PLEASEEEE ANSWER ALL OF THESE!!! one of the multiple choice is hidden in all of these so if you dont see the answer, its the last choice!

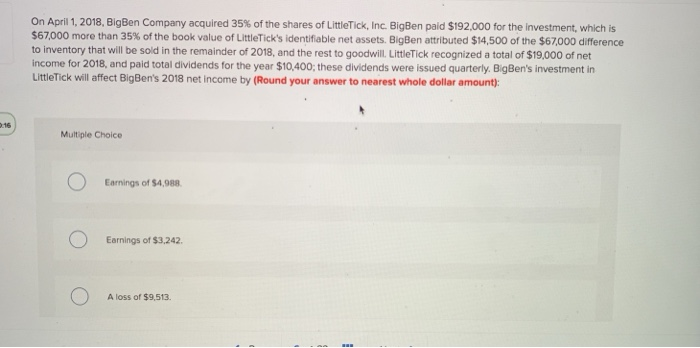

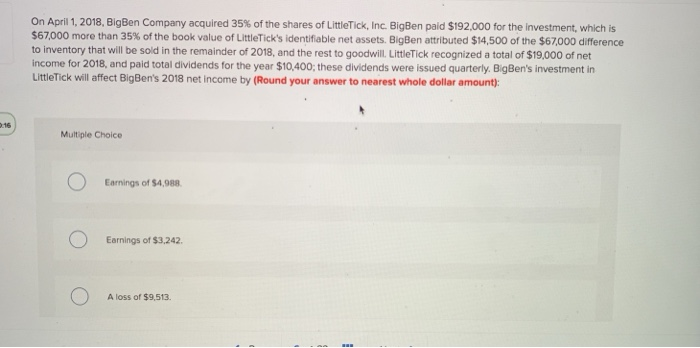

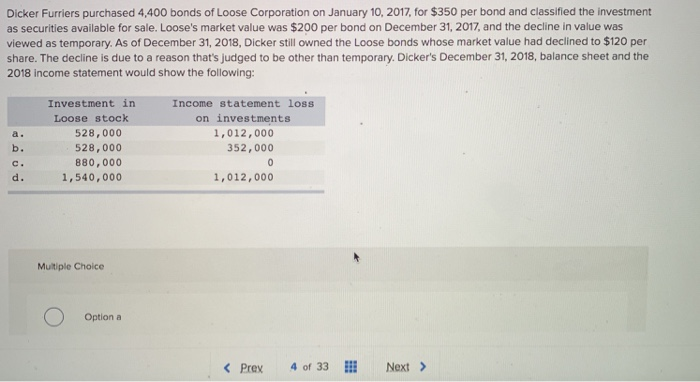

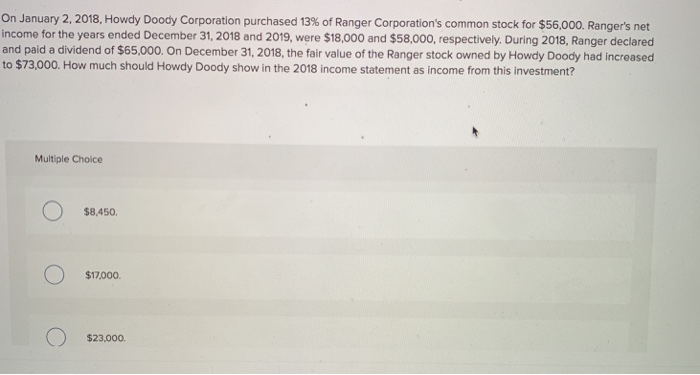

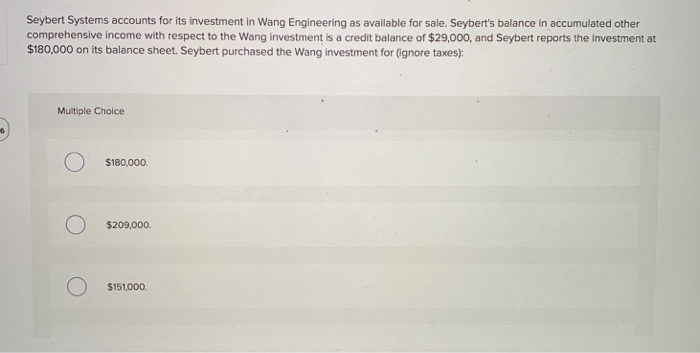

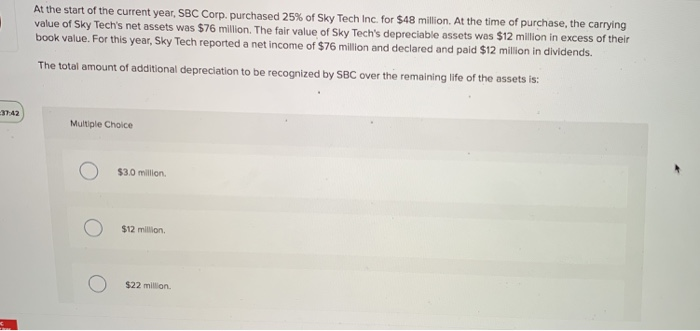

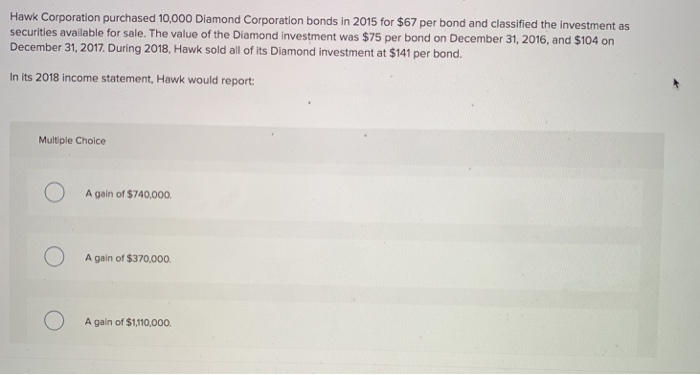

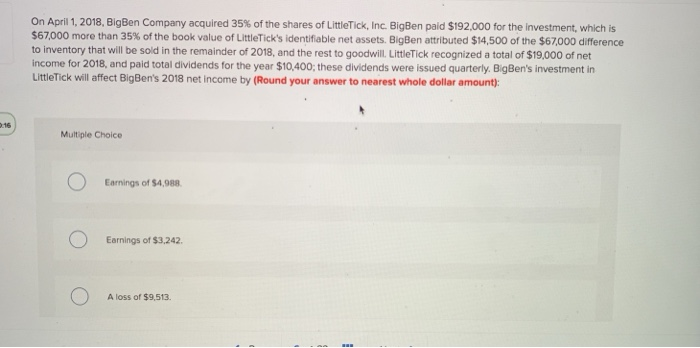

On April 1, 2018, BigBen Company acquired 35% of the shares of LittleTick, Inc. BigBen paid $192,000 for the investment, which is $67000 more than 35% of the book value of LittleTick's identifiable net assets. BigBen attributed $14,500 of the S67000 difference to inventory that will be sold in the remainder of 2018, and the rest to goodwill LittleTick recognized a total of $19,000 of net income for 2018, and paid total dividends for the year $10,400, these dividends were issued quarterly. BigBen's investment in LittleTick will affect BigBen's 2018 net income by (Round your answer to nearest whole dollar amount): 16 Multiple Choice Earnings of $4,988 Earnings of $3,242. A loss of $9,513. Dicker Furriers purchased 4,400 bonds of Loose Corporation on January 10, 2017, for $350 per bond and classified the investment as securities available for sale. Loose's market value was $200 per bond on December 31, 2017, and the decline in value was viewed as temporary. As of December 31, 2018, Dicker still owned the Loose bonds whose market value had declined to $120 per share. The decline is due to a reason that's judged to be other than temporary. Dicker's December 31, 2018, balance sheet and the 2018 income statement would show the following: Investment in Loose stock Income statement loss on investments 1,012,000 528,000 528,000 880,000 1,540,000 a. b. C. d. 352,000 1,012,000 Multiple Choice Option a K Prex 4 of 33 Next On January 2, 2018, Howdy Doody Corporation purchased 13% of Ranger Corporation's common stock for $5 OO Rangers net income for the years ended December 31, 2018 and 2019, were $18,000 and $58,000, respectively. During 2018, Ranger declared and paid a dividend of $65,000. On December 31, 2018, the fair value of the Ranger stock owned by Howdy Doody had increased to $73,000. How much should Howdy Doody show in the 2018 income statement as income from this investment? Multiple Choice $8,450 $17,000 $23,000. Seybert Systems accounts for its investment in Wang Engineering as available for sale. Seybert's balance in accumulated other comprehensive income with respect to the Wang investment is a credit balance of $29,000, and Seybert reports the investment at $180,000 on its balance sheet. Seybert purchased the Wang investment for (ignore taxes): Multiple Choice $180,000 $209,000 $151,000. for $48 million. At the time of purchase, the carrying At the start of the current year, SBC Corp. purchased 25% of Sky Tech Inc. value of Sky Tech's net assets was $76 million. The fair value of Sky Tech's depreciable assets was $12 million in excess of their book value. For this year, Sky Tech reported a net income of $76 million and declared and paid $12 million in dividends The total amount of additional depreciation to be recognized by SBC over the remaining life of the assets is: 3742 Multiple Choice $3.0 million $12 million. $22 million. Hawk Corporation purchased 10,000 Diamond Corporation bonds in 2015 for $67 per bond and classified the investment as securities available for sale. The value of the Diamond investment was $75 per bond on December 31, 2016, and $104 on December 31, 2017. During 2018, Hawk sold all of its Diamond investment at $141 per bond. In its 2018 income statement, Hawk would report Multiple Choice A gain of $740,000 A gain of $370,000 A gain of $1,10,000