Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls help asap will rate Question 4 Consider the following information: Motor van: Acquisition date Cost Residual value Estimated useful life Depreciation method 1 January

pls help asap will rate

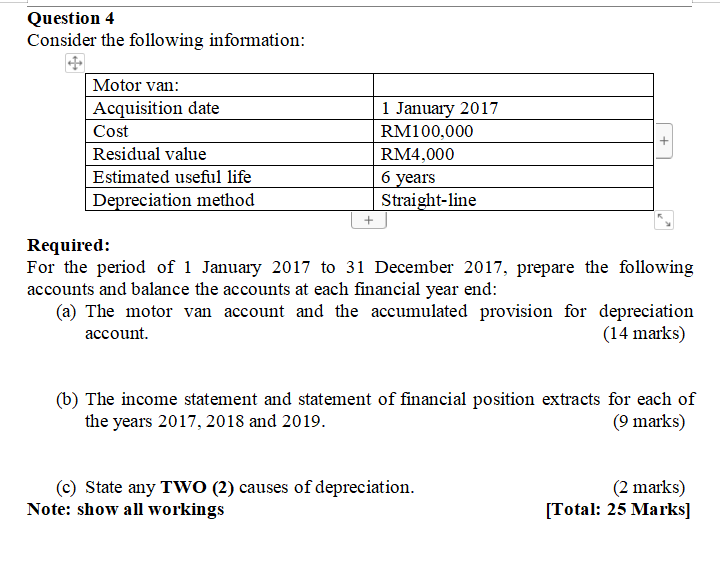

Question 4 Consider the following information: Motor van: Acquisition date Cost Residual value Estimated useful life Depreciation method 1 January 2017 RM100,000 RM4,000 6 years Straight-line Required: For the period of 1 January 2017 to 31 December 2017, prepare the following accounts and balance the accounts at each financial year end: (a) The motor van account and the accumulated provision for depreciation account. (14 marks) (b) The income statement and statement of financial position extracts for each of the years 2017, 2018 and 2019. (9 marks) (c) State any TWO (2) causes of depreciation. Note: show all workings (2 marks) [Total: 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started