Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plesse answer in the same format as the question. This is one question. thank you! The following defined benefit pension data of Wildhorse Corp. apply

Plesse answer in the same format as the question. This is one question. thank you!

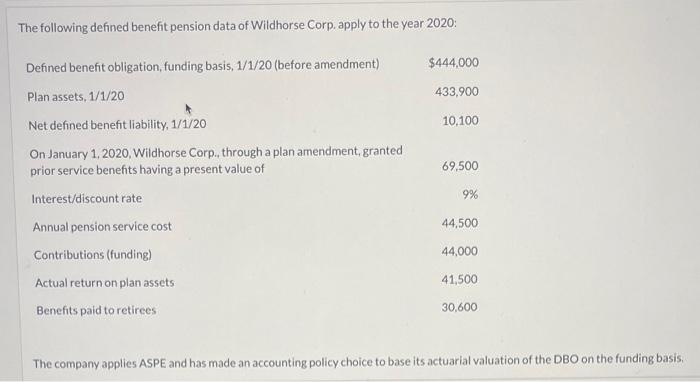

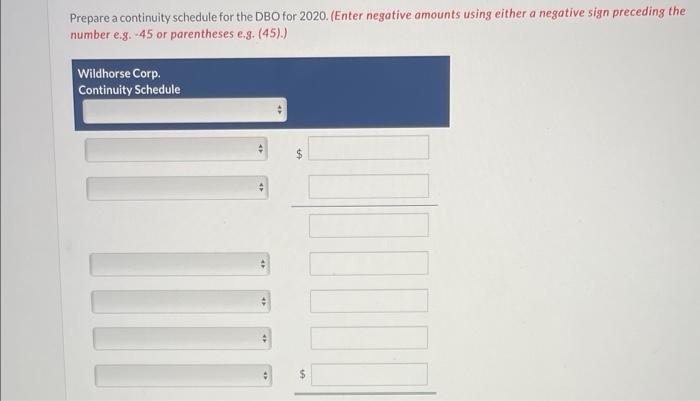

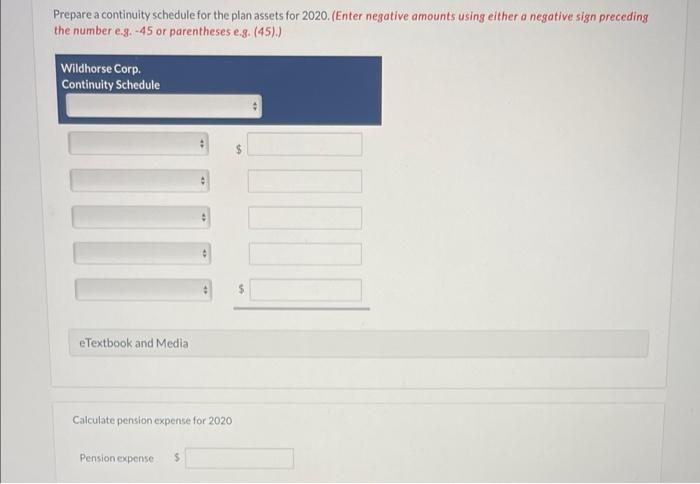

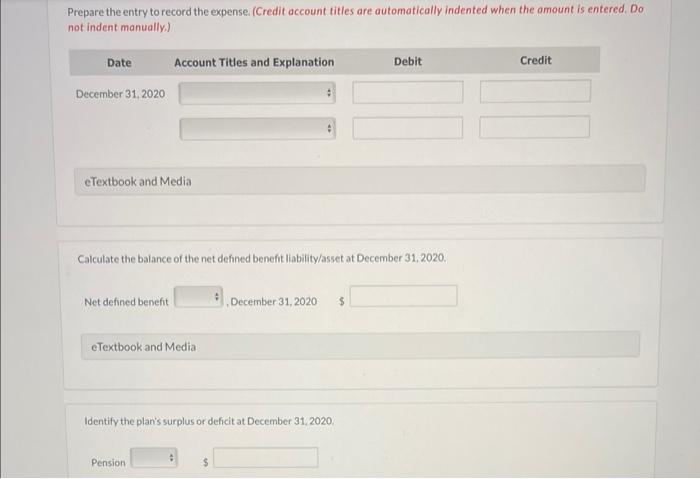

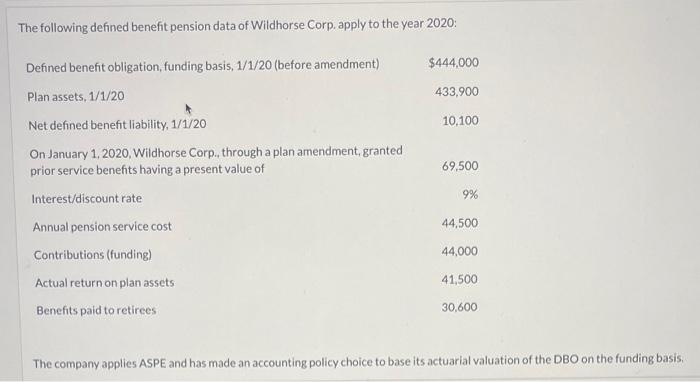

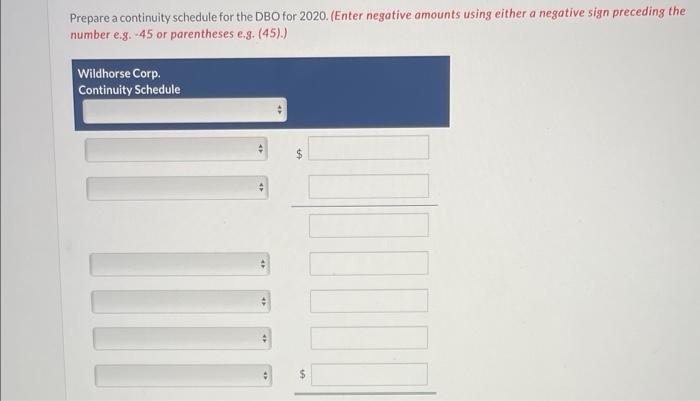

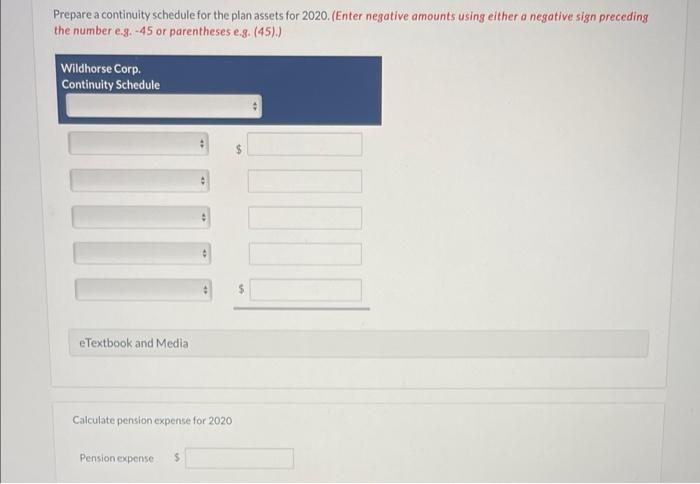

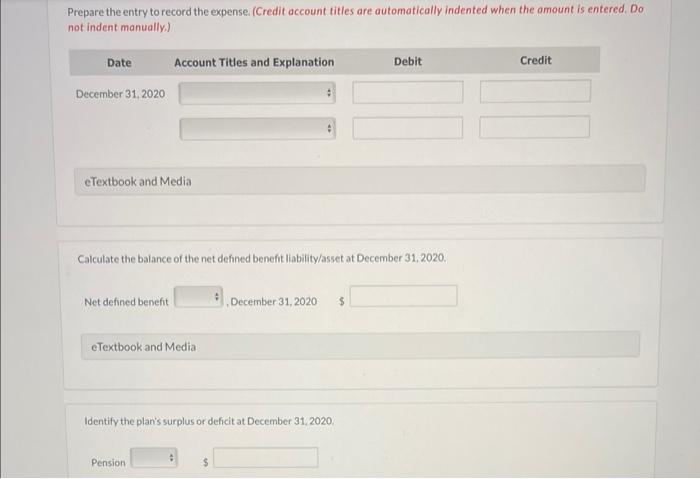

The following defined benefit pension data of Wildhorse Corp. apply to the year 2020 : The company applies ASPE and has made an accounting policy choice to base its actuarial valuation of the DBO on the funding basis. Prepare a continuity schedule for the DBO for 2020. (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Prepare a continuity schedule for the plan assets for 2020 . (Enter negative amounts using either a negative sign preceding the number e.g. 45 or parentheses e.g. (45).) Calculate pension expense for 2020 Pensionexpense 5 Prepare the entry to record the expense. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Calculate the balance of the net defned benefit liability/asset at December 31,2020. Net defined benefit December 31,2020 eTextbook and Media Identify the plan's surplus or deficit at December 31, 2020; Pension $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started