Pls answer the questions with your detailed explanations, it's much appreciated!

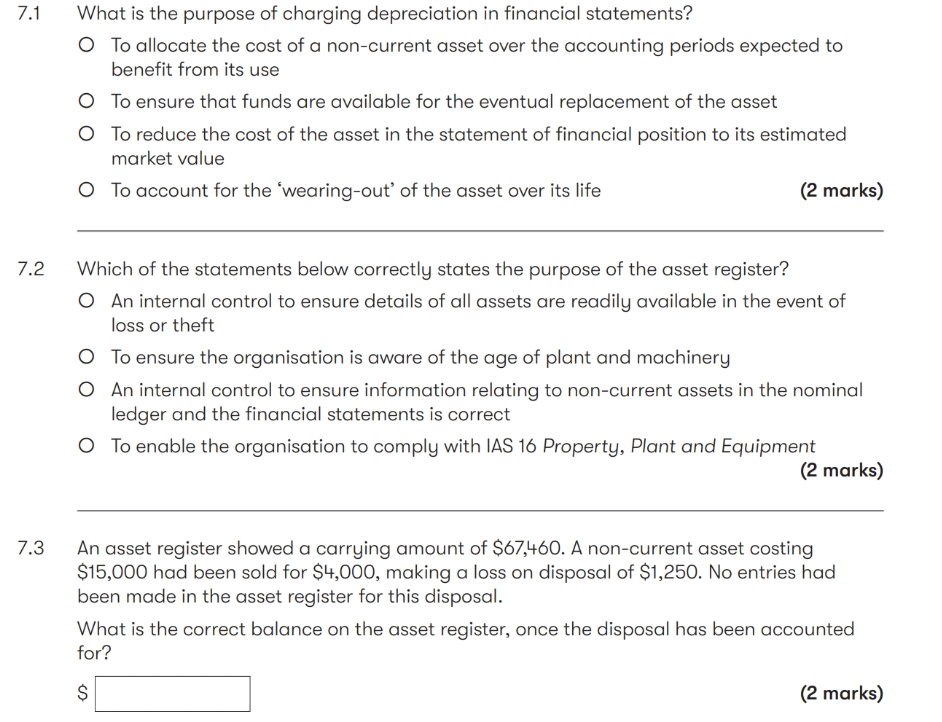

1 What is the purpose of charging depreciation in financial statements? To allocate the cost of a non-current asset over the accounting periods expected to benefit from its use To ensure that funds are available for the eventual replacement of the asset To reduce the cost of the asset in the statement of financial position to its estimated market value To account for the 'wearing-out' of the asset over its life (2 marks) 2 Which of the statements below correctly states the purpose of the asset register? An internal control to ensure details of all assets are readily available in the event of loss or theft To ensure the organisation is aware of the age of plant and machinery An internal control to ensure information relating to non-current assets in the nominal ledger and the financial statements is correct To enable the organisation to comply with IAS 16 Property, Plant and Equipment (2 marks) 3 An asset register showed a carrying amount of $67,460. A non-current asset costing $15,000 had been sold for $4,000, making a loss on disposal of $1,250. No entries had been made in the asset register for this disposal. What is the correct balance on the asset register, once the disposal has been accounted for? 1 What is the purpose of charging depreciation in financial statements? To allocate the cost of a non-current asset over the accounting periods expected to benefit from its use To ensure that funds are available for the eventual replacement of the asset To reduce the cost of the asset in the statement of financial position to its estimated market value To account for the 'wearing-out' of the asset over its life (2 marks) 2 Which of the statements below correctly states the purpose of the asset register? An internal control to ensure details of all assets are readily available in the event of loss or theft To ensure the organisation is aware of the age of plant and machinery An internal control to ensure information relating to non-current assets in the nominal ledger and the financial statements is correct To enable the organisation to comply with IAS 16 Property, Plant and Equipment (2 marks) 3 An asset register showed a carrying amount of $67,460. A non-current asset costing $15,000 had been sold for $4,000, making a loss on disposal of $1,250. No entries had been made in the asset register for this disposal. What is the correct balance on the asset register, once the disposal has been accounted for