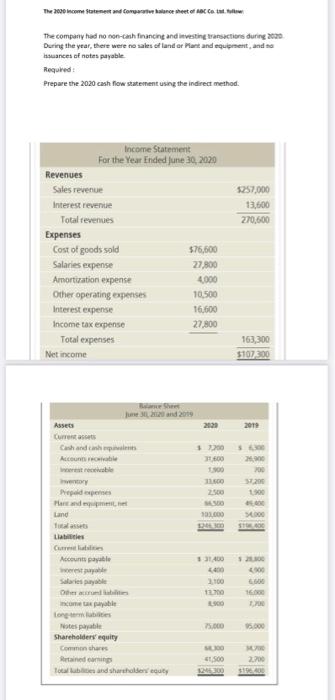

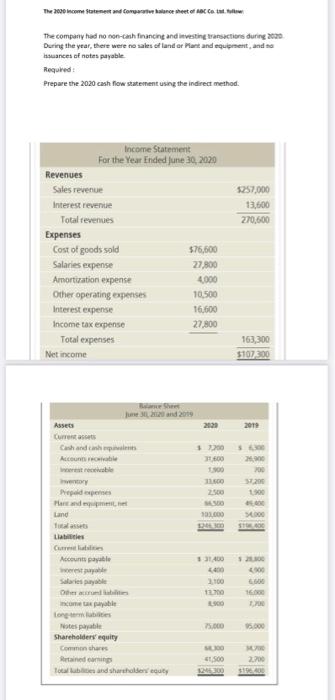

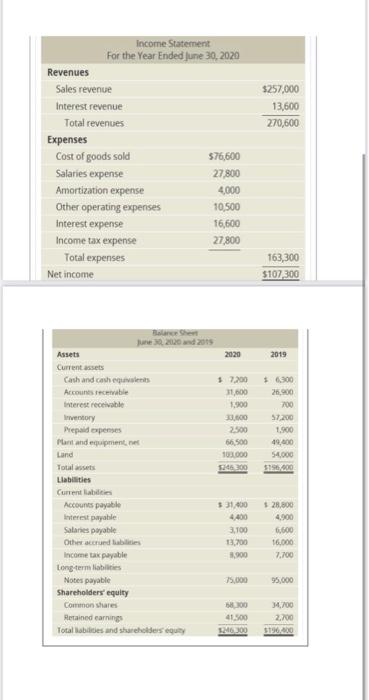

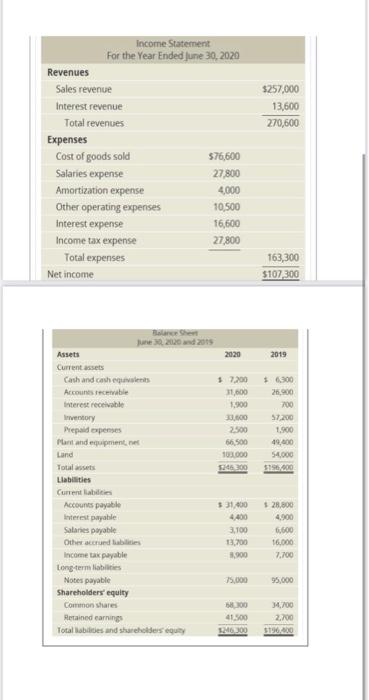

The company had no non-cash financing and investing transactions during 2020.

During the year, there were no sales of land or Plant and equipment, and no

issuances of notes payable.

Required:

Prepare the 2020 cash flow statement using the indirect method.

The 2020 income Statement and Comparate balance sheet of ABC Co The company had no non-cash financing and investing transactions during 2020 During the year, there were no sales of land or Plant and equipment, and no issuances of notes payable Required: Prepare the 2020 cash flow statement using the indirect method. Income Statement For the Year Ended June 30, 2020 Revenues $76,600 27,800 4,000 10,500 16,600 27,800 Sales revenue Interest revenue Total revenues Cost of goods sold Salaries expense Amortization expense Other operating expenses Interest expense Income tax expense Total expenses Expenses Net income Assets Current assets Cash and cash pan Accounts recevable interest receivable Inventory Prepaid expenses Plan and equipment, Land Tutal assets Labe Currestabes Balance Sheet June 30, 2020 and 2019 Accounts payable crest payable Salaries payable Other accrued abilities income tax payable Long-term labies Notes payable Shareholders' equity Common shares Retained earnings Total lublies and shareholders equity 2029 $ 7,200 31,600 1,500 11,600 2,500 $4.500 103,000 1246 300 1:31,400 4,400 1,100 13,700 1500 75,000 $300 41,500 1246300 $257,000 13,600 270,600 163,300 $107,300 2019 $6,300 26,900 700 37,200 1,900 46,400 $4,000 $ 21,300 4,000 16.000 95,000 M70 2.700 $196,400 The 2020 Income Statement and Comparative balance sheet of ABC Co tow The company had no non-cash financing and investing transactions during 2020. During the year, there were no sales of land or Plant and equipment, and no issuances of notes payable Required Prepare the 2020 cash flow statement using the indirect method Income Statement For the Year Ended June 30, 2020 Revenues $76,600 27,800 4,000 10,500 16,600 27,800 Sales revenue Interest revenue Total revenues Cost of goods sold Salaries expense Amortization expense Other operating expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash and canh equivalents Accounts receivable Interest recevable Inventory Prepaid expenses Land Total asets Liabilities Current abilities Expenses Jane X 2020 and 2019 Accounts payable Interest payable Salaries payable Other and bes Income tax payable Long-term liabilities Notes payable Shareholders' equity Common shares Retained camnings Total liabilities and shareholders' equity 2020 $ 7300 31,800 1,900 31,400 2.500 66.500 100.000 $244.300 4,400 1,100 8.900 75,000 ML300 41.500 12563 $257,000 13,600 270,600 163,300 $107,300 2019 $ 6,300 26,900 700 37.200 1.900 41,400 $4,000 $196,400 1:25,800 6,600 16,000 7,700 90.000 37000 2,700 $196,400 Revenues Sales revenue Interest revenue Total revenues Cost of goods sold Salaries expense Amortization expense Other operating expenses interest expense Income tax expense Total expenses Expenses Income Statement For the Year Ended June 30, 2020 $76,600 27,800 4,000 10,500 16,600 27,800 Net income Balance Sheet June 30, 2020 and 2015 Assets Current assets Cash and cash equivalents Accounts receivable Interest receivable Inventory Prepaid expenses Plant and equipment, net Land Total assets Liabilities Current liabilities Accounts payable Interest payable Salaries payable Other accrued liabilities Income tax payable Long-term liabilities Notes payable Shareholders' equity Common shares Retained earnings Total abilities and shareholders equity $257,000 13,600 270,600 163,300 $107,300 2020 2019 $ 7,200 $ 6,300 31,600 26,900 1,900 700 33,400 57,200 2,500 1,900 66,500 49,400 103,000 54,000 1246.300 $196,400 $31,400 $28,800 4,400 4,900 3,100 6,600 13,700 16,000 8,900 7,700 75,000 95,000 68,300 34,700 41,500 2,700 1246,300 $196,400