Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls answer asap Use the following to answer questions 515 T Transport purchased a new semi-trailer truck for an acquisition cost of $200,000. The company

pls answer asap

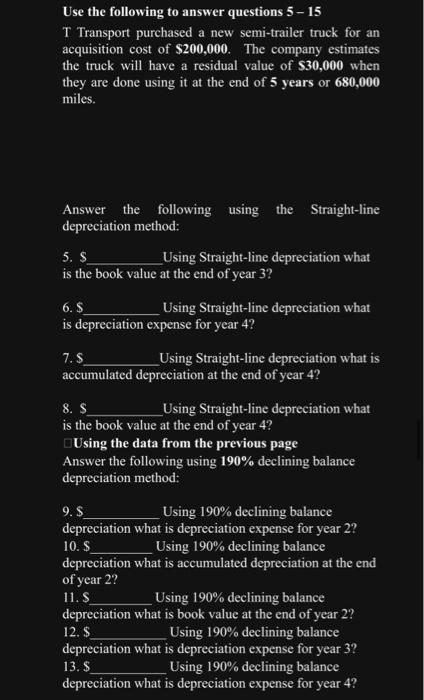

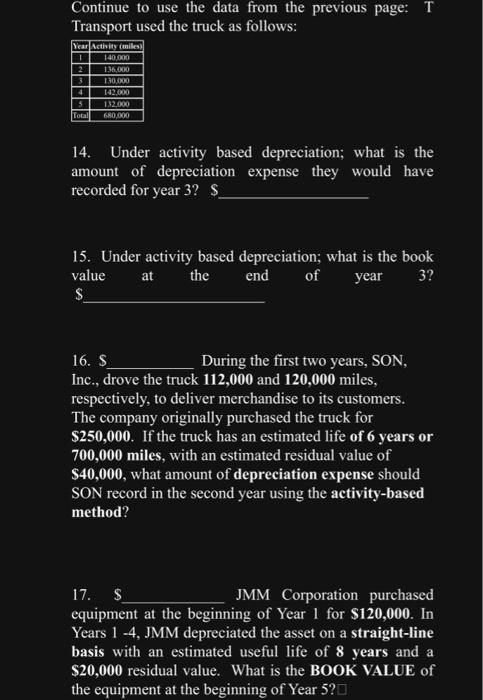

Use the following to answer questions 515 T Transport purchased a new semi-trailer truck for an acquisition cost of $200,000. The company estimates the truck will have a residual value of $30,000 when they are done using it at the end of 5 years or 680,000 miles. Answer the following using the Straight-line depreciation method: 5. $ Using Straight-line depreciation what is the book value at the end of year 3 ? 6.5 Using Straight-line depreciation what is depreciation expense for year 4 ? 7. S Using Straight-line depreciation what is accumulated depreciation at the end of year 4 ? 8. \$ Using Straight-line depreciation what is the book value at the end of year 4 ? Using the data from the previous page Answer the following using 190% declining balance depreciation method: 9. S Using 190% declining balance depreciation what is depreciation expense for year 2? 10. \$ Using 190% declining balance depreciation what is accumulated depreciation at the end of year 2 ? 11. S Using 190% declining balance depreciation what is book value at the end of year 2? 12. $ Using 190% declining balance depreciation what is depreciation expense for year 3 ? 13.\$ Using 190% declining balance depreciation what is depreciation expense for year 4 ? Continue to use the data from the previous page: T Transport used the truck as follows: 14. Under activity based depreciation; what is the amount of depreciation expense they would have recorded for year 3? \$ 15. Under activity based depreciation; what is the book value at the end of year 3 ? $ 16. $ During the first two years, SON, Inc., drove the truck 112,000 and 120,000 miles, respectively, to deliver merchandise to its customers. The company originally purchased the truck for $250,000. If the truck has an estimated life of 6 years or 700,000 miles, with an estimated residual value of $40,000, what amount of depreciation expense should SON record in the second year using the activity-based method? 17. JMM Corporation purchased equipment at the beginning of Year 1 for $120,000. In Years 14,JMM depreciated the asset on a straight-line basis with an estimated useful life of 8 years and a $20,000 residual value. What is the BOOK VALUE of the equipment at the beginning of Year 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started