pls answer asap

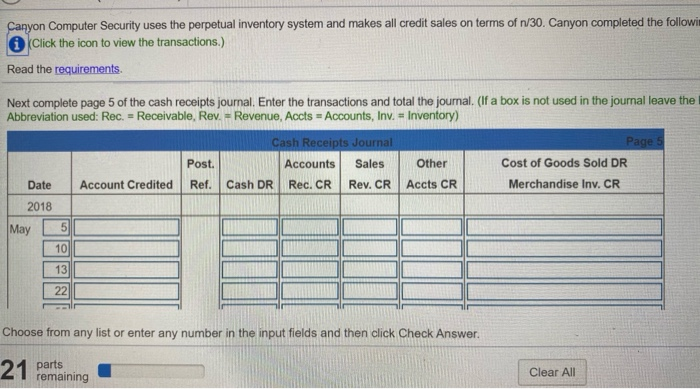

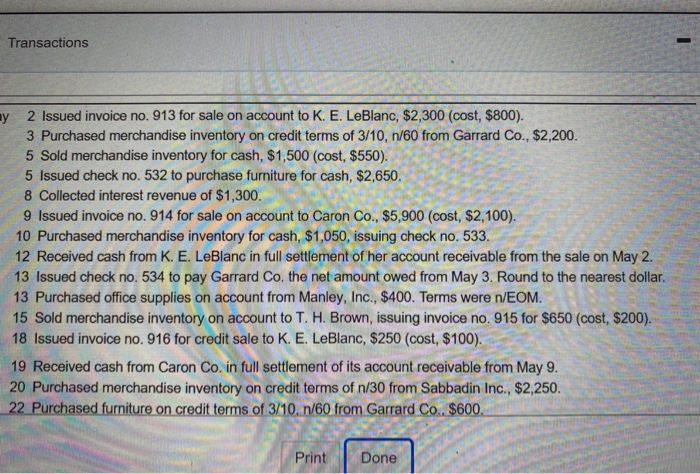

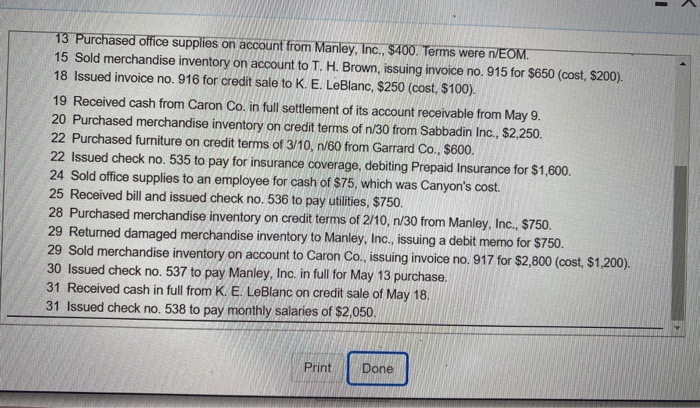

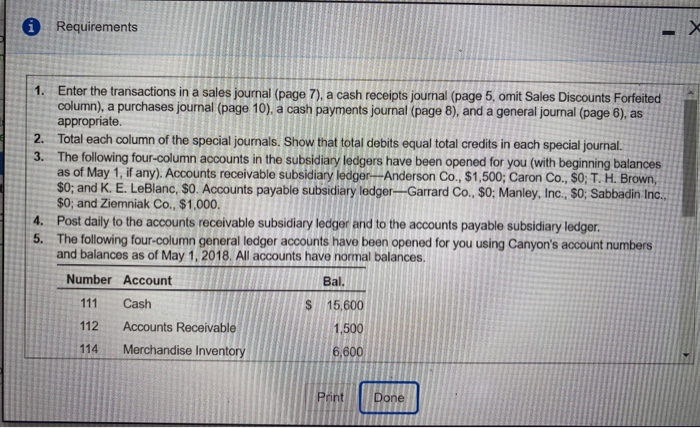

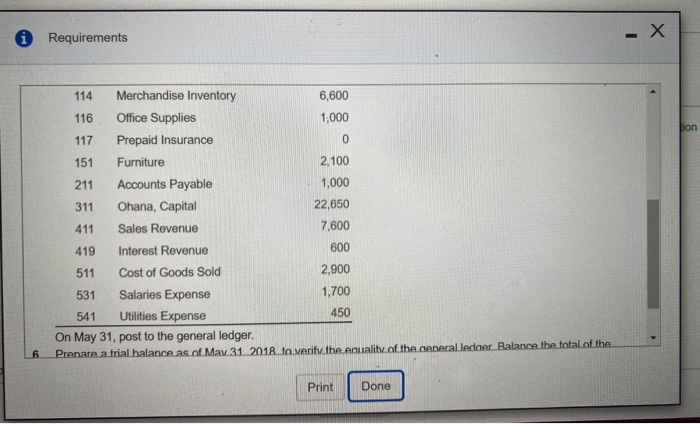

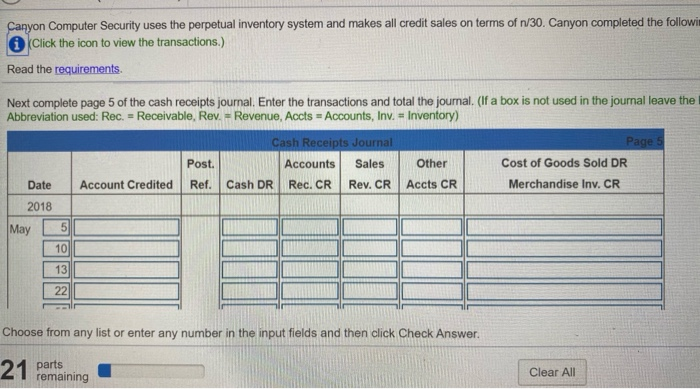

Canyon Computer Security uses the perpetual inventory system and makes all credit sales on terms of n/30. Canyon completed the followi Click the icon to view the transactions.) Read the requirements Next complete page 5 of the cash receipts journal. Enter the transactions and total the journal. (If a box is not used in the journal leave the Abbreviation used: Rec. = Receivable, Rev. - Revenue, Accts = Accounts, Inv. - Inventory) Cash Receipts Journal Page 5 Post. Accounts Sales Other Cost of Goods Sold DR Date Account Credited Ref. Cash DR Rec. CR Rev. CR Accts CR Merchandise Inv. CR 2018 May 5 Choose from any list or enter any number in the input fields and then click Check Answer 21 remaining 21 parts Clear All Transactions ny 2 Issued invoice no. 913 for sale on account to K. E. LeBlanc, $2,300 (cost, $800). 3 Purchased merchandise inventory on credit terms of 3/10, n/60 from Garrard Co., $2,200. 5 Sold merchandise inventory for cash, $1,500 (cost, $550). 5 Issued check no. 532 to purchase furniture for cash, $2,650. 8 Collected interest revenue of $1,300. 9 Issued invoice no. 914 for sale on account to Caron Co., $5,900 (cost, $2,100). 10 Purchased merchandise inventory for cash, $1,050, issuing check no. 533. 12 Received cash from K. E. LeBlanc in full settlement of her account receivable from the sale on May 2. 13 Issued check no. 534 to pay Garrard Co. the net amount owed from May 3. Round to the nearest dollar. 13 Purchased office supplies on account from Manley, Inc., $400. Terms were n/EOM. 15 Sold merchandise inventory on account to T. H. Brown, issuing invoice no. 915 for $650 (cost, $200). 18 Issued invoice no. 916 for credit sale to K. E. LeBlanc, $250 (cost, $100). 19 Received cash from Caron Co. in full settlement of its account receivable from May 9. 20 Purchased merchandise inventory on credit terms of n/30 from Sabbadin Inc., $2,250. 22 Purchased furniture on credit terms of 3/10,n/60 from Garrard Co.. $600. Print Done 13 Purchased office supplies on account from Manley, Inc., $400. Terms were nVEOM. 15 Sold merchandise inventory on account to T. H. Brown, issuing invoice no. 915 for $650 (cost, $200). 18 Issued invoice no. 916 for credit sale to K. E. LeBlanc, $250 (cost, $100). 19 Received cash from Caron Co. in full settlement of its account receivable from May 9. 20 Purchased merchandise inventory on credit terms of n/30 from Sabbadin Inc., $2,250. 22 Purchased furniture on credit terms of 3/10, 1/60 from Garrard Co., $600. 22 Issued check no. 535 to pay for insurance coverage, debiting Prepaid Insurance for $1,600. 24 Sold office supplies to an employee for cash of $75, which was Canyon's cost. 25 Received bill and issued check no. 536 to pay utilities, $750. 28 Purchased merchandise inventory on credit terms of 2/10, 1/30 from Manley, Inc., $750. 29 Returned damaged merchandise inventory to Manley, Inc., issuing a debit memo for $750. 29 Sold merchandise inventory on account to Caron Co., issuing invoice no. 917 for $2,800 (cost, $1,200). 30 Issued check no. 537 to pay Manley, Inc. in full for May 13 purchase. 31 Received cash in full from K. E. LeBlanc on credit sale of May 18, 31 Issued check no. 538 to pay monthly salaries of $2,050. Print Done i Requirements 1. Enter the transactions in a sales journal (page 7), a cash receipts journal (page 5, omit Sales Discounts Forfeited column), a purchases journal (page 10), a cash payments journal (page 8), and a general journal (page 6), as appropriate. 2. Total each column of the special journals. Show that total debits equal total credits in each special journal. 3. The following four-column accounts in the subsidiary ledgers have been opened for you (with beginning balances as of May 1, if any). Accounts receivable subsidiary ledger--Anderson Co., $1,500; Caron Co., SO; T. H. Brown, $0; and K. E. LeBlanc, $O. Accounts payable subsidiary ledger-Garrard Co., $0; Manley, Inc., $0; Sabbadin Inc., $0; and Ziemniak Co., $1,000. Post daily to the accounts receivable subsidiary ledger and to the accounts payable subsidiary ledger. 5. The following four-column general ledger accounts have been opened for you using Canyon's account number and balances as of May 1, 2018. All accounts have normal balances. Number Account 111 Cash $ 15,600 112 Accounts Receivable 1,500 114 Merchandise Inventory 6,600 Bal. Done * Requirements 311 114 Merchandise Inventory 6,600 116 Office Supplies 1,000 117 Prepaid Insure Prepaid Insurance Furniture 2,100 211 Accounts Payable 1,000 Ohana, Capital 22,650 411 Sales Revenue 7,600 419 Interest Revenue 600 511 Cost of Goods Sold 2,900 531 Salaries Expense 1,700 541 Utilities Expense 450 On May 31, post to the general ledger. 6. Prepare a trial balance as of May 31 2018 to verify the couality of the general ledoer Balance the total of the Print Done