For year 2017--0.04 For year 2018 -0.02 For year 2019--0.086 Fixed charge coverage: For year 2015-29.21 For year 2016-108.40 For year 2017-27.30 For year 2018-38.44 Inventory turnover: For year 2015-55.92 For year 2016-15.74 For year 2017-56.32 For year 2018-67.16 For year 2019-26.64 Fixed asset turnover: For year 2015-1.04 For year 2016-0.82 For year 2017-1.01 For year 2018-1.17 For year 2019-0.93 Return on equity: For year 2015-0.02 For year 2016--0.01 For year 2017 -0.06 For year 2018--0.03 For year 2019-0.18 Dividend: For year 2015-0 For year 2016-0 For year 2017-0 For year 2018-0 F G Accounts receivable turnover: For year 2015-150.90 For year 2016-67.91 For year 2017-118.55 For year 2018-38.86 For year 2019-37.36 Sales to working capital ratio: For year 2015-3.81 For year 2016-10.80 For year 2017--56.12 For year 2018--34.12 For year 2019-1.04 Gross profit margin: For year 2015-0.14 For year 2016-0.09 For year 2017-0.21 For year 2018-0.32 For year 2019-0.23 J Times interest earned: For year 2015-9.84 For year 2016-8.43 For year 2017-3.81 For year 2018-7.38 For year 2019-0.16 K M N Average collection period: For year 2015-2.03 For year 2016-5.37 For year 2017-4.38 For year 2018-9.39 For year 2019-9.84 Basic earning power: For year 2015-0.05 For year 2016-0.07 For year 2017-0.07 For year 2018-0.09 For year 2019-0.09 Cash coverage: For year 2015-281.81 For year 2016-59.15 For year 2017-23.44 For year 2018-8.59 For year 2019-21.40 0 Average payment period: For year 2015-34.97 For year 2016-24.26 For year 2017-25.33 For year 2018-20.43 For year 2019-45.55 Return on asset: For year 2015--0.02 For year 2016--0.03 For year 2017--0.04 For year 2018 -0.02 For year 2019--0.086 Fixed charge coverage: For year 2015-29.21 For year 2016-108.40 For year 2017-27.30 For year 2018-38.44 For year 2019-21.40 5 T Fixed asset turnover: For year 2015-1.04 For year 2016-0.82 For year 2017-1.01 For year 2018-1.17 For year 2019-0.93 Return on equity: For year 2015--0.02 For year 2016--0.01 For year 2017--0.06 For year 2018 -0.03 For year 2019-0.18 Dividend: For year 2015-0 For year 2016-0 V For year 2017-0 For year 2018-0 For year 2019-0 The company is In loss W X Quick ratio: For year 2015-1.48 For year 2016-0.86 For year 2017-0.34 For year 2018- 0.29 For year 2019-0.15 Day sales: For year 2015-0.02 For year 2016-0.022 For year 2017-0.02 For year 2018-0.015 For year 2019-0.04 Capital intensity: For year 2015-1.69 For year 2016-1.62 For year 2017-1.16 For year 2018-0.90 For year 2019-1.99 Debt to equity: For year 2015-0.10 For year 2016-0.001 For year 2017-0.14 for year 2018-0.20 COMPANY B GOOD TIMES RESTAURANT Current ratio: For year 2015- 4.84 For year 2016- 5.16 For year 2017-3.08 For year 2018-2.57. For year 2019- 1.93 Accounts receivable turnover: For year 2015-150.90 For year 2016-67.91 For year 2017-118.55 For year 2018-38.86 For year 2019-37.36 Sales to working capital ratio: For year 2015-3.81 For year 2016-10.80 For year 2017--56.12 For year 2018 -34.12 For year 2019- 1.01 Gross profit margin: For year 2015-0.14 For year 2016-0.09 For year 2017-0.21 For year 2018-0.32 Debe ratio: For year 2015-0.21 For year 2016-0.20 For year 2017-0.32 For year 2018-0.39 For year 2019-0.52 Average collection period: For year 2015-2.03 For year 2016-5.37 For year 2017-4.38 For year 2018-9.39 For year 2019-9.84 Basic earning power: For year 2015-0.05 For year 2016-0.07 For year 2017-0.07 For year 2018-0.09 For year 2019-0.09 Cash coverage: For year 2015-281.81 For year 2016-59.15 For year 2017-23.44 For year 2018-8.59 Equity multiplier: For year 2015- 1.26 For year 2016- 1.24 For year 2017-1.48 For year 2018-1.61 For year 2019- 2.07 Average payment period: For year 2015-34.97 For year 2016-24.26 For year 2017-25.33 For year 2018-20.43 For year 2019-45.55 Return on asset: For year 2015--0.02 For year 2016 -0.03 For year 2017--0.04 For year 2018 -0.02 For year 2019--0.086 Fixed charge coverage: For year 2015-29.21 For year 2016-108.40 For year 2017-27.30 For year 2018-38.44 Inventory turnover: For year 2015-55.92 For year 2016-15.74 For year 2017-56.32 For year 2018-67.16 For year 2019-26.64 Fixed asset turnover: For year 2015-1.04 For year 2016-0.82 For year 2017-1.01 For year 2018-1.17 For year 2019-0.93 Return on equity: For year 2015-0.02 For year 2016--0.01 For year 2017 -0.06 For year 2018--0.03 For year 2019-0.18 Dividend: For year 2015-0 For year 2016-0 For year 2017-0 For year 2018-0 F G Accounts receivable turnover: For year 2015-150.90 For year 2016-67.91 For year 2017-118.55 For year 2018-38.86 For year 2019-37.36 Sales to working capital ratio: For year 2015-3.81 For year 2016-10.80 For year 2017--56.12 For year 2018--34.12 For year 2019-1.04 Gross profit margin: For year 2015-0.14 For year 2016-0.09 For year 2017-0.21 For year 2018-0.32 For year 2019-0.23 J Times interest earned: For year 2015-9.84 For year 2016-8.43 For year 2017-3.81 For year 2018-7.38 For year 2019-0.16 K M N Average collection period: For year 2015-2.03 For year 2016-5.37 For year 2017-4.38 For year 2018-9.39 For year 2019-9.84 Basic earning power: For year 2015-0.05 For year 2016-0.07 For year 2017-0.07 For year 2018-0.09 For year 2019-0.09 Cash coverage: For year 2015-281.81 For year 2016-59.15 For year 2017-23.44 For year 2018-8.59 For year 2019-21.40 0 Average payment period: For year 2015-34.97 For year 2016-24.26 For year 2017-25.33 For year 2018-20.43 For year 2019-45.55 Return on asset: For year 2015--0.02 For year 2016--0.03 For year 2017--0.04 For year 2018 -0.02 For year 2019--0.086 Fixed charge coverage: For year 2015-29.21 For year 2016-108.40 For year 2017-27.30 For year 2018-38.44 For year 2019-21.40 5 T Fixed asset turnover: For year 2015-1.04 For year 2016-0.82 For year 2017-1.01 For year 2018-1.17 For year 2019-0.93 Return on equity: For year 2015--0.02 For year 2016--0.01 For year 2017--0.06 For year 2018 -0.03 For year 2019-0.18 Dividend: For year 2015-0 For year 2016-0 V For year 2017-0 For year 2018-0 For year 2019-0 The company is In loss W X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started