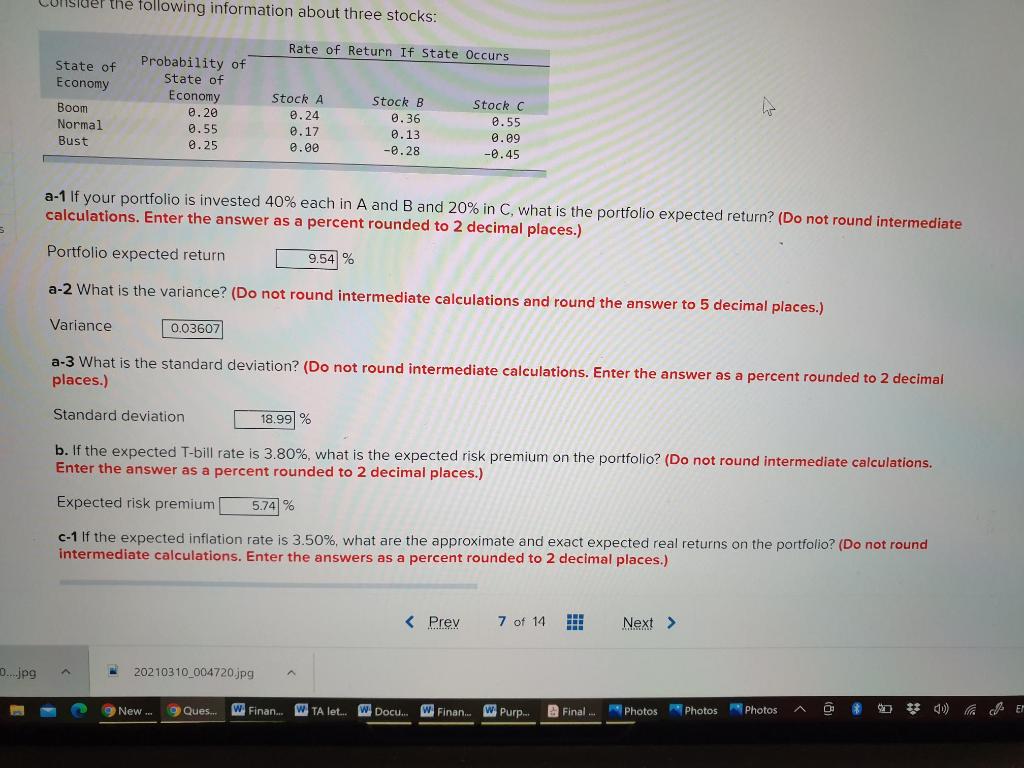

Pls ans the last part

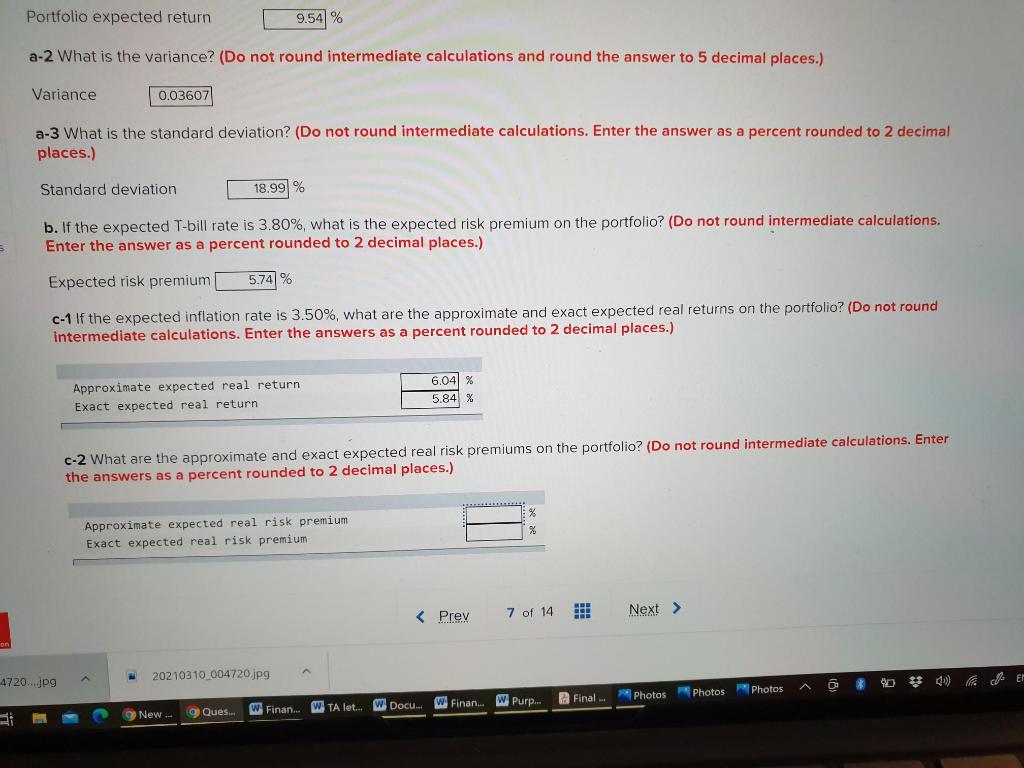

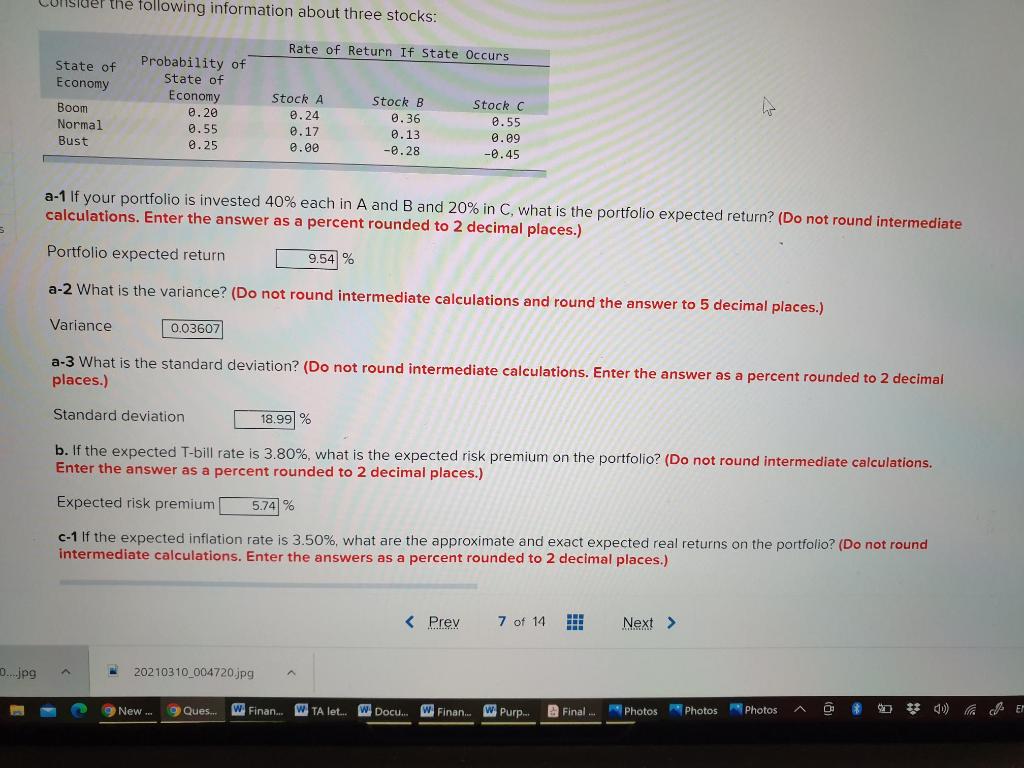

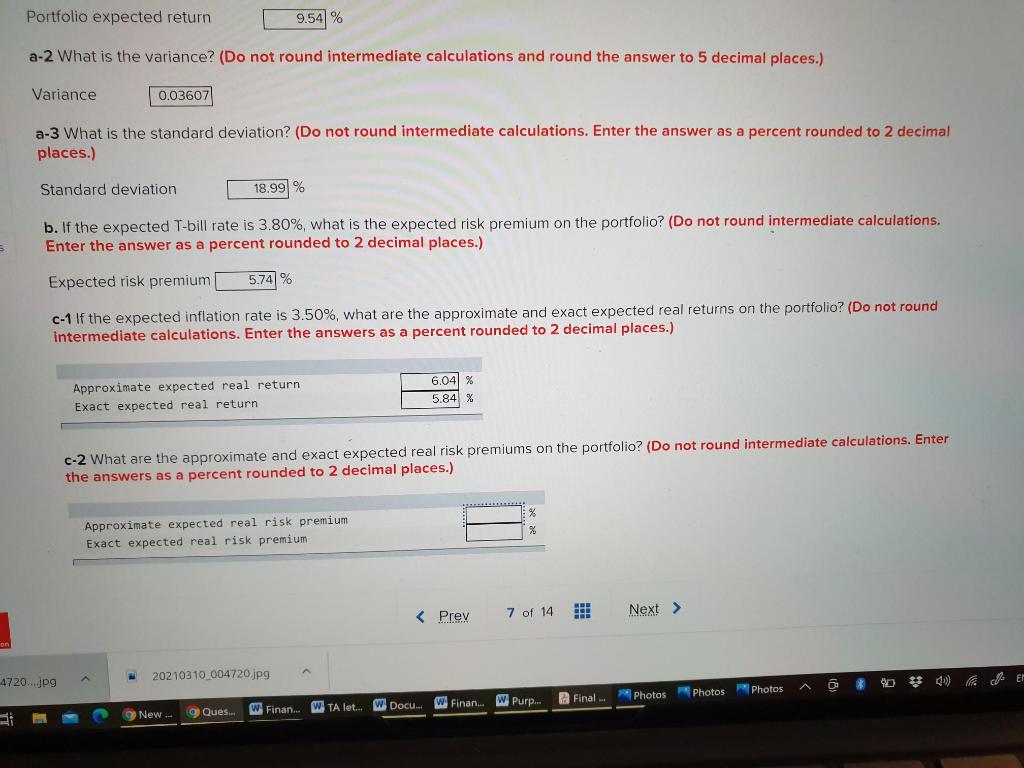

Portfolio expected return 9.54% a-2 What is the variance? (Do not round intermediate calculations and round the answer to 5 decimal places.) Variance 0.03607 a-3 What is the standard deviation? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Standard deviation 18.99% b. If the expected T-bill rate is 3.80%, what is the expected risk premium on the portfolio? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Expected risk premium 5.74% C-1 If the expected inflation rate is 3.50%, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) Approximate expected real return Exact expected real return 6.04 % 5.84 % C-2 What are the approximate and exact expected real risk premiums on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) % Approximate expected real risk premium Exact expected real risk premium 20210310_004720.jpg 4720....jpg Final W Purp.. Photos Photos Photos Finan.. Ques... WTA let... W Docu. W Finan... New Consider the following information about three stocks: Rate of Return If State Occurs State of Economy Boom Normal Bust Probability of State of Economy 0.20 0.55 0.25 Stock A 0.24 @.17 0.00 Stock B 0.36 0.13 -0.28 Stock C 0.55 0.09 -0.45 a-1 If your portfolio is invested 40% each in A and B and 20% in C, what is the portfolio expected return? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Portfolio expected return 9.54 % a-2 What is the variance? (Do not round intermediate calculations and round the answer to 5 decimal places.) Variance 0.03607 a-3 What is the standard deviation? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Standard deviation 18.99 % b. If the expected T-bill rate is 3.80%, what is the expected risk premium on the portfolio? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Expected risk premium 5.74% C-1 If the expected inflation rate is 3.50%, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) 0.jpg 20210310_004720.jpg 9 New... Ques... W Finan... WTA let... w Docu. W Finan.. W. Purp... Final Photos Photos Photos Portfolio expected return 9.54% a-2 What is the variance? (Do not round intermediate calculations and round the answer to 5 decimal places.) Variance 0.03607 a-3 What is the standard deviation? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Standard deviation 18.99% b. If the expected T-bill rate is 3.80%, what is the expected risk premium on the portfolio? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Expected risk premium 5.74% C-1 If the expected inflation rate is 3.50%, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) Approximate expected real return Exact expected real return 6.04 % 5.84 % C-2 What are the approximate and exact expected real risk premiums on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) % Approximate expected real risk premium Exact expected real risk premium 20210310_004720.jpg 4720....jpg Final W Purp.. Photos Photos Photos Finan.. Ques... WTA let... W Docu. W Finan... New Consider the following information about three stocks: Rate of Return If State Occurs State of Economy Boom Normal Bust Probability of State of Economy 0.20 0.55 0.25 Stock A 0.24 @.17 0.00 Stock B 0.36 0.13 -0.28 Stock C 0.55 0.09 -0.45 a-1 If your portfolio is invested 40% each in A and B and 20% in C, what is the portfolio expected return? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Portfolio expected return 9.54 % a-2 What is the variance? (Do not round intermediate calculations and round the answer to 5 decimal places.) Variance 0.03607 a-3 What is the standard deviation? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Standard deviation 18.99 % b. If the expected T-bill rate is 3.80%, what is the expected risk premium on the portfolio? (Do not round intermediate calculations. Enter the answer as a percent rounded to 2 decimal places.) Expected risk premium 5.74% C-1 If the expected inflation rate is 3.50%, what are the approximate and exact expected real returns on the portfolio? (Do not round intermediate calculations. Enter the answers as a percent rounded to 2 decimal places.) 0.jpg 20210310_004720.jpg 9 New... Ques... W Finan... WTA let... w Docu. W Finan.. W. Purp... Final Photos Photos Photos