Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pls explain how to get answer without excel 0 / 1 point Question 2 Your parents have an investment account that earns 4.9 percent compounded

Pls explain how to get answer without excel

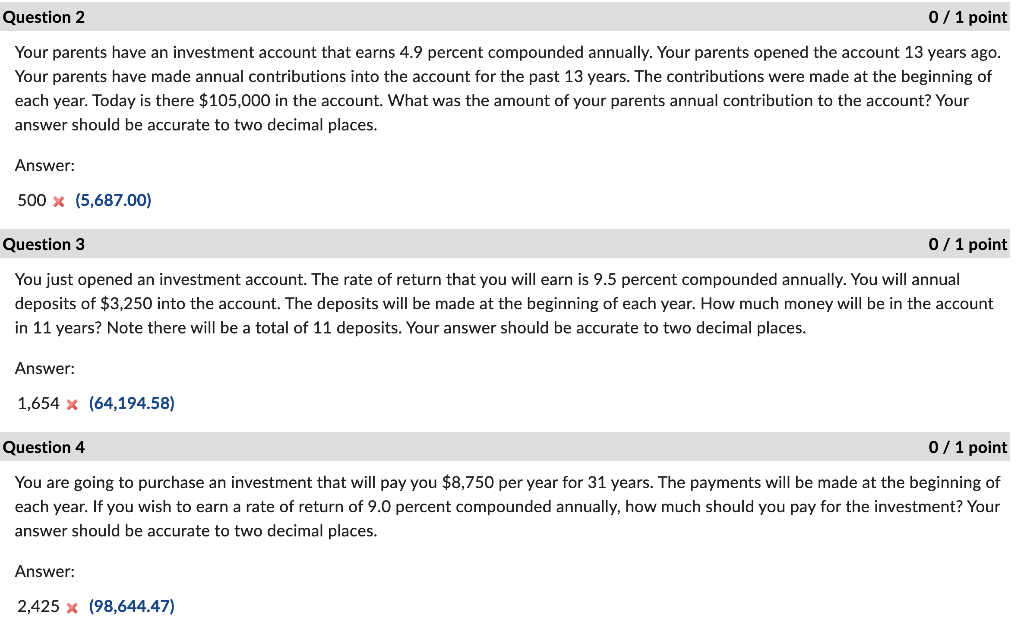

0 / 1 point Question 2 Your parents have an investment account that earns 4.9 percent compounded annually. Your parents opened the account 13 years ago. Your parents have made annual contributions into the account for the past 13 years. The contributions were made at the beginning of each year. Today is there $105,000 in the account. What was the amount of your parents annual contribution to the account? Your answer should be accurate to two decimal places. Answer: 500x (5,687.00) Question 3 0 / 1 point You just opened an investment account. The rate of return that you will earn is 9.5 percent compounded annually. You will annual deposits of $3,250 into the account. The deposits will be made at the beginning of each year. How much money will be in the account in 11 years? Note there will be a total of 11 deposits. Your answer should be accurate to two decimal places. Answer: 1,654 x (64,194.58) Question 4 0 / 1 point You are going to purchase an investment that will pay you $8,750 per year for 31 years. The payments will be made at the beginning of each year. If you wish to earn a rate of return of 9.0 percent compounded annually, how much should you pay for the investment? Your answer should be accurate to two decimal places. Answer: 2,425 x (98,644.47)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started