Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls explain further is a corporate financial analysis Answer ANY TWO (2) Questions from this section. All workings must be clearly shown Question 1 Blockbuster

pls explain further is a corporate financial analysis

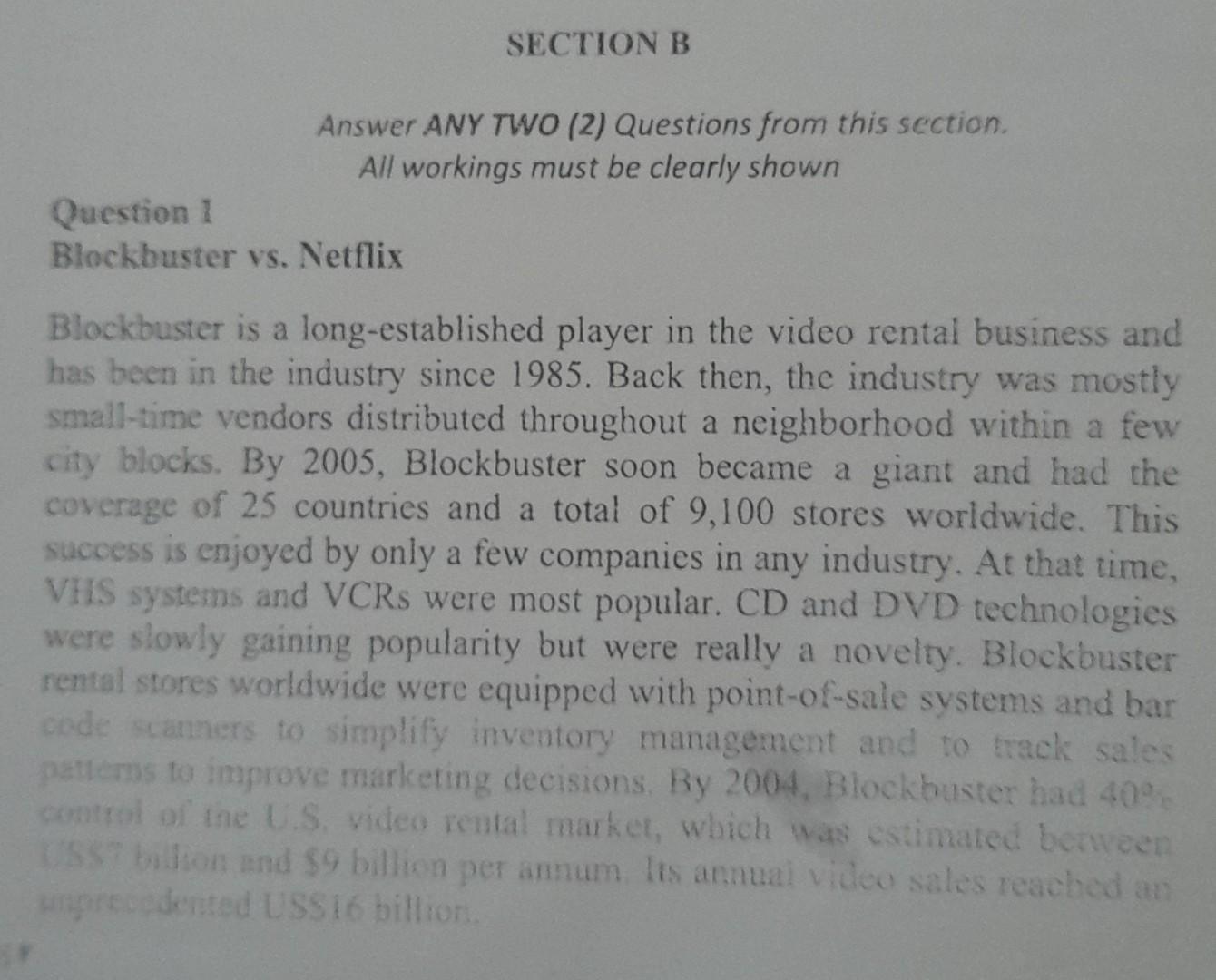

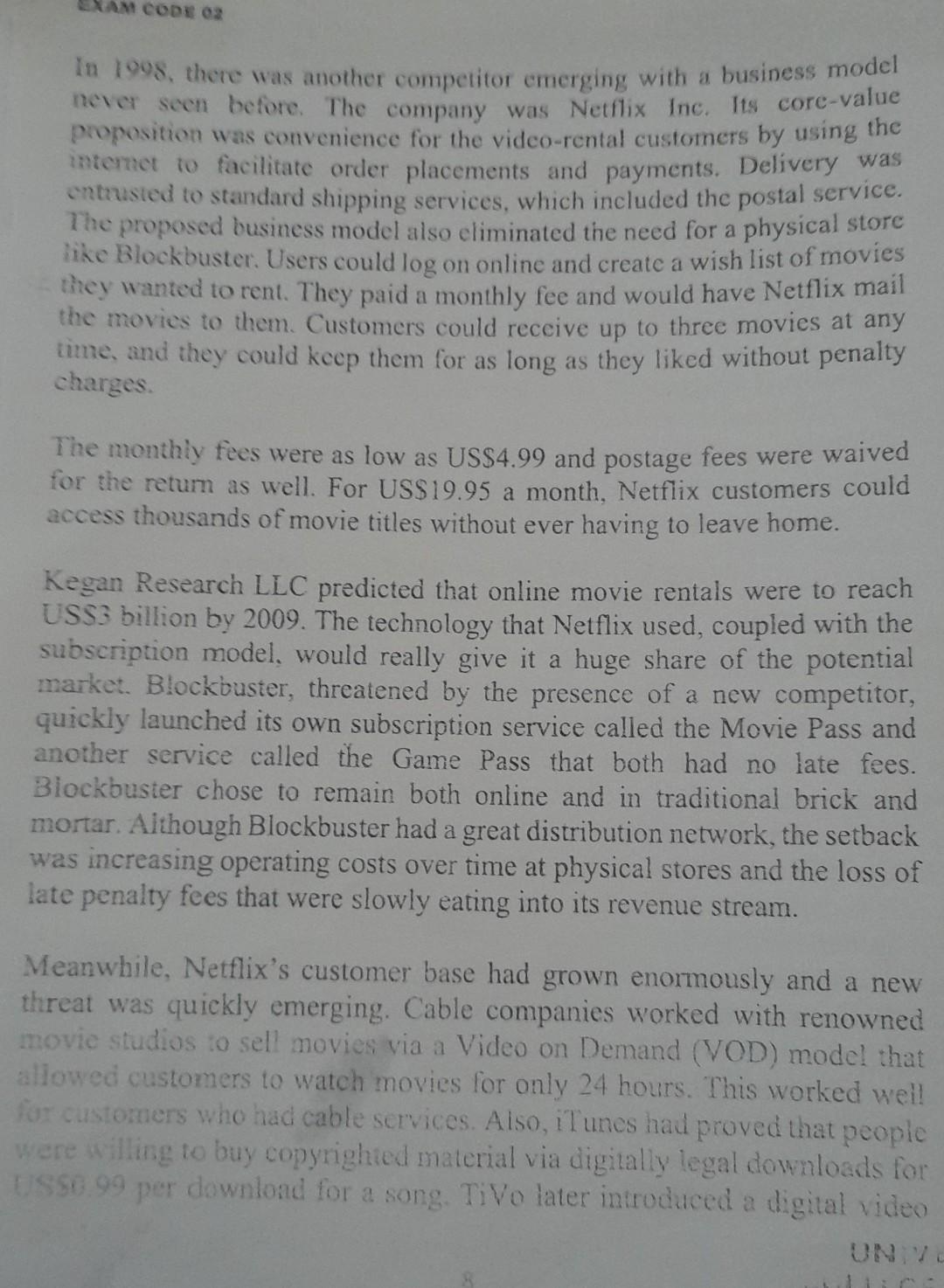

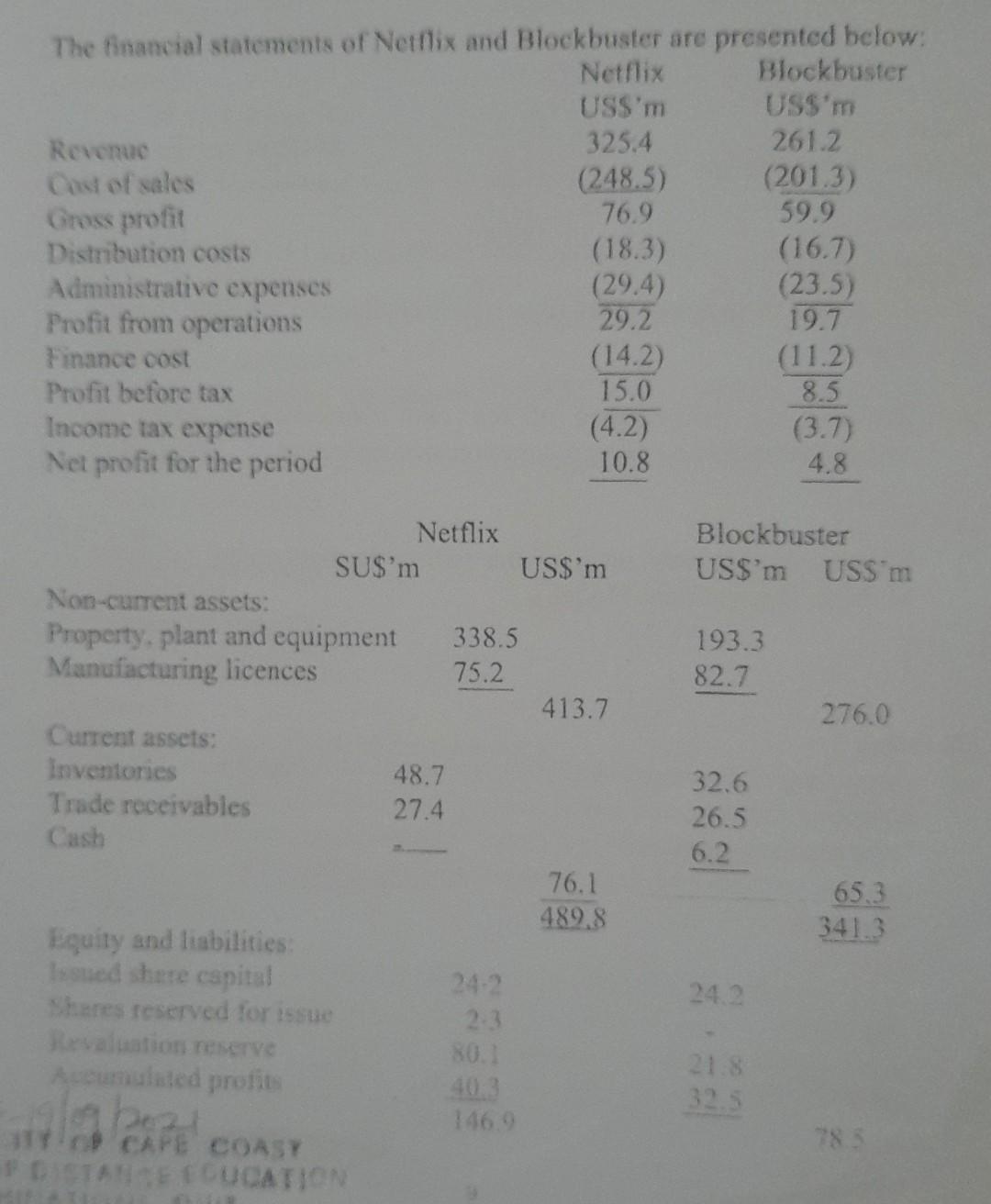

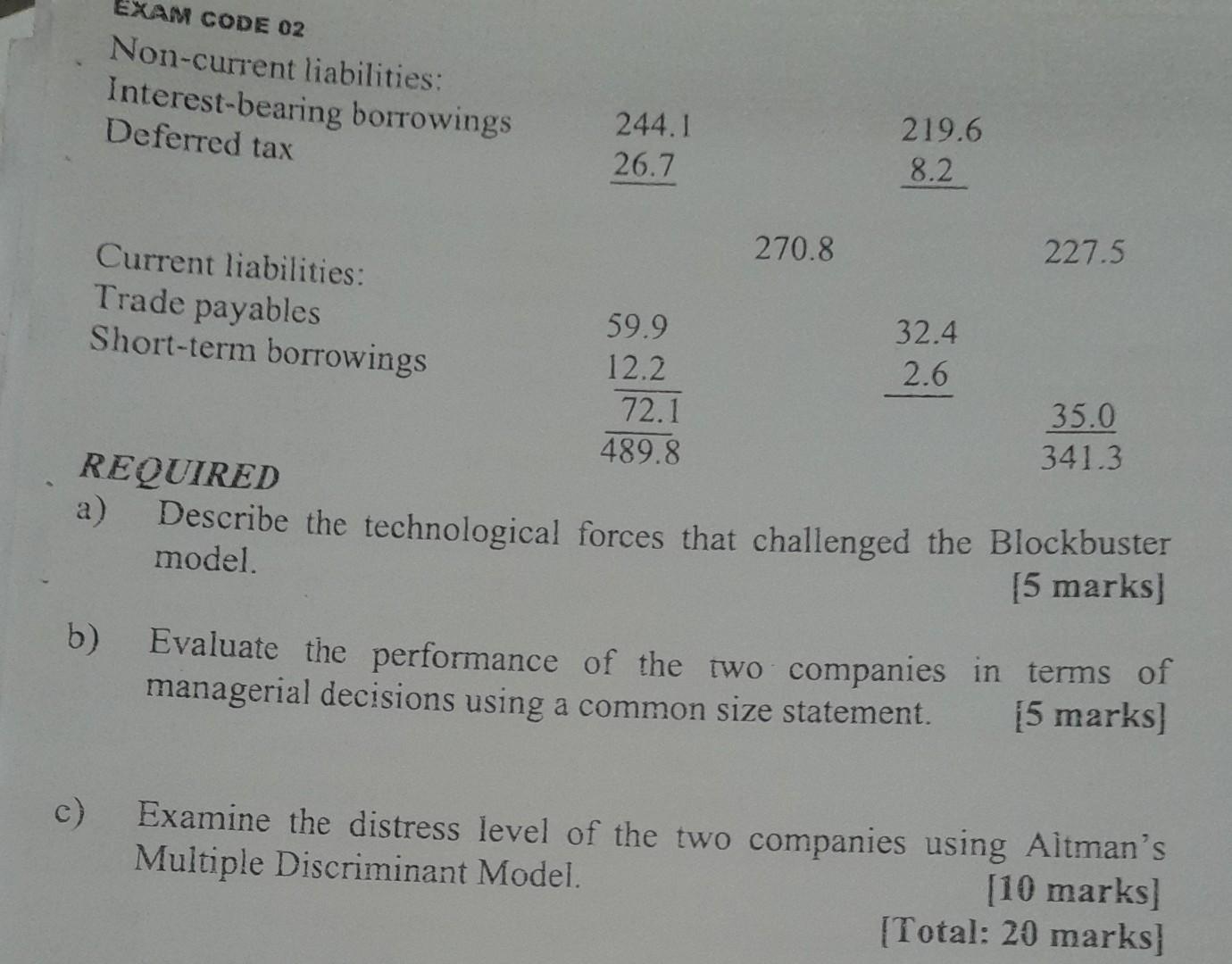

Answer ANY TWO (2) Questions from this section. All workings must be clearly shown Question 1 Blockbuster vs. Netflix Blockbuster is a long-established player in the video rental business and has been in the industry since 1985 . Back then, the industry was mostly small-time vendors distributed throughout a neighborhood within a few city blocks. By 2005, Blockbuster soon became a giant and had the coverage of 25 countries and a total of 9,100 stores worldwide. This success is enjoyed by only a few companies in any industry. At that time, VHS systems and VCRs were most popular. CD and DVD technologies were slowly gaining popularity but were really a novelty. Blockbuster rental stores worldwide were equipped with point-of-sale systems and bar code scanners to simplify inventory management and to track sales perterns to improve marketing decisions. By 2004 , Blocktucter had 400 comtroi of the U.S, video rental market, which was estimated berwoen angoreciedented USS16 billion. In 199s, there was another competitor emerging with a business model never seen before. The company was Netflix Inc. Its core-value proposition was convenience for the video-rental customers by using the internet to facilitate order placements and payments. Delivery was cntousted to standard shipping services, which included the postal service. The proposed business model also eliminated the need for a physical store hike Blockbuster. Users could log on online and create a wish list of movies they wanted to rent. They paid a monthly fee and would have Netflix mail the movies to them. Customers could receive up to three movies at any time, and they could keep them for as long as they liked without penalty charges. The monthiy fees were as low as US\$4.99 and postage fees were waived for the return as well. For US\$19.95 a month, Netflix customers could access thousands of movie titles without ever having to leave home. Kegan Research LLC predicted that online movie rentals were to reach USS3 billion by 2009 . The technology that Netflix used, coupled with the subscription model. would really give it a huge share of the potential market. Blockbuster, threatened by the presence of a new competitor, quickly launched its own subscription service called the Movie Pass and another service called the Game Pass that both had no late fees. Blockbuster chose to remain both online and in traditional brick and mortar. Although Blockbuster had a great distribution network, the setback was increasing operating costs over time at physical stores and the loss of late penalty fees that were slowly eating into its revenue stream. Meanwhile, Netflix's customer base had grown enormously and a new threat was quickly emerging. Cable companies worked with renowned movie studios to sell movies via a Video on Demand (VOD) model that allowed customers to watch movies for only 24 hours. This worked well furcustomers who had cable setvices. Aiso, it unes had proved that people were wilting to buy copyrighted material via digitalyy legal downloads for tiseg 99 per downlond for a song. Tivo later introdaced a digital video The financial statements of Netflix and Blockbuster are presented below: a) Describe the technological forces that challenged the Blockbuster model. [5 marks] b) Evaluate the performance of the two companies in terms of managerial decisions using a common size statement. [5 marks] c) Examine the distress level of the two companies using Aitman's Multiple Discriminant Model. [10 marks] [Total: 20 marks] Answer ANY TWO (2) Questions from this section. All workings must be clearly shown Question 1 Blockbuster vs. Netflix Blockbuster is a long-established player in the video rental business and has been in the industry since 1985 . Back then, the industry was mostly small-time vendors distributed throughout a neighborhood within a few city blocks. By 2005, Blockbuster soon became a giant and had the coverage of 25 countries and a total of 9,100 stores worldwide. This success is enjoyed by only a few companies in any industry. At that time, VHS systems and VCRs were most popular. CD and DVD technologies were slowly gaining popularity but were really a novelty. Blockbuster rental stores worldwide were equipped with point-of-sale systems and bar code scanners to simplify inventory management and to track sales perterns to improve marketing decisions. By 2004 , Blocktucter had 400 comtroi of the U.S, video rental market, which was estimated berwoen angoreciedented USS16 billion. In 199s, there was another competitor emerging with a business model never seen before. The company was Netflix Inc. Its core-value proposition was convenience for the video-rental customers by using the internet to facilitate order placements and payments. Delivery was cntousted to standard shipping services, which included the postal service. The proposed business model also eliminated the need for a physical store hike Blockbuster. Users could log on online and create a wish list of movies they wanted to rent. They paid a monthly fee and would have Netflix mail the movies to them. Customers could receive up to three movies at any time, and they could keep them for as long as they liked without penalty charges. The monthiy fees were as low as US\$4.99 and postage fees were waived for the return as well. For US\$19.95 a month, Netflix customers could access thousands of movie titles without ever having to leave home. Kegan Research LLC predicted that online movie rentals were to reach USS3 billion by 2009 . The technology that Netflix used, coupled with the subscription model. would really give it a huge share of the potential market. Blockbuster, threatened by the presence of a new competitor, quickly launched its own subscription service called the Movie Pass and another service called the Game Pass that both had no late fees. Blockbuster chose to remain both online and in traditional brick and mortar. Although Blockbuster had a great distribution network, the setback was increasing operating costs over time at physical stores and the loss of late penalty fees that were slowly eating into its revenue stream. Meanwhile, Netflix's customer base had grown enormously and a new threat was quickly emerging. Cable companies worked with renowned movie studios to sell movies via a Video on Demand (VOD) model that allowed customers to watch movies for only 24 hours. This worked well furcustomers who had cable setvices. Aiso, it unes had proved that people were wilting to buy copyrighted material via digitalyy legal downloads for tiseg 99 per downlond for a song. Tivo later introdaced a digital video The financial statements of Netflix and Blockbuster are presented below: a) Describe the technological forces that challenged the Blockbuster model. [5 marks] b) Evaluate the performance of the two companies in terms of managerial decisions using a common size statement. [5 marks] c) Examine the distress level of the two companies using Aitman's Multiple Discriminant Model. [10 marks] [Total: 20 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started