Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASEEEE HELPPPP Option valuation. Jack has 200 shares of Allied Business Corporation (ABC) in his portfolio with a current share price of $44. Call and

PLEASEEEE HELPPPP

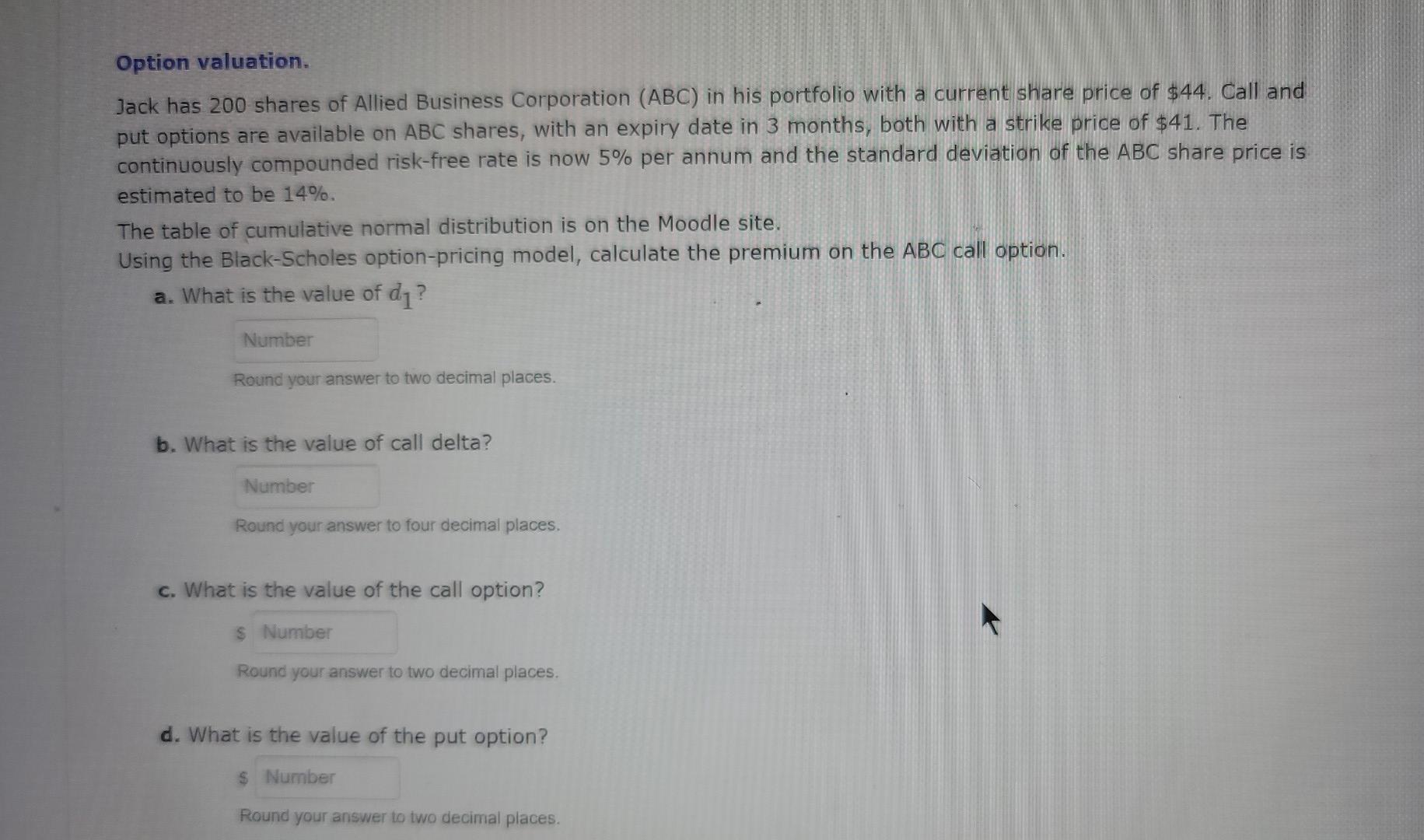

Option valuation. Jack has 200 shares of Allied Business Corporation (ABC) in his portfolio with a current share price of $44. Call and put options are available on ABC shares, with an expiry date in 3 months, both with a strike price of $41. The continuously compounded risk-free rate is now 5% per annum and the standard deviation of the ABC share price is estimated to be 14%. The table of cumulative normal distribution is on the Moodle site. Using the Black-Scholes option-pricing model, calculate the premium on the ABC call option. a. What is the value of d? Number Round your answer to two decimal places. b. What is the value of call delta? Number Round your answer to four decimal places. c. What is the value of the call option? $ Number Round your answer to two decimal places. d. What is the value of the put option? $ Number Round your answer to two decimal places. Option valuation. Jack has 200 shares of Allied Business Corporation (ABC) in his portfolio with a current share price of $44. Call and put options are available on ABC shares, with an expiry date in 3 months, both with a strike price of $41. The continuously compounded risk-free rate is now 5% per annum and the standard deviation of the ABC share price is estimated to be 14%. The table of cumulative normal distribution is on the Moodle site. Using the Black-Scholes option-pricing model, calculate the premium on the ABC call option. a. What is the value of d? Number Round your answer to two decimal places. b. What is the value of call delta? Number Round your answer to four decimal places. c. What is the value of the call option? $ Number Round your answer to two decimal places. d. What is the value of the put option? $ Number Round your answer to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started