pls help!

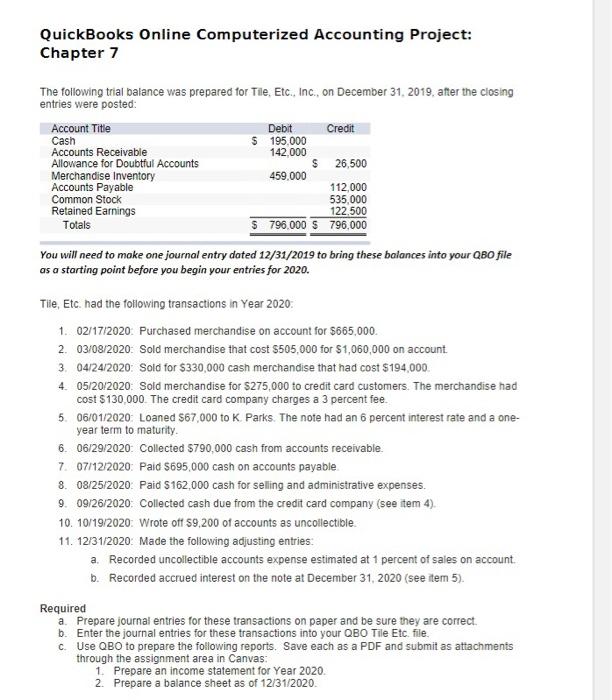

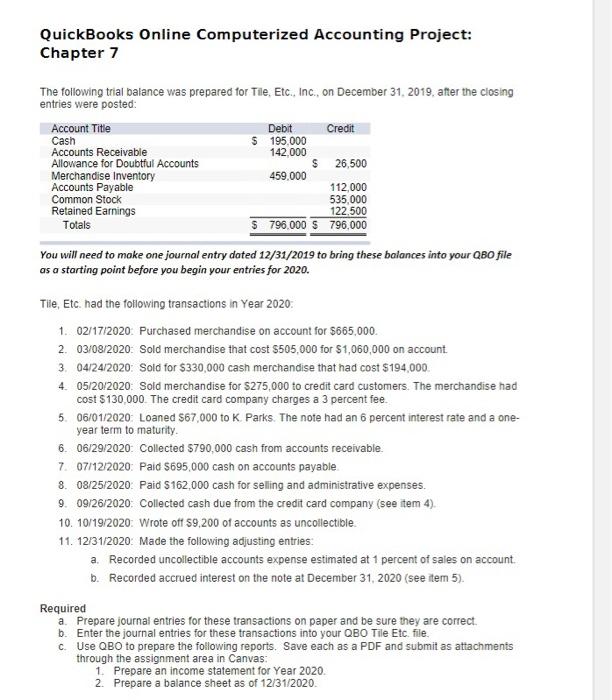

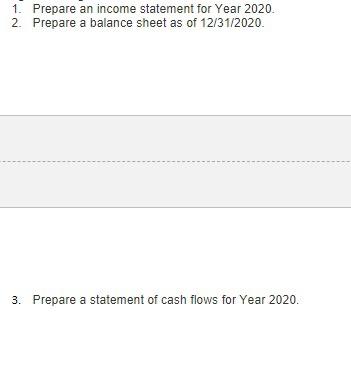

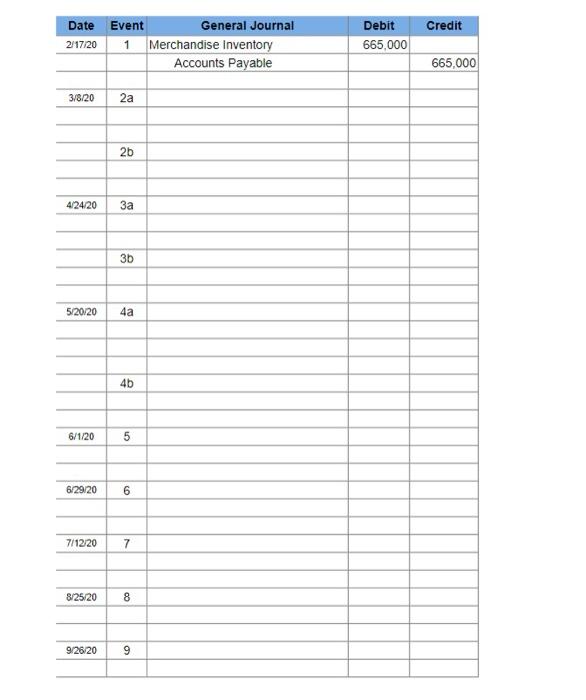

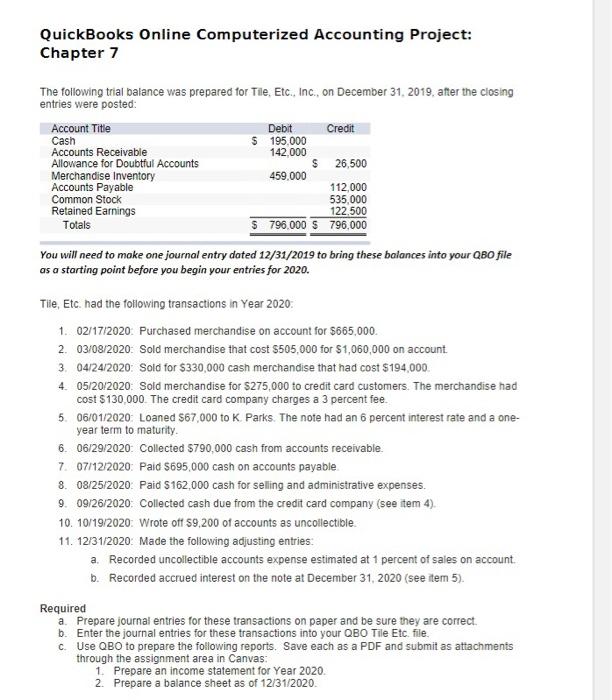

1. Prepare an income statement for Year 2020. 2. Prepare a balance sheet as of 12/31/2020. 3. Prepare a statement of cash flows for Year 2020. \begin{tabular}{l|c|l|l|l} & & & & \\ \hline 10/19/20 & 10 & & & \\ \hline & & & & \\ \hline & & & & \\ \hline 12/31/20 & 11a & & & \\ \hline & & & & \\ \hline & & & & \\ \hline 12/31/20 & 11b & & & \\ \hline \end{tabular} QuickBooks Online Computerized Accounting Project: Chapter 7 The following trial balance was prepared for Tile, Etc., Inc., on December 31, 2019, after the closing entries were posted: You will need to make one journal entry doted 12/31/2019 to bring these balances into your QBO file as a starting point before you begin your entries for 2020 . Tile, Etc. had the following transactions in Year 2020: 1. 02/17/2020: Purchased merchandise on account for $665,000. 2. 03/08/2020: Sold merchandise that cost $505,000 for $1,060,000 on account. 3. 04/24/2020: Sold for $330,000 cash merchandise that had cost $194,000 4. 05/20/2020: Sold merchandise for $275,000 to credit card customers. The merchandise had cost $130,000. The credit card company charges a 3 percent fee. 5. 06/01/2020: Loaned $67,000 to K. Parks. The note had an 6 percent interest rate and a oneyear term to maturity. 6. 06/29/2020 : Collected $790,000 cash from accounts receivable. 7. 07/12/2020. Paid $695,000 cash on accounts payable. 8. 08/25/2020. Paid $162,000 cash for seling and administrative expenses. 9. 09/26/2020: Collected cash due from the credit card company (see item 4). 10. 10/19/2020: Wrote off $9,200 of accounts as uncollectible. 11. 12/31/2020: Made the following adjusting entries: a. Recorded uncollectible accounts expense estimated at 1 percent of sales on account. b. Recorded accrued interest on the note at December 31,2020 (see item 5 ). Required a. Prepare journal entries for these transactions on paper and be sure they are correct. b. Enter the journal entries for these transactions into your QBO Tile Etc. file. c. Use QBO to prepare the following reports. Save each as a PDF and submit as attachments through the assignment area in Canvas: 1. Prepare an income statement for Year 2020. 2. Prepare a balance sheet as of 12/31/2020. \begin{tabular}{|c|c|c|c|c|} \hline Date & Event & General Journal & Debit & Credit \\ \hline \multirow[t]{2}{*}{2/17/20} & 1 & Merchandise Inventory & 665,000 & \\ \hline & & Accounts Payable & & 665,000 \\ \hline \multirow[t]{3}{*}{3/8/20} & 2a & & & \\ \hline & & & & \\ \hline & 2b & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \multirow[t]{3}{*}{4/24/20} & 3a & & & \\ \hline & & & & \\ \hline & 3b & & & \\ \hline & & & & \\ \hline \multirow[t]{4}{*}{5/20/20} & 4a & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & 4b & & & \\ \hline & & & & \\ \hline 6/1/20 & 5 & & & \\ \hline & & & & \\ \hline 6/29/20 & 6 & & & \\ \hline & & & & \\ \hline 7/12/20 & 7 & & & \\ \hline & & & & \\ \hline 8/25/20 & 8 & & & \\ \hline & & & & \\ \hline 9/26/20 & 9 & & & \\ \hline & & & & \\ \hline \end{tabular}