PLS ANSWER ASAP!!!

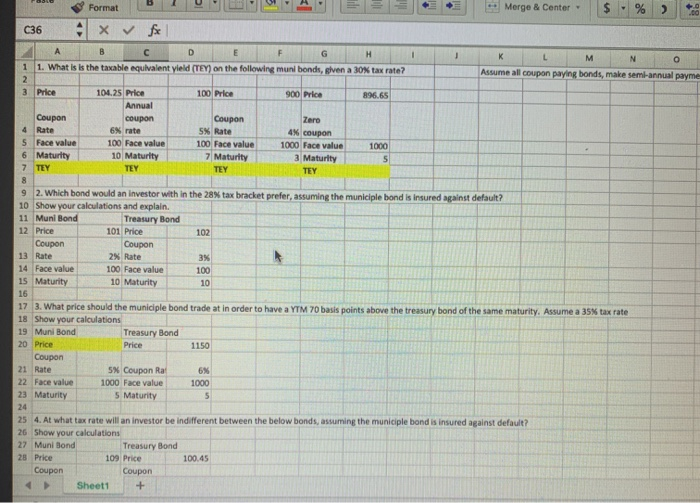

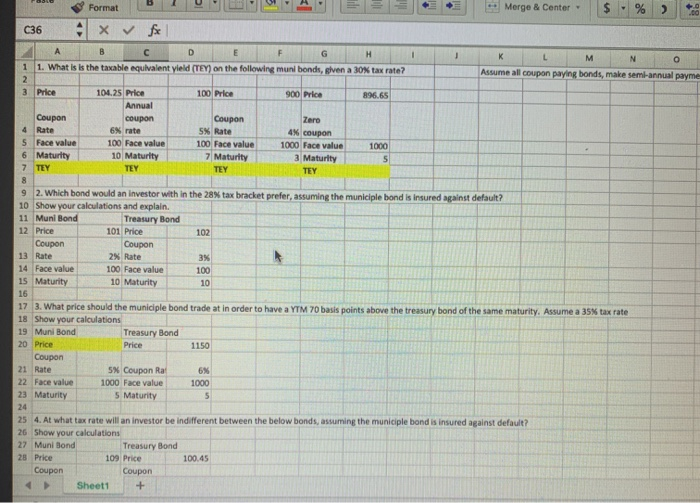

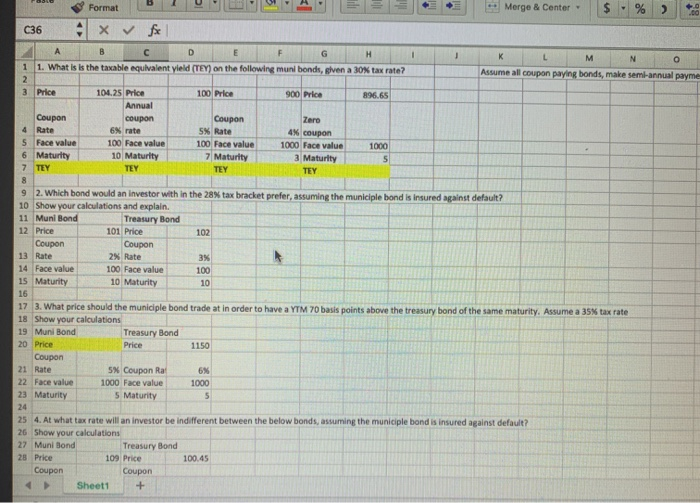

- Merge & Center C36 Format DUTY x y for 1. What is is the taxable equivalent yield (TEY) on the following muni bonds, given a 30tax rate? Assume all coupon paying bonds, make semi-annual payme Price 100 Price 900 Price Coupon 104,25 Price Annual coupon 6N rate 100 Face value 10 Maturity Coupon SN Rate 100 Face value 7 Maturity Zero 4x coupon 1000 Face value a Maturity Face value Maturity TLY TEY 9 2. Which bond would an investor within the 28 tax bracket prefer, assuming the municiple bond is insured against default? 10 Show your calculations and explain 11 Muni Bond Treasury Bond 12 Price 101 Price 102 Coupon Coupon 13 Rate 2x Rate 14 Face value 100 Face value 15 Maturity 10 Maturity 100 17 3. What price should the municiple bond trade at in order to have a YTM 70 baus points above the treasury bond of the same maturity. Assume a 35 tax rate 18 Show your calculations 19 Mun Bond Treasury Bond 20 Price Price 1150 Coupon 21 Rate 5x Coupon Rat 22 Face value 1000 Face value 23 Maturity 5 Maturity 1000 25 4. At what tax rate will an investor be indifferent between the below bonds, assuming the municiple bond is insured against default? 26 Show your calculations 27 Muni Bond Treasury Bond 2 Price 109 Price 100.45 Coupon Coupon Sheet1 + - Merge & Center C36 Format DUTY x y for 1. What is is the taxable equivalent yield (TEY) on the following muni bonds, given a 30tax rate? Assume all coupon paying bonds, make semi-annual payme Price 100 Price 900 Price Coupon 104,25 Price Annual coupon 6N rate 100 Face value 10 Maturity Coupon SN Rate 100 Face value 7 Maturity Zero 4x coupon 1000 Face value a Maturity Face value Maturity TLY TEY 9 2. Which bond would an investor within the 28 tax bracket prefer, assuming the municiple bond is insured against default? 10 Show your calculations and explain 11 Muni Bond Treasury Bond 12 Price 101 Price 102 Coupon Coupon 13 Rate 2x Rate 14 Face value 100 Face value 15 Maturity 10 Maturity 100 17 3. What price should the municiple bond trade at in order to have a YTM 70 baus points above the treasury bond of the same maturity. Assume a 35 tax rate 18 Show your calculations 19 Mun Bond Treasury Bond 20 Price Price 1150 Coupon 21 Rate 5x Coupon Rat 22 Face value 1000 Face value 23 Maturity 5 Maturity 1000 25 4. At what tax rate will an investor be indifferent between the below bonds, assuming the municiple bond is insured against default? 26 Show your calculations 27 Muni Bond Treasury Bond 2 Price 109 Price 100.45 Coupon Coupon Sheet1 +