pls answer all without explain

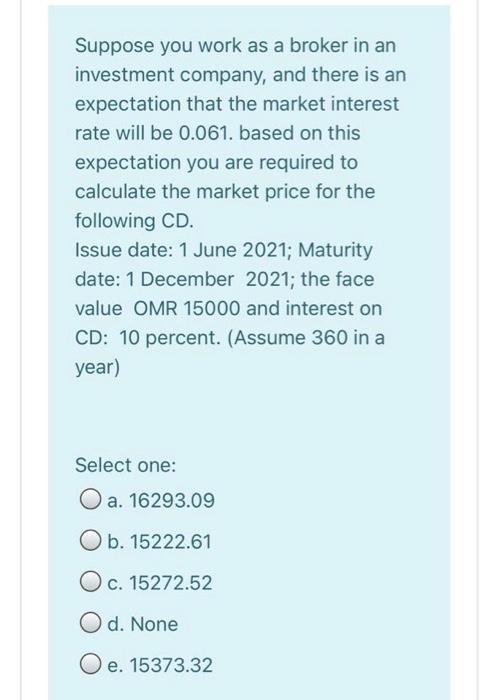

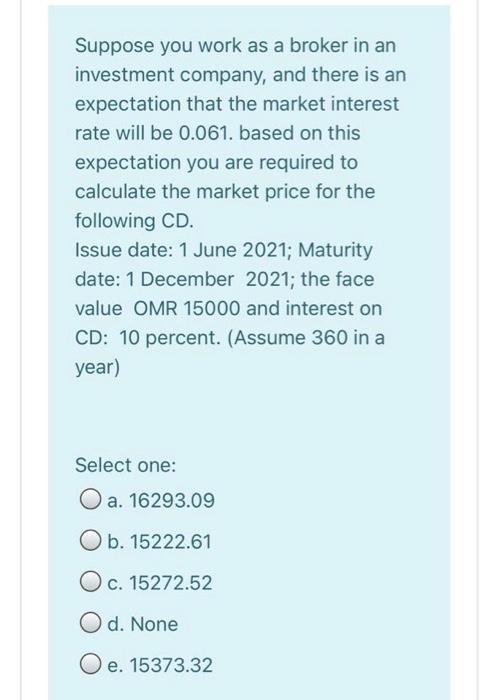

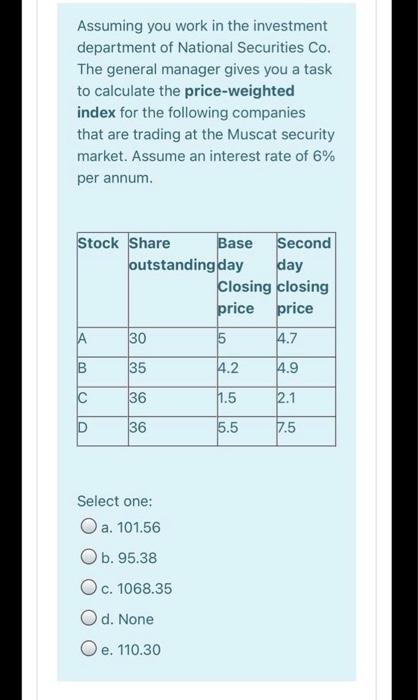

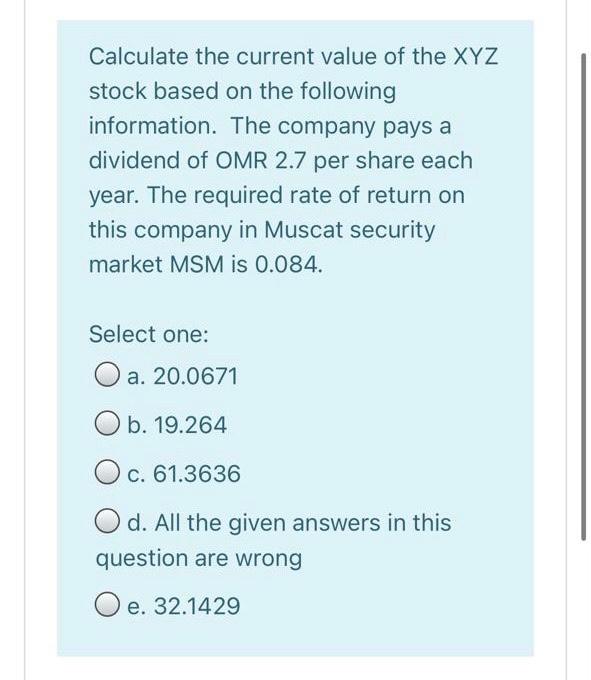

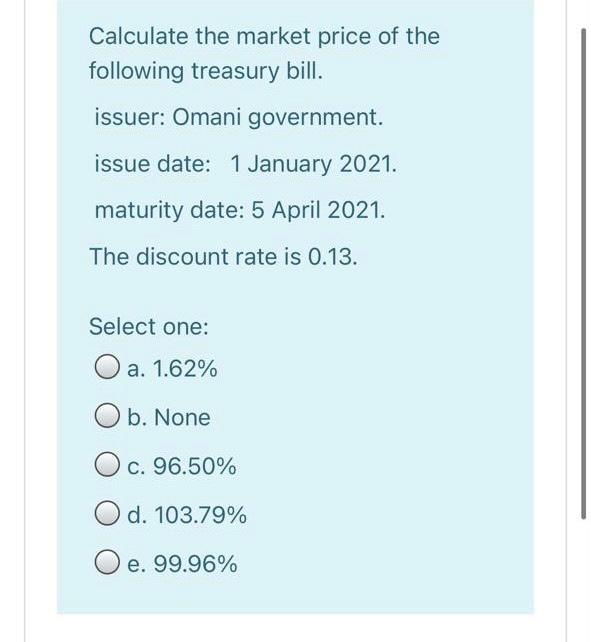

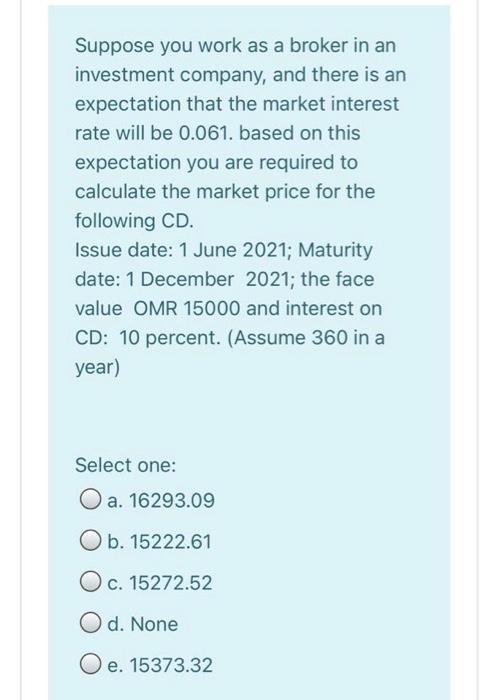

Suppose you work as a broker in an investment company, and there is an expectation that the market interest rate will be 0.061. based on this expectation you are required to calculate the market price for the following CD. Issue date: 1 June 2021; Maturity date: 1 December 2021; the face value OMR 15000 and interest on CD: 10 percent. (Assume 360 in a year) Select one: O a. 16293.09 O b. 15222.61 O c. 15272.52 O d. None O e. 15373.32 Assuming you work in the investment department of National Securities Co. The general manager gives you a task to calculate the price-weighted index for the following companies that are trading at the Muscat security market. Assume an interest rate of 6% per annum. Stock Share Base Second outstanding day day Closing closing price price A 30 5 4.7 B 35 4.2 4.9 36 11.5 2.1 D 36 5.5 7.5 Select one: O a. 101.56 Ob.95.38 O c. 1068.35 O d. None O e. 110.30 Calculate the current value of the XYZ stock based on the following information. The company pays a dividend of OMR 2.7 per share each year. The required rate of return on this company in Muscat security market MSM is 0.084. Select one: O a. 20.0671 O b. 19.264 O c. 61.3636 O d. All the given answers in this question are wrong e. 32.1429 Calculate the market price of the following treasury bill. issuer: Omani government. issue date: 1 January 2021. maturity date: 5 April 2021. The discount rate is 0.13. Select one: O a. 1.62% O b. None O c. 96.50% O d. 103.79% O e. 99.96% Suppose you work as a broker in an investment company, and there is an expectation that the market interest rate will be 0.061. based on this expectation you are required to calculate the market price for the following CD. Issue date: 1 June 2021; Maturity date: 1 December 2021; the face value OMR 15000 and interest on CD: 10 percent. (Assume 360 in a year) Select one: O a. 16293.09 O b. 15222.61 O c. 15272.52 O d. None O e. 15373.32 Assuming you work in the investment department of National Securities Co. The general manager gives you a task to calculate the price-weighted index for the following companies that are trading at the Muscat security market. Assume an interest rate of 6% per annum. Stock Share Base Second outstanding day day Closing closing price price A 30 5 4.7 B 35 4.2 4.9 36 11.5 2.1 D 36 5.5 7.5 Select one: O a. 101.56 Ob.95.38 O c. 1068.35 O d. None O e. 110.30 Calculate the current value of the XYZ stock based on the following information. The company pays a dividend of OMR 2.7 per share each year. The required rate of return on this company in Muscat security market MSM is 0.084. Select one: O a. 20.0671 O b. 19.264 O c. 61.3636 O d. All the given answers in this question are wrong e. 32.1429 Calculate the market price of the following treasury bill. issuer: Omani government. issue date: 1 January 2021. maturity date: 5 April 2021. The discount rate is 0.13. Select one: O a. 1.62% O b. None O c. 96.50% O d. 103.79% O e. 99.96%