Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls do all parts ty Angela, in late 2017, intends to save $100 for two years. She investigates lending to the U.S. government versus lending

pls do all parts ty

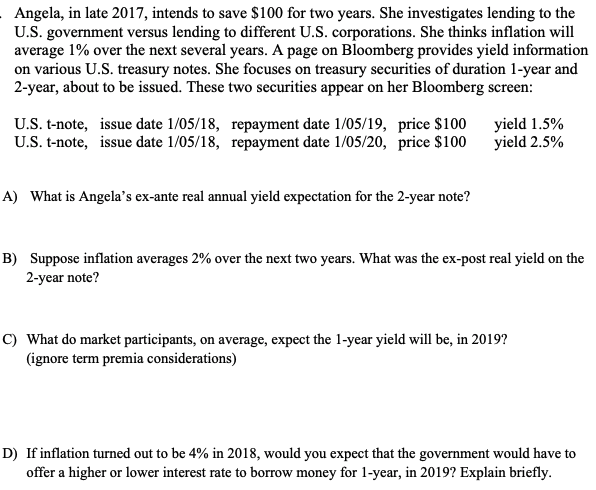

Angela, in late 2017, intends to save $100 for two years. She investigates lending to the U.S. government versus lending to different U.S. corporations. She thinks inflation will average 1% over the next several years. A page on Bloomberg provides yield information on various U.S. treasury notes. She focuses on treasury securities of duration 1-year and 2-year, about to be issued. These two securities appear on her Bloomberg screen: U.S. t-note, issue date 1/05/18, repayment date 1/05/19, price $100 U.S. t-note, issue date 1/05/18, repayment date 1/05/20, price $100 yield 1.5% yield 2.5% A) What is Angela's ex-ante real annual yield expectation for the 2-year note? B) Suppose inflation averages 2% over the next two years. What was the ex-post real yield on the 2-year note? C) What do market participants, on average, expect the 1-year yield will be, in 2019? (ignore term premia considerations) D) If inflation turned out to be 4% in 2018, would you expect that the government would have to offer a higher or lower interest rate to borrow money for 1-year, in 2019? Explain briefly. Angela, in late 2017, intends to save $100 for two years. She investigates lending to the U.S. government versus lending to different U.S. corporations. She thinks inflation will average 1% over the next several years. A page on Bloomberg provides yield information on various U.S. treasury notes. She focuses on treasury securities of duration 1-year and 2-year, about to be issued. These two securities appear on her Bloomberg screen: U.S. t-note, issue date 1/05/18, repayment date 1/05/19, price $100 U.S. t-note, issue date 1/05/18, repayment date 1/05/20, price $100 yield 1.5% yield 2.5% A) What is Angela's ex-ante real annual yield expectation for the 2-year note? B) Suppose inflation averages 2% over the next two years. What was the ex-post real yield on the 2-year note? C) What do market participants, on average, expect the 1-year yield will be, in 2019? (ignore term premia considerations) D) If inflation turned out to be 4% in 2018, would you expect that the government would have to offer a higher or lower interest rate to borrow money for 1-year, in 2019? Explain brieflyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started