Answered step by step

Verified Expert Solution

Question

1 Approved Answer

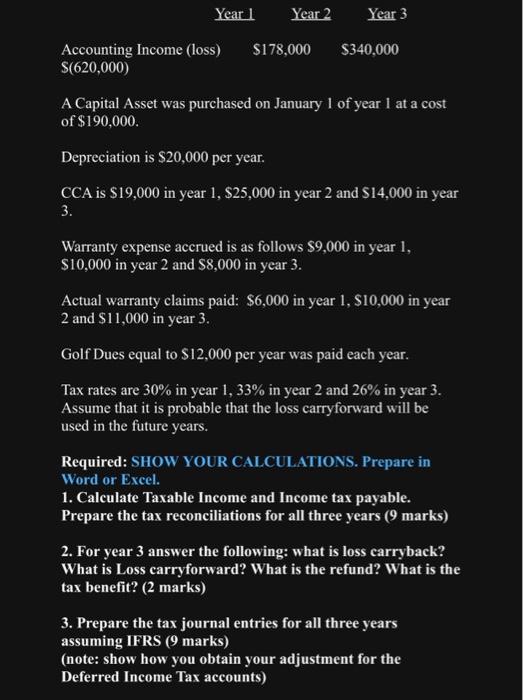

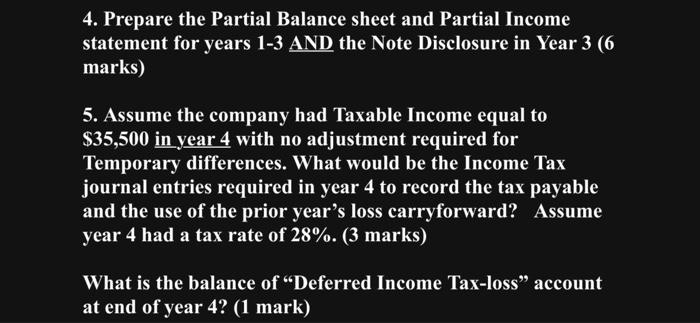

Pleasee I need this with detailed calculations and as askeed in the questions Accounting Income (loss) $178,000$340,000 $(620,000) A Capital Asset was purchased on January

Pleasee I need this with detailed calculations and as askeed in the questions

Accounting Income (loss) $178,000$340,000 $(620,000) A Capital Asset was purchased on January 1 of year 1 at a cost of $190,000. Depreciation is $20,000 per year. CCA is $19,000 in year 1,$25,000 in year 2 and $14,000 in year 3. Warranty expense accrued is as follows $9,000 in year 1 , $10,000 in year 2 and $8,000 in year 3. Actual warranty claims paid: $6,000 in year 1,$10,000 in year 2 and $11,000 in year 3. Golf Dues equal to $12,000 per year was paid each year. Tax rates are 30% in year 1,33% in year 2 and 26% in year 3 . Assume that it is probable that the loss carryforward will be used in the future years. Required: SHOW YOUR CALCULATIONS. Prepare in Word or Excel. 1. Calculate Taxable Income and Income tax payable. Prepare the tax reconciliations for all three years ( 9 marks) 2. For year 3 answer the following: what is loss carryback? What is Loss carryforward? What is the refund? What is the tax benefit? ( 2 marks) 3. Prepare the tax journal entries for all three years assuming IFRS ( 9 marks) (note: show how you obtain your adjustment for the Deferred Income Tax accounts) 4. Prepare the Partial Balance sheet and Partial Income statement for years 1-3 AND the Note Disclosure in Year 3 (6 marks) 5. Assume the company had Taxable Income equal to $35,500 in year 4 with no adjustment required for Temporary differences. What would be the Income Tax journal entries required in year 4 to record the tax payable and the use of the prior year's loss carryforward? Assume year 4 had a tax rate of 28%. ( 3 marks) What is the balance of "Deferred Income Tax-loss" account at end of year 4? (1 mark) Accounting Income (loss) $178,000$340,000 $(620,000) A Capital Asset was purchased on January 1 of year 1 at a cost of $190,000. Depreciation is $20,000 per year. CCA is $19,000 in year 1,$25,000 in year 2 and $14,000 in year 3. Warranty expense accrued is as follows $9,000 in year 1 , $10,000 in year 2 and $8,000 in year 3. Actual warranty claims paid: $6,000 in year 1,$10,000 in year 2 and $11,000 in year 3. Golf Dues equal to $12,000 per year was paid each year. Tax rates are 30% in year 1,33% in year 2 and 26% in year 3 . Assume that it is probable that the loss carryforward will be used in the future years. Required: SHOW YOUR CALCULATIONS. Prepare in Word or Excel. 1. Calculate Taxable Income and Income tax payable. Prepare the tax reconciliations for all three years ( 9 marks) 2. For year 3 answer the following: what is loss carryback? What is Loss carryforward? What is the refund? What is the tax benefit? ( 2 marks) 3. Prepare the tax journal entries for all three years assuming IFRS ( 9 marks) (note: show how you obtain your adjustment for the Deferred Income Tax accounts) 4. Prepare the Partial Balance sheet and Partial Income statement for years 1-3 AND the Note Disclosure in Year 3 (6 marks) 5. Assume the company had Taxable Income equal to $35,500 in year 4 with no adjustment required for Temporary differences. What would be the Income Tax journal entries required in year 4 to record the tax payable and the use of the prior year's loss carryforward? Assume year 4 had a tax rate of 28%. ( 3 marks) What is the balance of "Deferred Income Tax-loss" account at end of year 4? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started